The Union Budget 2025 introduced significant reforms to simplify the Indian taxation system, particularly through the New Tax Regime. For non-government employees, this new structure offers a straightforward and transparent approach to managing taxes. When combined with an Automated Income Tax Preparation Software All-in-One in Excel, the benefits multiply, saving both time and money. Let’s explore why choosing the New Tax Regime for FY 2025-26 is a smart decision and how automation enhances your tax management experience.

Understanding the New Tax Regime for FY 2025–26

The Government introduced the New Tax Regime to simplify the taxation process and make it more transparent. Instead of dealing with countless deductions and exemptions, taxpayers now enjoy lower tax rates and a straightforward system. Moreover, the New Regime empowers salaried individuals to make efficient financial decisions confidently. They no longer need to gather piles of documents or worry about complex calculations. Instead, they can focus entirely on their income levels and tax slabs.

Furthermore, the Budget 2025 refined these slabs to ensure fairness and equity across all income groups. The new structure encourages compliance and boosts trust between taxpayers and the system. Consequently, individuals experience less stress while filing returns. Therefore, the New Tax Regime promotes clarity, transparency, and taxpayer satisfaction simultaneously.

Benefits of the New Tax Regime for Non-Government Employees

Non-government employees often earn through various salary components such as allowances, bonuses, and incentives. The New Tax Regime caters perfectly to this dynamic structure. It introduces a uniform, fair, and predictable taxation method. Moreover, employees with fluctuating incomes benefit from the simplified slab structure and lower tax rates.

In addition, the system removes the burden of tracking multiple investments or claiming complicated deductions. Consequently, employees can spend less time on paperwork and more time focusing on their careers.

Key Benefits Include:

- Simplified Structure: Employees calculate taxes without applying numerous deduction sections.

- Reduced Paperwork: They submit fewer proofs, receipts, or certificates.

- Lower Tax Rates: The regime benefits those who don’t rely heavily on deductions.

- Instant Comparison: Taxpayers can easily evaluate old versus new regime benefits.

- Greater Flexibility: Every financial year, they can choose the option that fits best.

Therefore, the New Tax Regime for FY 2025–26 emerges as an attractive, time-saving, and smart option for all salaried professionals.

How Automated Income Tax Preparation Software Simplifies Your Tax Filing

Filing taxes manually often overwhelms individuals. Errors, missed entries, and complex computations lead to unnecessary complications. However, with the Automated Income Tax Preparation Software All-in-One in Excel, users can now enjoy a seamless, error-free filing experience.

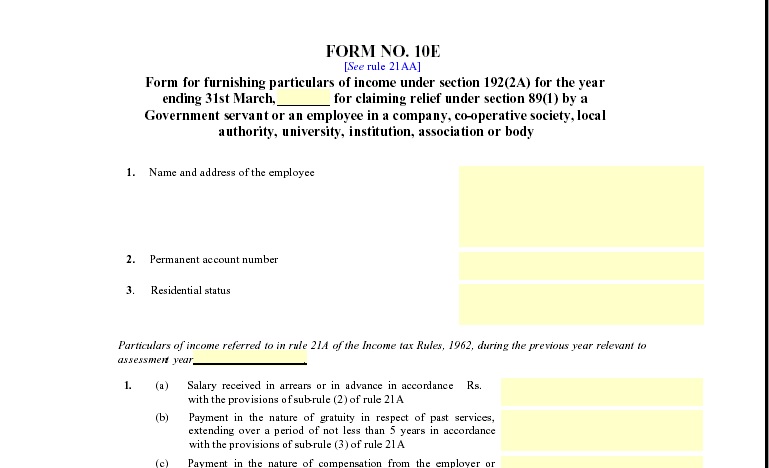

This Excel-based tool automates every calculation and instantly applies the latest tax slabs. Moreover, it generates accurate Form 10E, computation sheets, and salary statements within seconds. As a result, taxpayers no longer worry about manual errors or confusing formulas.

With this software, you can:

- Automatically compute taxable income, tax payable, and savings.

- Generate comparative reports for both old and new regimes.

- Eliminate manual errors through advanced preset formulas.

- Save time, maintain accuracy, and stay compliant with tax laws.

Additionally, the software’s user-friendly interface ensures that even individuals without deep tax knowledge can file confidently. Consequently, they complete their tax filing process faster and more accurately.

Why Combining the New Tax Regime with Automation Is the Future

When taxpayers adopt both the New Tax Regime and Automated Excel Software, they embrace the future of smart taxation. Together, these two innovations redefine efficiency, accuracy, and convenience.

