How to do Income Tax Count for FY 2020-21? Which Tax Structure to Choose U/s 115 BAC?

According to Financial plan 2020, you can’t claim any tax deduction or exception on the off chance that you intend to pick new tax structure. Along these lines, as an individual tax payer on the off chance that you choose the new tax system with diminishes tax rate you have to swear off all tax breaks available today. Luckily, you have alternative to proceed with old tax structure. Salaried individual can switch among old and new tax structure.

Right off the bat, we will discuss which tax deduction and exception you have to renounce on the off chance that you settle on new tax structure with decrease tax rate. Also, we will step through hardly any exam cases and do income tax figuring for FY 2020-21 to realize which tax structure to choose?

Download Automated Income Tax Revised Form 16 Part A&B for the Financial Year 2020-21 as per New Section 115 BAC- New and Old Tax Regime Option [ This Excel Utility can prepare at a time 50 Employees Form 16 Part A&B]

A list of Tax Deductions and Exclusion not permitted in new Tax Structure

1 Tax Deduction Under Section 80 C

The most mainstream tax deduction of 1.5 Lakh under section 80C isn’t material for new tax structure. This implies you can’t claim any profit for venture made in the instruments, for example, PF, PPF, Disaster protection premium, school education costs of kids, ELSS, PPF, NPS and so forth.

You can claim deduction under section 80 CCD for the business commitment because of representative for NPS.

2 Tax Deduction Under Section 80 D

No tax deduction is considered the clinical protection premium and preventive wellbeing test under section 80D for new tax structure.

3 No LTA Advantages

For new tax structure LTA – Leave travel stipend exclusion which is right now available to salaried representative for twice in square of four years isn’t permitted.

4 HRA

HRA is house lease stipend. HRA is paid to salaried people by manager as a piece of compensation. Prior taxpayer had the option to claim HRA up as far as possible. In new tax structure it isn’t passable.

5 Standard Deduction

A standard deduction advantage of Rs.50000 as of now available to salaried tax payer isn’t appropriate in new tax piece.

6 Section 80TTA Advantages

Section 80TTA gives deduction of Rs.10000 on intrigue income. On new tax system this advantage isn’t available.

7 Section 80DDB Advantages

Advantages for handicap under section 80DDB up to Rs.40000 not available on the off chance that you are intending to choose new diminished tax structure.

8 Section 80E Instruction Credit

Tax break allowable on the intrigue paid on training credit won’t be claimable under section 80E.

9 Section 80G

You had the option to make gift under section 80G and claim income tax advantage of identical sum. The said deduction isn’t available in decreased tax structure.

10 Section 24 Home Credit Intrigue

Under section 24 of the Income tax act, an individual had the option to claim tax deduction on the intrigue installment on the lodging credit up to a greatest measure of Rs.200000. This advantage isn’t expanded on the off chance that you choose new tax structure.

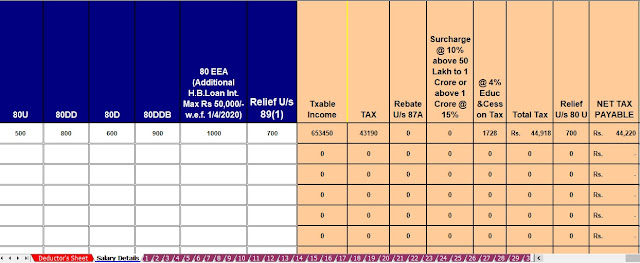

So, all deduction material under part By means of like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, and so on) won’t be claimable by those selecting the new tax system.

Conclusion:-

In a large portion of the cases old tax rate with deduction offers higher tax benefits. New diminished tax rate is helpful just in the event that you are not claiming any deductions starting at now. (which is uncommon)

On the off chance that you have home advance and higher income you will get higher tax benefits in old tax rate contrasted with new tax rate.

Download Automated Income Tax Preparation Excel Based Software All in One for the Non-Govt (Private) Employees for the F.Y.2020-21 and A.Y.2021-22

Feature of this Excel Utility:-

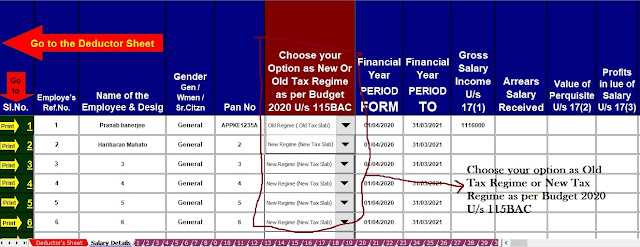

1) This Excel utility prepares and calculate your income tax as per the New Section 115 BAC (New and Old Tax Regime)

2) This Excel Utility has an option where you can choose your option as New or Old Tax Regime

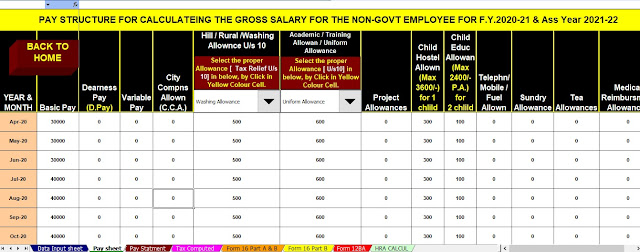

3) This Excel Utility has a unique Salary Structure for All the Non-Government (Private) Employee’s Salary Structure.

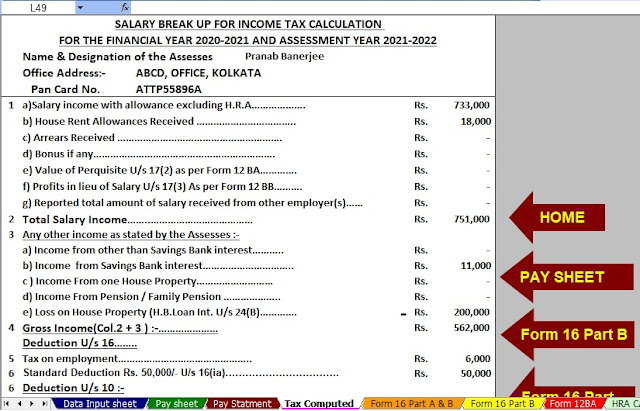

4) Automated Income Tax Form 12 BA

5) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) Individual Salary Sheet