Introduction

The Union Budget 2025 once again sparked discussions among salaried taxpayers, especially the non-government employees, about whether to stay with the Old Regime or shift to the New Regime. While the New Regime offers simplified tax slabs, many individuals still prefer the Old Regime for its deductions, exemptions, and flexibility.

But here comes the big question: Who chose the Old Regime as per Budget 2025? And how can employees make this selection smooth without getting lost in complex calculations?

That’s where the Automatic Income Tax Preparation Software All-in-One in Excel becomes a game-changer. This tool not only helps in deciding between the regimes but also auto-prepares income tax calculations for F.Y. 2025-26.

Let’s dive deep into the details!

Table of Contents

| Sr# | Headings |

| 1 | Understanding the Old Regime in Budget 2025 |

| 2 | Difference Between Old and New Regimes |

| 3 | Who are the Choise of the Old Regime as per Budget 2025 |

| 4 | Why Non-Govt Employees Prefer the Old Regime |

| 5 | Key Benefits of Choosing the Old Regime |

| 6 | Common Deductions Available in the Old Regime |

| 7 | Role of Automatic Income Tax Preparation Software |

| 8 | Features of All-in-One Excel Software for F.Y.2025-26 |

| 9 | How This Software Helps Non-Government Employees |

| 10 | Step-by-Step Guide to Using the Software |

| 11 | Mistakes to Avoid While Choosing the Regime |

| 12 | Practical Examples: Old Regime vs. New Regime |

| 13 | Budget 2025 Impact on Old Regime Taxpayers |

| 14 | Should You Stick to the Old Regime in 2025-26? |

| 15 | Final Thoughts and Recommendations |

Understanding the Old Regime in Budget 2025

The Old Regime allows taxpayers to continue claiming deductions and exemptions. It follows the traditional tax slab system where Section 80C, 80D, HRA, LTA, Home Loan Interest, and Standard Deduction play a major role in reducing taxable income.

Difference Between Old and New Regimes

The New Regime provides lower tax rates but removes most deductions. On the other hand, the Old Regime offers higher tax rates but allows multiple deductions.

Think of it like ordering food: the Old Regime is like a buffet with lots of choices (deductions), while the New Regime is like a fixed meal at a lower price (simplified but fewer options).

Who chose the Old Regime as per the Budget 2025?

The people who are chosen by the Old Regime as per Budget 2025 are usually:

- Non-govt employees with home loans.

- Those investing in PF, LIC, ELSS, and other Section 80C instruments.

- Salaried individuals who claim HRA and LTA.

- Families with medical insurance under Section 80D.

- Anyone whose deductions significantly reduce taxable income.

Why Non-Govt Employees Prefer the Old Regime

Non-govt employees often have flexible salary structures that include HRA, transport allowance, and medical reimbursements. With the Old Regime, they can maximise exemptions and save more tax.

Key Benefits of Choosing the Old Regime

- Multiple Deductions – From 80C to 80D, you can save big.

- Housing Benefits – Interest on home loans is deductible.

- Family Security – Life insurance and medical policies reduce tax burden.

- Retirement Savings – PF and pension investments are tax-deductible.

Common Deductions Available in the Old Regime

- 80C: Investments up to ₹1.5 lakh.

- 80D: Medical insurance for family.

- 24(b): Home loan interest deduction up to ₹2 lakh.

- HRA & LTA: Salary components exempted.

- Standard Deduction: ₹75,000 as per Budget 2025.

Role of Automatic Income Tax Preparation Software

Calculating taxes manually can be time-consuming and confusing. This is why the Automatic Income Tax Preparation Software in Excel helps taxpayers compare both regimes instantly and choose the best option.

Features of All-in-One Excel Software for F.Y.2025-26

- Auto tax calculation for the Old and New Regime.

- Preloaded deductions under various sections.

- Salary structure customisation for non-Govt employees.

- User-friendly Excel-based tool.

- Auto-generated Form 16 and reports.

How This Software Helps Non-Government Employees

Imagine calculating tax for hours and still making errors. With this software:

- You get error-free results instantly.

- It saves time and effort.

- It provides a clear comparison between regimes.

- It ensures compliance with the latest Budget 2025 rules.

Step-by-Step Guide to Using the Software

- Download the software.

- Fill in salary details.

- Enter deductions (like 80C, 80D, etc.).

- Select your regime preference.

- Get an auto-generated tax report.

Mistakes to Avoid While Choosing the Regime

- Not calculating both regimes before choosing.