Moreover, automation removes complexity by allowing employees to input salary details, allowances, and deductions easily. Consequently, the tool instantly displays the tax difference between the old and new regimes. Therefore, employees make informed decisions before submission.

Additionally, the software aligns with the Income Tax Department’s Form 10E and adheres to Section 89(1) rules for arrears relief. As a result, taxpayers enjoy complete compliance without stress or confusion.

Key Features of the Automated Excel Tool Include:

- All-in-One Functionality: Handles salary computation, Form 10E, and tax calculation.

- Auto Tax Calculation: Instantly applies the latest Budget 2025 tax slabs.

- Regime Comparison: Clearly shows the tax benefit under each regime.

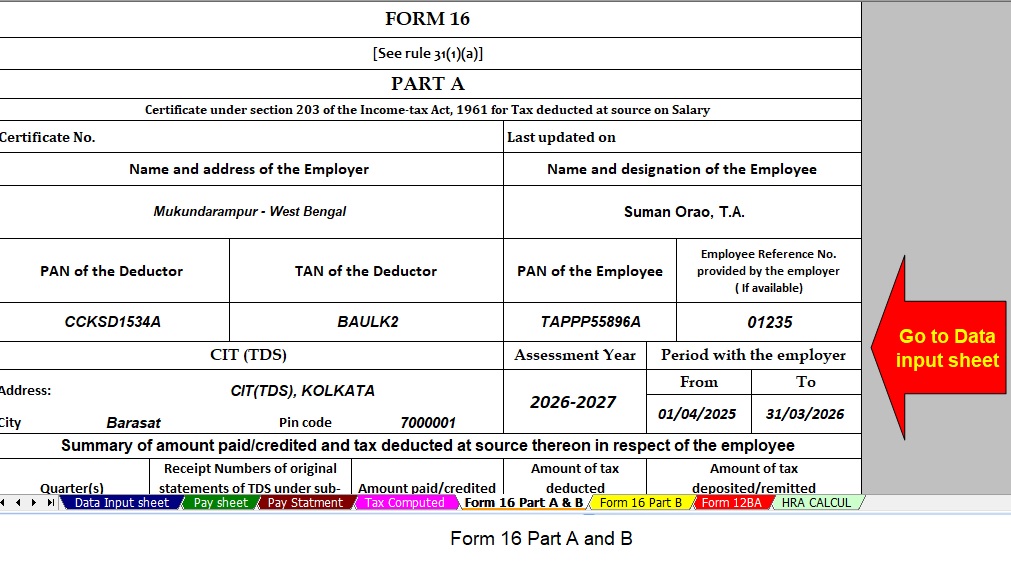

- Form 16 Ready: Prepares data for Form 16 automatically.

- Printable Reports: Offers ready-to-print documents for submission.

- Error-Free Operation: Built-in formulas ensure precise accuracy.

- Compatibility: Runs smoothly on all Excel versions without extra setup.

Hence, this Automated Excel Software becomes the perfect companion for every non-government employee during the FY 2025–26 tax season.

Impact of Budget 2025 on the New Tax Regime

The Union Budget 2025 made significant strides in simplifying and strengthening the New Tax Regime. For instance, the government revised the standard deduction and rebate limits, giving taxpayers greater relief. Moreover, individuals earning up to ₹7.5 lakh annually now enjoy a full rebate under Section 87A, reducing their total tax liability to zero.

Furthermore, the Budget expanded exemptions and fine-tuned income slabs to ensure balanced taxation. Consequently, middle-income groups benefit through lower rates, while higher earners experience greater compliance flexibility.

Additionally, the Budget 2025 promotes digital transformation by encouraging taxpayers to use automated tax filing tools, particularly Excel-based calculators. Therefore, every step—from computation to final submission—becomes faster, clearer, and paperless.

Comparison Between Old and New Tax Regime

| Category | Old Tax Regime | New Tax Regime (FY 2025–26) |

| Deductions & Exemptions | Multiple available | Limited or none |

| Tax Rates | Higher | Lower |

| Paperwork | Complex | Simplified |

| Flexibility | Moderate | High |

| Suitability | For high-investment individuals | For those preferring simplicity |

This comparison clearly illustrates why the New Regime, when paired with Automated Software, is a smarter, time-saving, and stress-free choice for non-government employees. Moreover, the digital shift encourages accuracy, reduces compliance risks, and saves valuable time.

How Non-Government Employees Benefit the Most

Non-government employees often face salary variations and limited HR assistance for tax planning. However, the Automated Income Tax Preparation Software resolves these issues effectively. It automatically calculates tax amounts, ensuring employees pay only what is due.

