Introduction

For West Bengal State employees, calculating income tax for the Financial Year 2025-26 has become easier with the introduction of Automatic Income Tax Preparation Software in Excel. This tool is specifically designed to save time, minimise errors, and ensure accurate compliance with the latest income tax rules. Employees often struggle with manual calculations, exemptions, deductions, and Form 16 preparation. With this Excel-based software, everything is automated, helping employees file their returns efficiently and hassle-free.

Why West Bengal State Employees Need Automatic Income Tax Software

West Bengal State employees include thousands of teachers, government clerks, officers, and other staff who receive regular monthly salaries. Tax filing often becomes confusing due to frequent updates in income tax rules, rebates, and exemptions announced in every budget. Manual preparation not only takes more time but also increases the chances of errors that may lead to penalties or notices from the Income Tax Department.

By using Automatic Income Tax Preparation Software in Excel, West Bengal employees can:

- Automatically calculate taxable income after considering exemptions and deductions.

- Generate Form 16 instantly without manual effort.

- Prepare Form 10E for relief under Section 89(1) if arrears are received.

- Save time and reduce errors with pre-programmed Excel formulas.

- Stay compliant with the latest Budget 2025-26 provisions.

Key Features of the Automatic Income Tax Preparation Software in Excel

The software has been designed with user-friendly features that make tax preparation easy for employees in West Bengal. Some of the major features include:

1. Automatic Tax Calculation

The software automatically computes tax liability based on the latest slab rates of F.Y. 2025-26 under both the old and new tax regimes.

2. Standard Deduction Updates

The standard deduction as per Budget 2025 is already updated, giving employees relief in taxable income calculations.

3. Exemptions and Deductions

It supports deductions under various sections like 80C, 80D, 80CCD(1B), 80TTA, and 80G, ensuring maximum tax benefits.

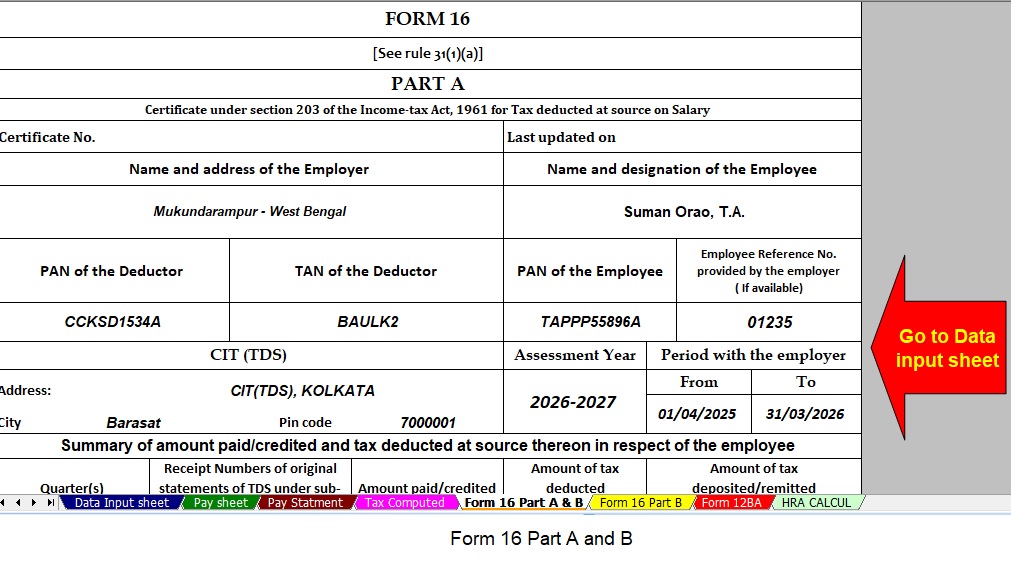

4. Automatic Form 16 Generation

Employees can easily generate Form 16 in Excel format, which is required for filing the Income Tax Return (ITR).

5. Arrears Relief Calculator (Form 10E)

In case of arrears, employees can calculate relief under Section 89(1) using the built-in Form 10E preparation system.

