Introduction

The Budget 2025 has reshaped the way individuals approach their tax savings. With the introduction of new income tax slabs from April 1, 2025, many taxpayers are leaning toward the new tax regime. The government has designed it to appear simpler and more attractive by offering standard deductions, higher rebates, and increased employer NPS benefits.

However, here’s the catch: the new tax regime removes many exemptions and deductions available under the old regime. Still, most people don’t realise they can claim tax-free interest from post office savings accounts, even under this new structure.

In this article, we will explain the Income Tax Exemption from Savings Interest U/s 80TTA and 80TTB as per the Budget 2025, the role of post office savings exemptions, and how Automatic Income Tax Preparation Software in Excel with Form 10E simplifies the filing process for both Government and Non-Government employees in F.Y.2025-26.

Table of Contents

| Sr# | Headings |

| 1 | What Changed in the Budget 2025? |

| 2 | Old vs. New Tax Regime – What’s Different? |

| 3 | Tax-Free Interest from Post Office Savings Accounts |

| 4 | Understanding Section 80TTA |

| 5 | Who Can Claim Section 80TTA Benefits? |

| 6 | Maximum Deduction Limit under 80TTA |

| 7 | Understanding Section 80TTB |

| 8 | Who Qualifies for 80TTB? |

| 9 | Difference Between 80TTA and 80TTB |

| 10 | Impact of New Tax Regime on 80TTA and 80TTB |

| 11 | How Post Office Interest Remains Exempt in the New Tax Regime |

| 12 | Automatic Income Tax Preparation Software in Excel |

| 13 | Key Features of All-in-One Software with Form 10E |

| 14 | Benefits for Government Employees |

| 15 | Benefits for Non-Government Employees |

| 16 | Step-by-Step Process to Claim Post Office Interest Exemption |

| 17 | Common Mistakes to Avoid |

| 18 | Practical Example of Tax Calculation |

| 19 | Final Thoughts |

| 20 | FAQs |

What Changed in the Budget 2025?

The government revised the income tax slabs under the new regime. It offered a higher standard deduction, increased rebates, and improved employer contribution benefits to NPS. These changes aim to make the new regime more attractive and reduce dependency on exemptions.

Old vs. New Tax Regime – What’s Different?

- Old regime: Allowed multiple exemptions like 80C, 80D, 80TTA, 80TTB

- New regime: Offers fewer exemptions but compensates with lower tax rates and rebates

This shift encourages taxpayers to simplify their returns without depending heavily on multiple deductions.

Tax-Free Interest from Post Office Savings Accounts

Even though the new regime removes 80TTA and 80TTB deductions, the post office savings account interest remains exempt up to ₹3,500 for individuals and ₹7,000 for joint accounts under Section 10(15)(i).

Therefore, taxpayers can still enjoy limited tax relief on post office interest income, despite the reduced scope of deductions.

Understanding Section 80TTA

Section 80TTA applies to individuals below 60 years and HUFs. It allows a deduction of up to ₹10,000 on interest earned from savings accounts with banks, cooperative societies, or post offices.

Who Can Claim Section 80TTA Benefits?

- Individuals below 60 years

- HUFs

- Not available for senior citizens (covered under 80TTB instead)

Maximum Deduction Limit under 80TTA

You can deduct up to ₹10,000 per year. For example, if you earned ₹12,000 as savings account interest, you will pay tax only on ₹2,000 after claiming this exemption.

Understanding Section 80TTB

Section 80TTB is exclusively for senior citizens aged 60 years or above. It provides a higher deduction of up to ₹50,000 on interest earned from:

- Savings accounts

- Fixed deposits

- Recurring deposits

Who Qualifies for 80TTB?

- Resident senior citizens (60+)

- Interest earned from deposits with banks, post offices, and cooperative banks

Difference Between 80TTA and 80TTB

| Criteria | Section 80TTA | Section 80TTB |

| Eligible Persons | Individuals & HUFs (below 60) | Senior Citizens (60+) |

| Maximum Deduction | ₹10,000 | ₹50,000 |

| Income Type | Only Savings Interest | Savings, FDs, RDs, etc. |

Impact of New Tax Regime on 80TTA and 80TTB

Under the new tax regime, you cannot claim deductions under 80TTA and 80TTB. However, the old tax regime continues to allow them. Thus, taxpayers must choose their regime wisely based on their income profile.

How Post Office Interest Remains Exempt in the New Tax Regime

While the new tax regime removes deductions, it still allows exemptions on post office savings interest under Section 10(15)(i).

- Individual accounts: Exempt up to ₹3,500

- Joint accounts: Exempt up to ₹7,000

This exemption remains valid even without 80TTA or 80TTB, making the post office account a tax-smart option for savers.