Moreover, the tool includes pre-filled templates for income details, deductions, and arrears. Consequently, it ensures complete compliance with the latest income tax rules for FY 2025–26. Therefore, employees experience fewer errors and greater confidence during filing.

Additionally, by adopting the New Tax Regime, they save time that would otherwise go into collecting documents or investment proofs. Hence, the combination of automation and simplified taxation truly empowers employees.

Step-by-Step Process to Use Automated Excel Software

- Download the Excel-based tool designed for FY 2025–26.

- Enter personal details such as Name, PAN, Designation, and Financial Year.

- Input income data, including Basic Pay, HRA, DA, Bonus, and Allowances.

- Include deductions (if opting for the Old Regime).

- Select the preferred regime and let the software automatically compare both.

- Generate reports like Tax Computation, Form 10E, and Form 16 data.

- Review and print the finalised report for submission or e-filing.

Consequently, this step-by-step process ensures transparency, precision, and convenience for every taxpayer. Moreover, the simplicity of Excel makes it accessible to all, regardless of technical skill.

Conclusion: Simplify Your Tax Filing for FY 2025–26

In conclusion, choosing the New Tax Regime as per Budget 2025 and using the Automated Income Tax Preparation Software All-in-One in Excel represents a progressive move toward smarter tax management. Moreover, this combination eliminates confusion, minimises paperwork, and boosts accuracy.

Furthermore, automation ensures compliance with evolving tax norms while saving significant time. Therefore, whether you are a salaried professional or a financial consultant, embracing this tool guarantees effortless and reliable tax filing.

Ultimately, in an era where technology meets transparency, adopting automated systems like the Excel-based All-in-One tool allows taxpayers to manage returns efficiently, confidently, and compliantly. Consequently, FY 2025–26 becomes not just another tax year but a step toward a more digital, simplified, and empowered future.

Download Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) for Non-Government Employees

Key Features of the Excel-Based Tax Preparation Utility

- Dual Regime Option:

You effortlessly choose between the New or Old Tax Regime under Section 115BAC. Moreover, the tool automatically compares both regimes and identifies the most tax-saving option for you. - Customised Salary Structure:

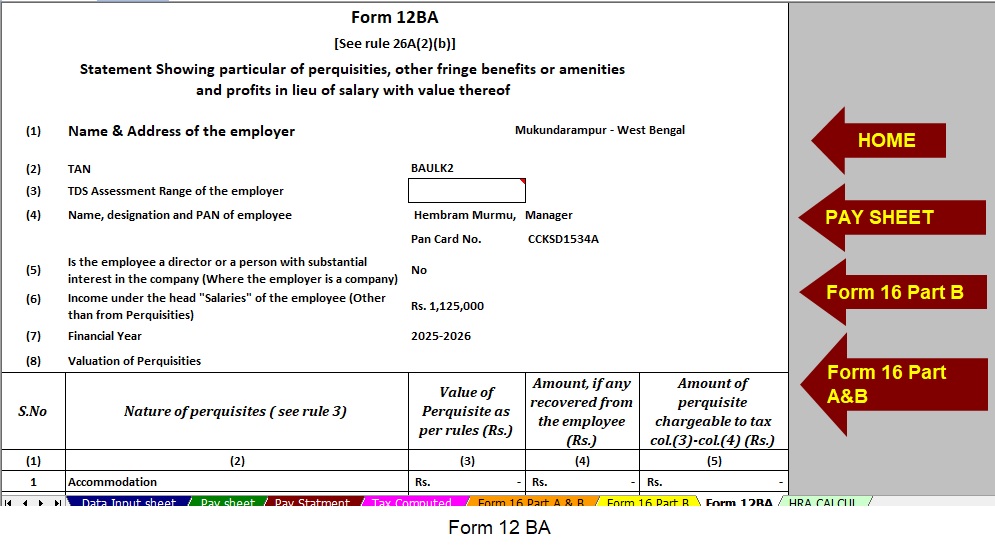

The software adjusts automatically to your salary format, whether you work in a Non-Government organisation or the private sector. Additionally, this customisation reduces manual entry, saves time, and boosts - Automatic Income Tax Form 12BA:

The software generates Form 12BA instantly and ensures compliance with current tax norms. Furthermore, it eliminates manual errors, making the process seamless and reliable. - Updated Form 16 (Part A & B) and Part B:

The tool creates a Revised Form 16 (Part A & B) automatically for the Financial Year 2025–26. Likewise, it ensures that your Form 16 remains compliant with the latest Income Tax Department - Simplified Compliance:

The utility guarantees quick and error-free tax computation through advanced built-in formulas. Furthermore, it enables you to prepare your return confidently, enhancing both speed and accuracy while minimising manual effort.