Introduction

Saving taxes can often feel like navigating through a maze. You know there’s a way out, but every turn looks confusing. In India, taxpayers must decide between the Old Tax Regime and the New Tax Regime, each with its own benefits and drawbacks. Choosing wisely can save you a significant amount of money.

In this article, I will walk you through the best ways to save income tax for F.Y.2025-26 in simple terms. We’ll look at deductions, exemptions, and practical tax-saving methods under both regimes. To make your journey easier, I’ll also show how the Automatic Income Tax Preparation Software All-in-One in Excel with Form 10E can simplify calculations for both Government and Non-Government employees.

Think of this as your roadmap to tax savings—clear, step-by-step, and designed to help you keep more of your hard-earned money.

Table of Contents

| Sr# | Headings |

| 1 | Understanding the Two Tax Regimes |

| 2 | Tax Slabs Under the Old Tax Regime |

| 3 | Best Ways to Save Income Tax in the Old Regime |

| 4 | Section 80C – Investments and Expenses |

| 5 | Section 80D – Health Insurance Premiums |

| 6 | Section 80E and 80EE – Loans and Deductions |

| 7 | Section 80G, 80GG & 80TTA – Additional Savings |

| 8 | Tax Slabs Under the New Tax Regime 2025-26 |

| 9 | What Tax Benefits You Still Get in the New Regime |

| 10 | Other Legal Ways to Save Taxes in India |

| 11 | Old vs New Tax Regime – Which Should You Choose? |

| 12 | Role of Automatic Income Tax Preparation Software |

| 13 | Importance of Form 10E in Tax Relief |

| 14 | Practical Tips to Reduce Tax Burden |

| 15 | Conclusion |

1. Understanding the Two Tax Regimes

India now offers two tax regimes:

- Old Tax Regime: Allows deductions and exemptions but comes with higher tax rates.

- New Tax Regime: Offers lower rates but fewer deductions.

So, the decision boils down to this: Do you prefer flexibility with deductions, or simplicity with lower rates?

2. Tax Slabs Under the Old Tax Regime

- ₹0 – ₹2.5 Lakh: No tax

- ₹2.5 – ₹5 Lakh: 5%

- ₹5 – ₹10 Lakh: 20%

- Above ₹10 Lakh: 30%

This regime benefits those who invest in tax-saving schemes or have expenses like insurance, loans, and rent.

3. Best Ways to Save Income Tax in the Old Regime

Let’s dive into the most effective deductions:

4. Section 80C – Investments and Expenses

This section allows a maximum deduction of ₹1.5 Lakh. You can save tax by investing in:

- Employee Provident Fund (EPF)

- Public Provident Fund (PPF)

- National Pension Scheme (NPS)

- Life Insurance Premiums

- Equity Linked Savings Scheme (ELSS)

- Tax-saving Fixed Deposits

- Home Loan Principal Repayment

- Sukanya Samriddhi Yojana

5. Section 80D – Health Insurance Premiums

Health is wealth, but did you know it also saves taxes?

- Deduction of ₹25,000 for premiums paid (if below 60 years).

- Deduction of ₹50,000 if you or your parents are senior citizens.

6. Section 80E and 80EE – Loans and Deductions

- Section 80E: Deduction on interest from education loans (no limit, up to 8 years).

- Section 80EE: Extra deduction of ₹50,000 for first-time homebuyers meeting eligibility conditions.

7. Section 80G, 80GG & 80TTA – Additional Savings

- 80G: Deduction for donations to charitable institutions.

- 80GG: For rent paid without HRA (up to ₹5,000/month or limits applied).

- 80TTA: Deduction of ₹10,000 on bank savings account interest (₹50,000 for senior citizens under 80TTB).

8. Tax Slabs Under the New Tax Regime 2025-26

- ₹0 – ₹4 Lakh: No tax

- ₹4 – ₹8 Lakh: 5%

- ₹8 – ₹12 Lakh: 10%

- ₹12 – ₹16 Lakh: 15%

- ₹16 – ₹20 Lakh: 20%

- ₹20 – ₹24 Lakh: 25%

- Above ₹24 Lakh: 30%

This simplified structure works well for people who don’t want the hassle of multiple deductions.

9. What Tax Benefits You Still Get in the New Regime

Even in the New Regime, you still enjoy:

- Standard Deduction: ₹75,000

- Section 87A Rebate: ₹60,000 rebate for income up to ₹12 Lakh

- Family Pension Deduction: Up to ₹25,000

- EPF/PPF interest (within limits)

- Long-term Capital Gains exemption (up to ₹1.25 Lakh)

10. Other Legal Ways to Save Taxes in India

Apart from regimes, you can also save tax through:

- Agricultural income (fully exempt).

- Inheritance (no inheritance tax).

- Business expense claims (travel, office costs).

- Creating a Hindu Undivided Family (HUF) for separate exemptions.

- Political donations (100% deduction under Sections 80GGB & 80GGC).