- Ignoring deductions like HRA or home loan.

- Forgetting to update tax rules as per Budget 2025.

- Depending only on guesswork instead of tools.

Practical Examples: Old Regime vs. New Regime

- Example 1: A non-govt employee with home loan + insurance – Old Regime saves more.

- Example 2: A fresher with no deductions – New Regime works better.

Budget 2025 Impact on Old Regime Taxpayers

The Standard Deduction increased to ₹75,00,0 and continued deductions make the Old Regime more attractive for many salaried individuals.

Should You Stick to the Old Regime in 2025-26?

If your deductions are high, the Old Regime will help you save more. But if you have fewer investments, the New Regime may suit you better.

Final Thoughts and Recommendations

The decision of who chooses the Old Regime as per Budget 2025 depends on personal income, deductions, and lifestyle. For non-govt employees with multiple exemptions, the Old Regime remains a powerful choice, especially when supported by the Automatic Income Tax Preparation Software All in One in Excel.

By using this tool, you not only save taxes but also gain peace of mind knowing your tax preparation is error-free.

FAQs

- Who chose the Old Regime as per Budget 2025?

Those with high deductions under 80C, home loans, HRA, and medical insurance are more likely to choose the Old Regime. - Can non-govt employees still use exemptions in the Old Regime?

Yes, non-govt employees can continue claiming exemptions like HRA, LTA, and deductions under various sections. - How does the Automatic Income Tax Preparation Software help?

It provides instant, accurate, and comparative tax calculations under both regimes with Excel automation. - Is the Old Regime better for first-time earners?

Not necessarily. If you have no investments or deductions, the New Regime might save more. - What is the standard deduction in the Old Regime for F.Y.2025-26?

As per Budget 2025, the standard deduction has been increased to ₹75,000.

Download Automatic Income Tax Calculator All in One for the Non-Government Employees in Excel for the F.Y.2025-26

Features of this Excel Utility:-

- Firstly, this Excel Calculator prepares your Tax Computed Sheet instantly as per the Budget 2025.

- In addition, it includes an inbuilt Salary Structure designed specifically for Non-Government Employees.

- Moreover, it generates an Automatic Salary Sheet without manual effort.

- Next, it calculates the H.R.A. Exemption U/s 10(13A) automatically and accurately.

- Furthermore, it computes the Income Tax Form 12 BA without errors.

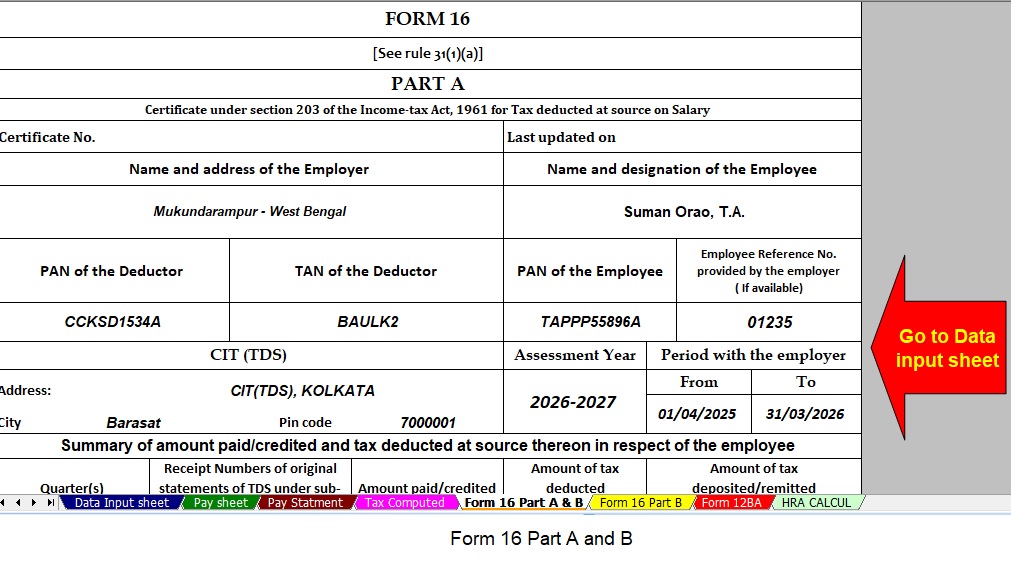

- Then, it creates Automatic Form 16 Part A and B with precision.

- Finally, it also generates the Automatic Income Tax Form 16 Part B for your convenience.