6. State-Specific Focus

The software is tailored for West Bengal State employees, ensuring compliance with both central tax rules and state salary structures.

7. Easy-to-Use Interface

Even employees with basic Excel knowledge can use the software without difficulty.

Income Tax Slab Rates for F.Y. 2025-26

For the convenience of West Bengal State employees, here are the updated tax slab rates as per Budget 2025:

New Tax Regime (Default Option)

- Income up to ₹12,00,000 – No tax (after rebate).

- Income between ₹12,00,001 – ₹15,00,000 – 10% tax.

- Income above ₹15,00,000 – 20% tax.

Old Tax Regime (Optional)

- Up to ₹2,50,000 – Nil.

- ₹2,50,001 – ₹5,00,000 – 5%.

- ₹5,00,001 – ₹10,00,000 – 20%.

- Above ₹10,00,000 – 30%.

Employees can choose the regime that provides them with maximum tax savings, and the Excel software instantly compares both regimes for their benefit.

Advantages of Using Excel-Based Income Tax Software

Unlike online portals or manual calculation, Excel-based tax preparation software offers a wide range of advantages:

- Offline Access – No internet connection required.

- Full Control – Employees can modify and recheck values directly.

- Data Security – Sensitive financial data remains on the employee’s personal computer.

- Customizable – Suitable for different salary structures of West Bengal

- Faster Filing – Saves hours of manual work during tax season.

Step-by-Step Guide to Using the Software

- Download the software in Excel format.

- Enter personal details such as name, PAN, designation, and department.

- Input salary details, including basic pay, allowances, and other income.

- Select exemptions and deductions like HRA, standard deduction, and Chapter VI-A deductions.

- Review automatic tax calculation under both new and old regimes.

- Generate Form 16 directly from the software.

- Prepare Form 10E if claiming arrears relief.

- Save and print for submission during tax filing.

Who Can Use This Software?

The Automatic Income Tax Preparation Software in Excel is best suited for:

- West Bengal Government Teachers

- Clerical Staff and Officers in State Government Departments

- Employees of Local Bodies within West Bengal

- Other Salaried Persons covered under the West Bengal State Payroll

This ensures that every employee can easily prepare their income tax statements without professional assistance.

Compliance with Budget 2025 Provisions

The Union Budget 2025 has introduced new reforms that directly impact salaried employees. Some of the important provisions included in the software are:

- Enhanced rebate up to ₹12 lakh under the new tax regime.

- Updated standard deduction limits.

- Automatic consideration of deductions under Section 80C, 80D, 80CCD, etc.

- Latest tax slab integration as per new announcements.

The Excel software ensures full compliance so that employees never miss out on new benefits.

Why This Software is Essential for West Bengal State Employees

West Bengal has a large number of state employees who often face difficulties in keeping track of frequent tax updates. This software becomes essential because:

- It saves time during tax season.

- It reduces dependency on external professionals.

- It provides accuracy with updated formulas.

- It simplifies tax filing for everyone, from clerks to senior officers.

Conclusion

The Automatic Income Tax Preparation Software in Excel for West Bengal State Employees for the F.Y. 2025-26 is a complete solution for error-free, quick, and efficient tax preparation. It eliminates the stress of manual calculation and ensures compliance with the latest tax laws. By using this software, employees can confidently prepare and submit their income tax returns without relying heavily on third-party services.

Download Automatic Income Tax Preparation Software in Excel for the West Bengal Govt Employees for the F.Y.2025-26

- This Excel Calculator instantly prepares your Tax Computed Sheet according to the latest Budget 2025 provisions.

- Moreover, it includes an inbuilt Salary Structure tailored specifically for Non-Government Employees.

- In addition, it generates an Automatic Salary Sheet for accurate monthly records.

- It also calculates H.R.A. Exemption under Section 10(13A) automatically without manual effort.

- Furthermore, the software prepares Form 12BA automatically for perquisite details.

- With ease, it creates Form 16 Part A and Part B for smooth income tax filing.

- Finally, it also produces Form 16 Part B automatically, ensuring complete compliance and accuracy.