For the Financial Year (F.Y.) 2025-26,

Section 80TTA of the Income Tax Act provides a deduction of up to ₹10,000 on the interest income earned from savings accounts. This deduction is available to individuals and Hindu Undivided Families (HUFs) who choose the old tax regime.

Key provisions under Section 80TTA for F.Y. 2025-26

Eligibility

The deduction can be claimed by the following taxpayers:

- Individuals: This applies to residents and non-residents, as long as they are not senior citizens (60 years or older). Senior citizens have a separate provision, Section 80TTB, with a higher deduction limit.

- Hindu Undivided Families (HUFs): HUFs are also eligible to claim this deduction.

Deduction limit

- The 80TTA deduction allowed is ₹10,000 per financial year.

- This limit is cumulative across all eligible savings accounts held by the taxpayer. For example, if you have multiple savings accounts in different banks, the total interest earned from all of them is subject to this single ₹10,000 limit.

- If your total interest income from savings accounts is less than ₹10,000, you can claim the entire amount as a deduction.

Eligible interest income

The deduction can be claimed on interest earned from savings accounts held at the following financial institutions:

- Banks

- Cooperative societies engaged in the banking business

- Post offices

Non-eligible interest income

The deduction does not apply to interest earned from:

- Fixed deposits (FDs)

- Recurring deposits (RDs)

- Corporate bonds

- Any other type of term deposit

How to claim the deduction

To claim the deduction while filing your Income Tax Return (ITR):

- Add interest income: First, declare the total interest earned from all your savings accounts under the head “Income from Other Sources.”

- Claim deduction: In the deductions section (Chapter VI-A) of your ITR, enter the eligible amount (up to ₹10,000) under Section 80TTA.

- File return: After completing the necessary steps, file your ITR.