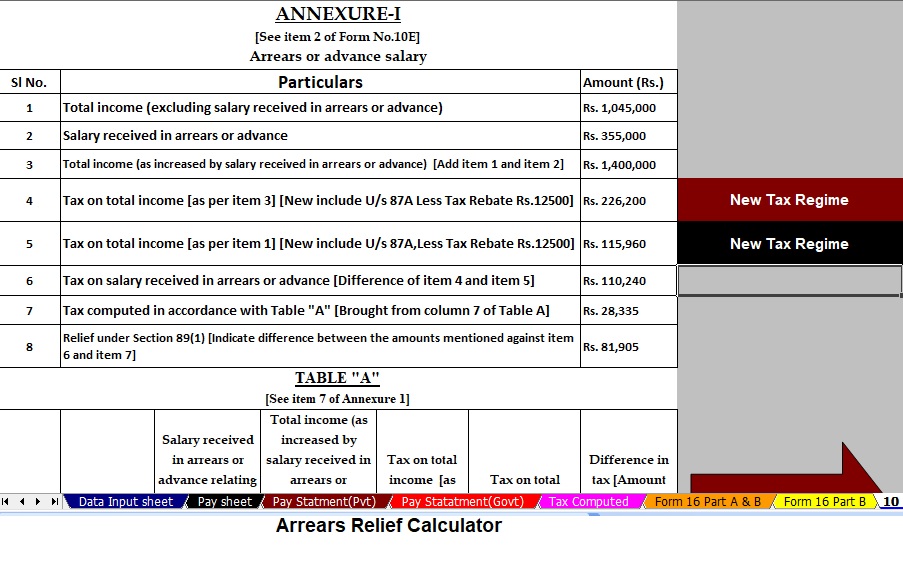

Automatic Income Tax Preparation Software in Excel

Managing exemptions and choosing the right tax regime can feel overwhelming. That’s where Automatic Income Tax Preparation Software All in One in Excel with Form 10E helps. It calculates taxes accurately and automatically for both Government and Non-Government employees.

Key Features of All-in-One Software with Form 10E

- Auto-calculation of tax liability for F.Y.2025-26

- Pre-filled options for exemptions and deductions

- Integrated with Form 10E for arrears relief under Section 89(1)

- Simple, user-friendly interface

Benefits for Government Employees

- Covers allowances like HRA, DA, TA

- Ensures compliance with Budget 2025 rules

- Saves time during filing season

Benefits for Non-Government Employees

- Adjusts for variable pay and allowances

- Simplifies investment declaration under 80C, 80CCD(1B)

- Minimizes filing errors

Step-by-Step Process to Claim Post Office Interest Exemption

- Collect your interest certificate from the post office

- Identify the exempt portion under Section 10(15)(i)

- Enter details in the Excel software

- Allow the software to calculate your taxable vs. exempt income

- Finalise and file with confidence

Common Mistakes to Avoid

- Mixing old and new regime rules

- Forgetting the post office exemption limit

- Claiming 80TTA/80TTB under the new regime (not allowed)

Practical Example of Tax Calculation

- X (35 years old) earns ₹12,000 as savings account interest. Under the old regime, he can claim ₹10,000 under 80TTA.

- Y (65 years old) earns ₹40,000 as deposit interest. She claims ₹40,000 under 80TTB in the old regime.

- Z (chooses new regime) earns ₹4,000 from a post office savings account. He claims ₹3,500 exemption under Section 10(15)(i).

Final Thoughts

The new tax regime offers simplicity but removes popular deductions like 80TTA and 80TTB. Still, you can claim tax-free interest on post office savings accounts, making them a hidden gem for smart savers. Whether you are a Government or Non-Government employee, using Automatic Excel Software with Form 10E ensures smooth, accurate, and stress-free filing for F.Y.2025-26.

FAQs

- Can I claim Section 80TTA or 80TTB under the new tax regime?

No, these deductions are available only in the old regime. - Is post office savings interest exempt under the new regime?

Yes, up to ₹3,500 (individual) or ₹7,000 (joint accounts) remains exempt under Section 10(15)(i). - What is the maximum deduction for senior citizens under 80TTB?

Senior citizens can claim up to ₹50,000 as an exemption under the old regime. - Do I need Form 10E to claim the post office interest exemption?

No, Form 10E applies only for arrear relief under Section 89(1). - Can I use Automatic Excel Software for both regimes?

Yes, the software calculates taxes for both old and new regimes with accuracy.

Download Automatic Income Tax Calculator All in One for Government and Non-Government Employees with Form 10E in Excel for the F.Y.2025-26

- This Excel Calculator instantly prepares your Tax Computed Sheet as per Budget 2025, ensuring accuracy and saving time.

- Moreover, it includes an inbuilt salary structure tailored for both Government and Non-Government employees.

- In addition, it generates an Automatic Salary Sheet with precision.

- It also calculates H.R.A. Exemption automatically under Section 10(13A), eliminating manual effort.

- Furthermore, it computes Income Tax Arrears Relief automatically under Section 89(1) along with Form 10E.

- The software prepares the Automatic Form 16 Part A and B

- Finally, it creates the Automatic Income Tax Form 16 Part B, making the filing process hassle-free.