Introduction: Understanding India’s Dual Tax System

India’s income tax structure offers two distinct regimes — the Old Tax Regime and the New Tax Regime. Both systems aim to give taxpayers flexibility, yet each carries unique implications for deductions, compliance, and overall tax liability.

Since Budget 2025, the government has continued to emphasise simplifying taxation, particularly for middle-income earners and salaried individuals. However, deciding which tax regime suits you best depends on how you earn and invest.

Before choosing, let’s dive into the latest updates, comparisons, and saving strategies so you can make a smart and informed choice this financial year.

The Union Budget 2025 brought significant updates to India’s income tax system, especially under the New Tax Regime. While the Old Regime remained largely unchanged, the new rules aim to simplify tax filing, increase savings, and reduce the burden on millions of salaried taxpayers.

But what do these updates really mean for you? Should you stick with the Old Regime, or is it time to embrace the New Regime? Let’s explore every key detail, compare both systems, and help you make a smart, informed choice.

Table of Contents

| Sr# | Headings |

| 1 | Introduction |

| 2 | Key Highlights of Budget 2025 |

| 3 | Basic Exemption and Standard Deduction Updates |

| 4 | Rebate under Section 87A Explained |

| 5 | Simplified Tax Slabs: A Fresh Perspective |

| 6 | Overview: Old vs. New Tax Regime (FY 2025–26) |

| 7 | Income Tax Slabs Under the Old Regime |

| 8 | Income Tax Slabs Under the New Regime |

| 9 | Major Differences Between Old and New Tax Regimes |

| 10 | Advantages of the Old Tax Regime |

| 11 | Benefits of the New Tax Regime |

| 12 | Tax-Saving Strategies for Both Regimes |

| 13 | Who Should Choose Which Regime? |

| 14 | Pro Tips to Maximize Tax Savings |

| 15 | Final Thoughts & FAQs |

Key Highlights of Budget 2025

The Budget 2025 introduced progressive tax reforms designed to promote fairness and financial stability. Importantly, while the New Tax Regime underwent transformative changes, the Old Regime largely retained its traditional structure.

Key updates include:

- Basic Exemption Limit: Increased from ₹3 lakh to ₹4 lakh.

- Standard Deduction: Raised from ₹50,000 to ₹75,000 for salaried taxpayers and pensioners.

- Rebate (Section 87A): Enhanced to ₹60,000, making income up to ₹12 lakh completely tax-free.

- Simplified Slabs: Introduced reduced tax rates across multiple income brackets.

- Default Option: The New Regime continues as the default system, though you may opt for the Old Regime if preferred.

In short, the New Tax Regime now emphasises automation and simplicity, whereas the Old Regime continues to reward careful financial planning.

Basic Exemption and Standard Deduction Updates

The increase in the basic exemption limit to ₹4 lakh offers instant relief for all taxpayers. Moreover, the enhanced standard deduction of ₹75,000 significantly boosts disposable income for both salaried individuals and pensioners.

Transition-wise, this move reduces taxable income effectively and encourages consumer spending, which in turn stimulates the economy.

Rebate under Section 87A Explained

The rebate under Section 87A now covers incomes up to ₹12 lakh, allowing many taxpayers to enjoy zero tax liability. Consequently, individuals earning ₹12 lakh or less can effectively avoid paying any tax, provided they choose the New Regime.

This change bridges the gap between low- and middle-income earners, fostering a more equitable tax landscape.

Simplified Tax Slabs: A Fresh Perspective

The New Tax Regime’s restructured slabs make the process more intuitive. Earlier, many found the system confusing due to numerous deductions and exemptions. Now, with simplified slabs, taxpayers can quickly calculate their liability and file returns efficiently.

| Income Range | Tax Rate (FY 2025–26) |

| Up to ₹4 lakh | Nil |

| ₹4–₹8 lakh | 5% |

| ₹8–₹12 lakh | 10% |

| ₹12–₹16 lakh | 15% |

| ₹16–₹20 lakh | 20% |

| ₹20–₹24 lakh | 25% |

| Above ₹24 lakh | 30% |

The combination of lower rates and higher deductions makes the New Regime appealing to most salaried individuals.

Overview: Old vs. New Tax Regime (FY 2025–26)

Let’s break down the comparison between both two regimes for clarity and convenience.

| Feature | Old Regime | New Regime (Default) |

| Tax Slabs | Based on age | Uniform for all |

| Basic Exemption | ₹2.5 lakh (<60 yrs) | ₹4 lakh |

| Standard Deduction | ₹50,000 | ₹75,000 |

| Rebate (87A) | ₹12,500 (up to ₹5 lakh) | ₹60,000 (up to ₹12 lakh) |

| Deductions | Available under 80C, 80D, HRA, etc. | Mostly removed |

| Default Option | Must opt manually | Automatic |

| Documentation | Extensive | Minimal |

| Flexibility | Annual switch allowed | Limited (for business income) |

✅ Old Regime: Best for taxpayers claiming deductions exceeding ₹2.5 lakh.

✅ New Regime: Ideal for those with minimal deductions seeking simplicity.

Income Tax Slabs Under the Old Regime

The Old Regime rewards long-term investors and disciplined savers. It also offers higher exemptions for senior citizens, encouraging financial security.

| Category | Income Range | Tax Rate |

| Individuals (<60 yrs) | Up to ₹2.5 lakh | Nil |

| ₹2.5–₹5 lakh | 5% | |

| ₹5–₹10 lakh | 20% | |

| Above ₹10 lakh | 30% | |

| