Introduction Are you wondering how you can save more tax in the Financial Year 2025-26? Well, here’s some good news! The Section 80C deduction as per Budget 2025 continues to be one of the most powerful tools for every Non-Government employee to reduce their taxable income. Therefore, imagine it like a golden key that unlocks multiple doors of tax savings — from investments in PPF, ELSS, and LIC premiums to tuition fees and home loan principal repayments. Moreover, the Automatic Income Tax Calculator All-in-One in Excel makes it incredibly easy…

Tag: Section 87A

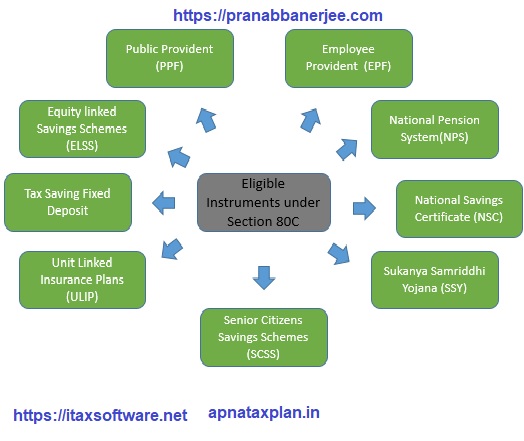

Top Tax-Saving Investment Options Under Income Tax Section 80C for the Old Tax Regimes

Do you want to save more taxes and grow your money at the same time? You’re not alone. Most investors look for ways to legally reduce their tax burden while still earning good returns. Luckily, Income Tax Section 80C for the Old Tax Regimes gives you a wide range of tax-saving investment options. But here’s the catch—not all of them work the same way. Some give better returns, others offer more safety. So, how do you pick the right one for your goals? Let’s simplify it. We’ll walk you through…

Section 87A Tax Rebate Allowed on STCG in New Tax Regime – Relief for Salaried Taxpayers

Introduction If you’ve been confused about whether the Section 87A tax rebate applies to short-term capital gains (STCG) under the new tax regime, you’re not alone. Many salaried taxpayers wondered if they could claim this rebate when their total income included gains taxed under Section 111A. Thankfully, two recent appellate rulings have brought much-needed clarity and relief. In simple terms, the Commissioners of Income Tax (Appeals) confirmed that taxpayers earning up to ₹7 lakh annually—including income from STCG—can still claim the Section 87A rebate under Section 115BAC(1A). Let’s dive deeper…