- Wedding gifts from relatives (fully exempt).

11. Old vs New Tax Regime – Which Should You Choose?

Here’s the rule of thumb:

- If you have loans, insurance, investments, and donations, the Old Regime saves more.

- If you have fewer deductions or prefer simplicity, the New Regime is better.

12. Role of Automatic Income Tax Preparation Software

Manual tax filing can be stressful. That’s why the Automatic Income Tax Preparation Software All-in-One in Excel comes to the rescue.

It helps by:

- Auto-calculating based on your regime choice.

- Filling deductions correctly.

- Generating Form 10E for arrears.

- Saving time and preventing errors.

13. Importance of Form 10E in Tax Relief

If you receive arrears or salary back-pay, your tax may spike. Filing Form 10E ensures relief under Section 89(1), preventing unnecessary extra tax.

14. Practical Tips to Reduce Tax Burden

- Invest early in 80C schemes.

- Buy health insurance for family and parents.

- Claim HRA or 80GG if you pay rent.

- Consider NPS contributions.

- Use software tools to avoid mistakes.

15. Conclusion

The best way to save income tax for F.Y.2025-26 depends on your lifestyle and financial commitments. If you actively invest and have eligible deductions, the Old Regime could save you more. If not, the New Regime offers simplicity with decent savings.

With the Automatic Income Tax Preparation Software All-in-One in Excel with Form 10E, you no longer need to worry about complex calculations. Instead, you can focus on making smart financial decisions while letting technology do the hard work.

FAQs

- What is the best way to save income tax for F.Y.2025-26?

The best way depends on whether you choose the Old or New Regime. If you invest in 80C schemes, health insurance, or home loans, the Old Regime saves more. Otherwise, the New Regime is simpler. - Can I switch between old and new tax regimes every year?

Yes, salaried individuals can switch annually, but business owners with income from a business or profession have restrictions. - How does Form 10E help in saving taxes?

Form 10E allows you to claim tax relief on arrears or advance salary under Section 89(1), preventing higher tax liability. - Is agricultural income completely tax-free?

Yes, agricultural income is exempt from tax, though it may be considered for rate purposes if you have non-agricultural income. - Why should I use Automatic Income Tax Preparation Software?

Because it saves time, reduces errors, auto-applies deductions, and generates forms like Form 10E, making tax filing stress-free.

Download Automatic Income Tax Calculator All in One for the Government and Non-Government Employees with Form 10E in Excel for the F.Y.2025-26

Feature of this Excel Utility:-

+This Excel Calculator can prepare at a time your Tax Computed Sheet as per the Budget 2025

+ Inbuilt Salary Structure for both Govt and Non-Govt Employees

+ Automatic Salary Sheet

+ Automatic calculation of H.R.A. Exemption U/s 10(13A

+ Automatic calculate Income Tax Arrears Relief Calculation U/s 89(1) with Form 10E

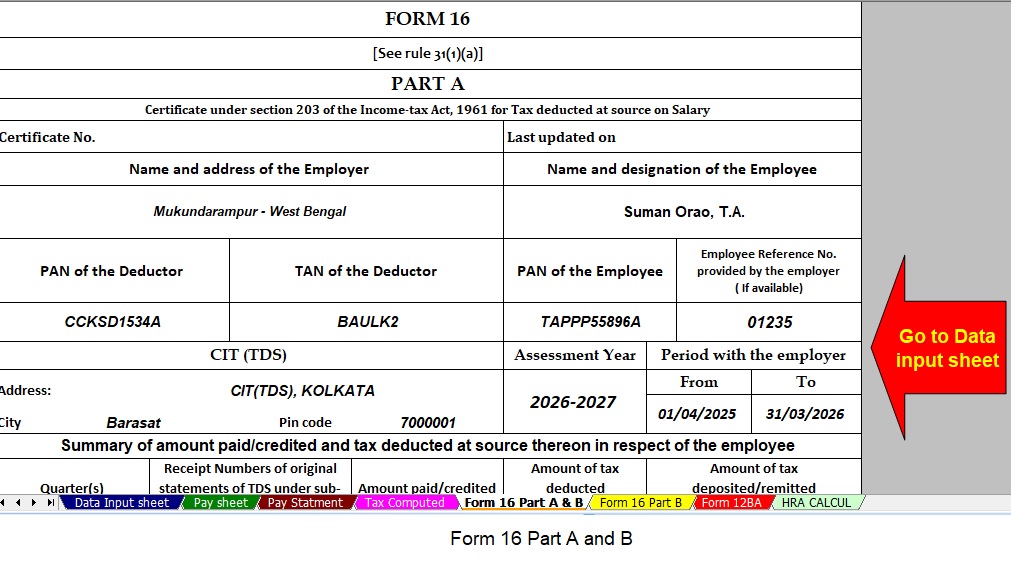

+ Automatic Form 16 Part A and B

+ Automatic Income Tax Form 16 Part B]