In India, the choice between the old and new tax regimes for the financial year (FY) 2025–26 depends entirely on your specific financial situation, primarily your income level and the amount you can claim as deductions. There is no single “best” option for everyone, so a careful comparison is needed.

The key changes announced in the Budget 2025 significantly sweeten the deal for the new tax regime, but the old regime remains a better choice for taxpayers with substantial investments and eligible expenses.

Key differences between the two regimes

| Criteria | Old Tax Regime | New Tax Regime (FY 2025–26) |

| Tax Rates and Slabs | Features higher tax rates. For individuals below 60, the basic exemption is up to ₹2.5 lakh, after which taxes begin at 5%. |

Features lower and simplified tax rates with more slabs. The basic exemption limit has been increased to ₹4 lakh. The 30% tax rate now applies to income above ₹24 lakh, increased from ₹15 lakh. |

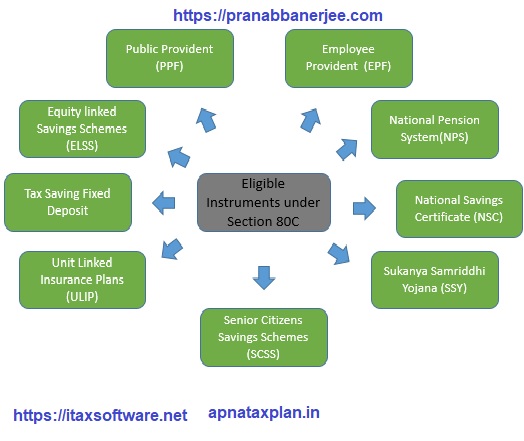

| Deductions and Exemptions | Allows numerous deductions, such as Section 80C (PPF, ELSS, insurance), HRA, home loan interest, and Section 80D (medical insurance). | Eliminates most major deductions and exemptions. |

| Tax Rebate (Sec 87A) | The maximum rebate remains ₹12,500, making income up to ₹5 lakh tax-free. | The rebate has been increased to ₹60,000, making taxable income up to ₹12 lakh effectively zero. |

| Standard Deduction | Remains ₹50,000 for salaried employees and pensioners. | Increased to ₹75,000 for salaried employees and pensioners, making income up to ₹12.75 lakh tax-free. |

| Tax Filing | Requires more paperwork to furnish proof of investments and expenses. | It is simpler and involves less documentation. |

| Default Regime | The new tax regime is the default option for all taxpayers. | To choose the old regime, you must actively opt out of the new one while filing your Income Tax Return. |

How to decide what is best for you

The new tax regime is generally the better choice if:

- Your annual income is up to ₹12.75 lakh (for salaried individuals), and you want a zero tax liability.

- You do not have significant deductions from investments (like PPF or ELSS) or expenses (like home loan interest or HRA).

- You prefer a simpler and easier tax filing process with minimal documentation.

- Your income falls between ₹12 lakh and ₹24 lakh, as the revised slabs can offer lower tax liability than the old regime, especially if your deductions are low.

The old tax regime could still be more beneficial if:

- You have high deductions and exemptions that can reduce your taxable income substantially. For example, individuals with home loans, significant HRA, and full investments under Section 80C can save more.

- Your total deductions and exemptions exceed the benefit offered by the new regime’s lower tax rates. Tax experts suggest a threshold of around ₹8 lakh in deductions for very high earners, but this break-even point is much lower for middle-income groups.

- You have income from a business or profession and want to switch back to the old regime. Note that those with business income can only switch back to the new regime once in a lifetime.

Key takeaways

To make the best decision for your circumstances:

- Do the math. The most reliable method is to calculate your tax liability under both regimes. Use an online tax calculator to input your income and potential deductions to compare the final tax payable.

- Evaluate your deductions. Tally up all the deductions you can claim under the old regime, such as Section 80C investments, HRA, and home loan interest. If this amount is high, the old regime might win.

- Consider your financial goals. The new regime offers more flexibility with your money since it doesn’t tie you to long-term tax-saving investments like the old one does.

- Remember the default. The new regime is now the default option, but salaried individuals can choose the old regime every year while filing their tax returns.