Income tax preparation can be a daunting task, especially for government employees in West Bengal. However, with the advent of advanced technology, All-in-One Income Tax Preparation Software has emerged as a saviour for those navigating the complexities of tax filing in the financial year 2023-24. Introduction In the digital age, income tax preparation software has become an indispensable tool for individuals and businesses alike. For West Bengal Government Employees, ensuring a hassle-free tax filing experience for the financial year 2023-24 is crucial. Therefore, Let’s delve into the specifics of why…

Category: Income Tax Challan ITNS 280 in Excel

Exemptions and Deductions under the Old Tax Regime-A Guide for the Financial Year 2023-24 with Automatic Income Tax Preparation Software in Excel All in One for the F.Y.2023-24

Introduction Exemptions and Deductions under the Old Tax Regime-A Guide for the Financial Year 2023-24. In the complex realm of taxation, Therefore, understanding exemptions and deductions is crucial for every taxpayer. The financial year 2023-24 brings with it a set of rules that dictate how individuals can reduce their taxable income. In other words, In this article, we will delve into the specifics of Section 80C and Section 10 of the Income Tax Act, unravelling the opportunities they offer. Exemptions and Deductions under the Old Tax Regime-A Guide for the Financial…

Excel Software All in One for West Bengal Govt Employees FY 2023-24

Introduction In the ever-evolving landscape of government administration, efficiency is key. For West Bengal government employees, staying updated with the latest tools and technologies is essential to streamline their work. Therefore, One such indispensable tool is Microsoft Excel, an all-in-one solution for managing data, generating reports, and optimizing workflow. In this article, we will delve into how Excel software can be a game-changer for West Bengal government employees in the fiscal year 2023-24. In other words, The Power of Microsoft Excel Microsoft Excel, a versatile spreadsheet application, has become an…

Maximize Deductions with Tax Strategies and Auto Calculate Income Tax All in One for the Government and Non-Government Employees for F.Y.2023-24

In today’s ever-changing financial landscape, optimizing your tax deductions is more crucial than ever before. With the right tax strategies, individuals and businesses can minimize their tax liabilities and maximize their financial resources. Therefore, This article will guide you through effective tax strategies that will help you keep more of your hard-earned money in your pocket. Table of Contents 1. Introduction: The Importance of Tax Deductions In other words, Tax deductions are a powerful tool to legally reduce your taxable income, thereby lowering the amount of taxes you owe to the…

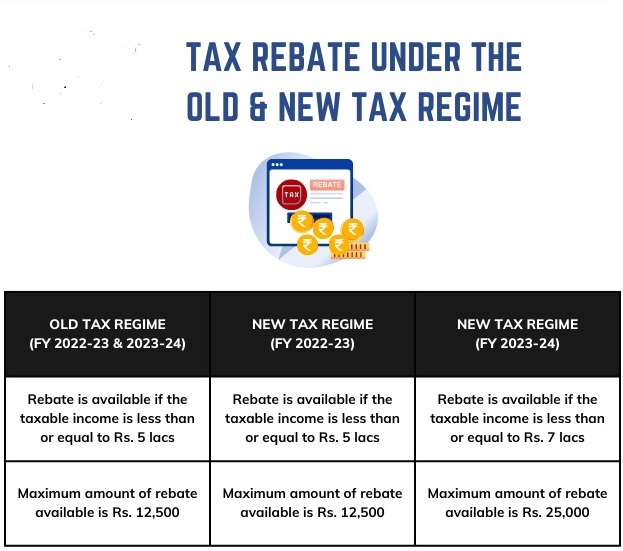

Is Sec 87A Tax Rebate Rs.50,000/- Available in both Tax Regimes? With Auto Calculate Income Tax Preparation Software All in One for the Government and Non-Government Employees for the F.Y.2023-24 as per Budget 2023

Is Sec 87A Tax Rebate Rs.50,000/- Available in both Tax Regimes? With Auto Calculate Income Tax Preparation Software All in One in Excel for the Government & Non-Government Employees for the F.Y.2023-24 as per Budget 2023 In India’s tax world, knowing the rules is crucial. Section 87A is a hot topic—it offers a tax rebate of Rs. 50,000 to individual taxpayers. But does it work in both old and new tax systems? Let’s dive in and find out. We’ll also explore a handy income tax tool for government and non-government…

Easy Tax Saving Tips with Automatic Income Tax Preparation Software All in One in Excel for the Non-Govt Employees for F.Y.2023-24

Introduction In today’s busy world, it’s important to manage your money well. One big part of that is making sure you don’t pay too much in taxes. In this article, we’ll share simple tips for saving on taxes. Therefore, By the end, you’ll have a better idea of how to handle taxes and keep more money in your wallet. In other words, Understanding Taxes Know Your Tax Rate Before we get into saving money, let’s figure out your tax rate. Different incomes have different tax rates, so let’s start there. Use…

Is the tax due for one year more than Rs.10,000? You are responsible for paying taxes in advance

Is the tax due for one year more than Rs.10,000? Where the tax payable by a person exceeds Rs 10,000 after deducting the original TDS it comes into play. Challan280 has been cleared by the IT department for early payment of taxes. It can be paid online using the link https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp and click on Challan no./ITNS 280 tab. Download the Automated Income Tax Challan 280 in Excel Therefore, Advance taxes are paid by those who have a source of income other than their salary. Individuals who earn from rentals, capital gains from shares, fixed income, lottery…

Section 80U – Tax Exemption for Persons with Disabilities| With Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E for the F.Y.2022-23

Section 80U – Check Eligibility, Amount of Deduction, How to Claim, Documents, Definitions, For F.Y 2022-23 (A.Y 2023-24), Diagnosed Disease Section 80U Exclusion of Disability Section 80U of income tax is deductible for those who are unable to work. This section provides a lump sum exemption for a person with a disability based on the severity of the disability, regardless of the amount of the income. Therefore,The criteria for entitled this deduction are -. Taxpayers must be residents. Must be at least 40% disabled for work. The disability must also be…

Download Automated Income Tax Preparation Software in Excel. for the Non-Government (Private) Employees for the F.Y.2022-23

Download Automated Income Tax Preparation Software in Excel | Calculation of income tax for employees of a private company in 2022: The annual CTC of a person working in a private company consists of several components. These include LTA, HRA, pension fund contributions and tips, entertainment reimbursements, phone bills, transportation, books and periodicals, and more. While the names of CTC components may vary from company to company, the applicable tax rules remain the same. For proper tax planning, it is important to understand the tax implications of the various components of the…

Income Tax Preparation Software All in One in Excel for the West Bengal Government Employees for the F.Y.2022-23

Income Tax Preparation Software All in One in Excel| All the West Bengal Government Employees are well known that the Bengal Government has not paid the D.A.till now from the financial year 2020-21 to on-words. The Govt employees get the benefits only the Annual Increment in the month of July of each financial year. It is too hard to listen to the pending D.A. In this regard where the other State Government has already paid the up-to- date D.A. as same as the Central Govt Employees. The Pending D.A. of the West Bengal…