What is Section 80TTA? Under the Income Tax Act of India, the Indian taxpayer is granted several deductions to reduce his tax liability and thus reduce his tax expense. These deductions may be based on wages, investments or payments.

Therefore,

In other words, under section 80TTA of the Income Tax Act, tax credits are available to eligible taxpayers on interest earned in a savings account. The savings account in question may exist at a bank, cooperative, or post office.

However,

Section 80TTA became part of the Treasury Act in 2013 and has provided benefits to many taxpayers ever since.

Therefore, Let’s take a look at the conditions that apply to using the benefits of Section 80TTA.

Deduction applicable under Section 80TTA – Terms and Conditions

The terms and conditions applicable to tax credits under section 80TTA are listed below:

For instance, up to INR 10,000 deducted annually on interest earned on savings accounts.

Deductions may be claimed by Hindu Indivisible Persons and Families (HUF).

Above all,

If an entity has more than one savings account with multiple banks, the combined interest income of all accounts must be less than INR 10,000 in order to benefit from the deductions.

In addition, If the accrued interest income in the above case exceeds the limit of INR 10,000, INR 10,000 tax exemption can be requested and the remaining amount will be subject to tax.

Eligibility for 80TTA deductions

After that, under the Income Tax Act, deductions under section 80TTA may be claimed for:

Taxpayers categorized as individuals or undivided Hindu families (HUF)

Indians

Non Resident Indians (NRIs) with NRO Savings Accounts

An organization with savings accounts at institutions such as banks, post offices, or cooperatives.

80TTA Tax Credit Claim

Similarly, under section 80TTA, a tax deduction of up to INR 10,000 over the Lac limit of INR 1.5 under section 80C may be claimed for an eligible beneficiary. Be sure to report interest on bank savings accounts in the “Income from Other Sources” section when filing your tax return.

In conclusion,

Exceptions under Section 80TTA

If the entity’s total gross income is less than the minimum taxable income, a tax deduction cannot be claimed under section 80TTA.

Senior citizens cannot take advantage of the tax exemption under section 80TTA.

The 80TTA tax deduction does not apply to the following:

Term deposits

Term deposits

Regular deposits

NBFC deposits (non-banking financial corporations)

NRIs with an NRE account cannot claim tax credits under section 80TTA because NRE accounts are tax deductible.

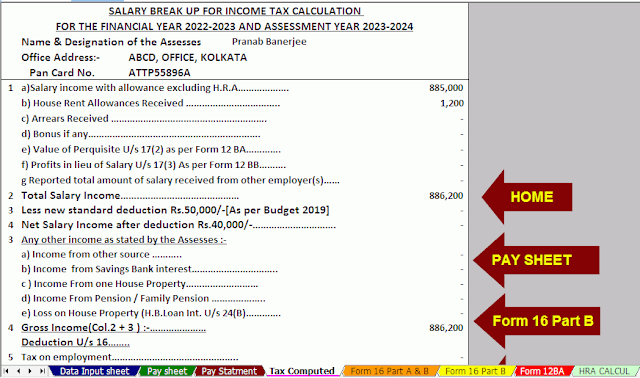

Download Automated Income Tax Preparation Excel Based Software All in One for the Non-Government(Private) Employees for the Financial Year 2022-23 and Assessment Year 2023-24U/s 115BAC

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2022

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Non-Govt(Private) Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2022-23

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2022-23