Important considerations

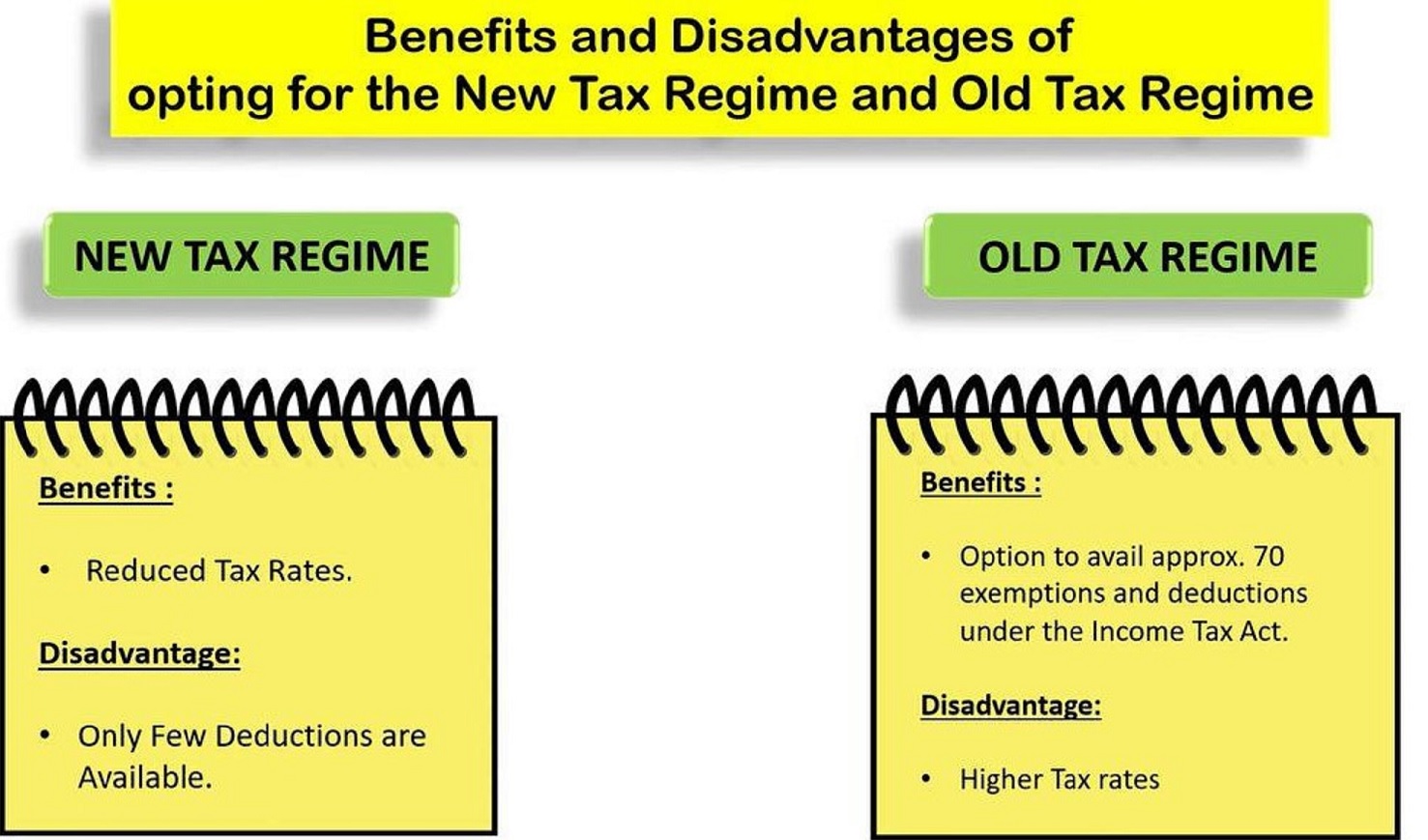

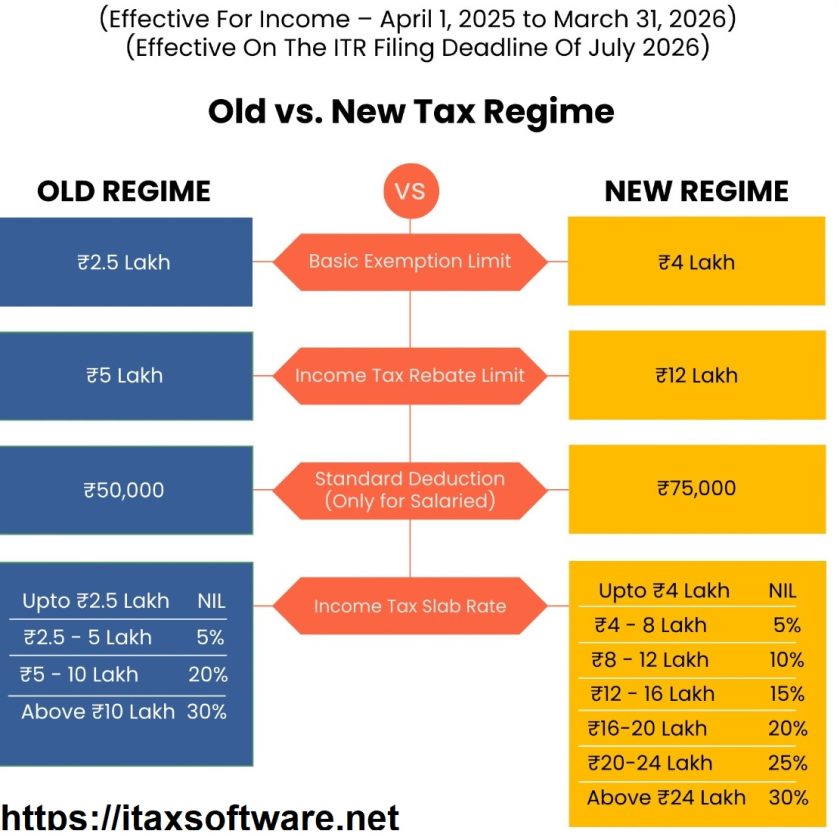

- Old vs. New Tax Regime: The deduction under Section 80TTA is available only if you choose to file your taxes under the old tax regime. If you opt for the new, simplified tax regime, you cannot claim this benefit.

- Senior citizens: Individuals who are 60 years of age or older are covered by Section 80TTB, which allows a higher deduction of up to ₹50,000 on interest from both savings and fixed deposits.

- NRIs: Non-Resident Indians (NRIs) can claim the deduction, but only on interest from a Non-Resident Ordinary (NRO) savings account. Interest from a Non-Resident External (NRE) account is already tax-exempt.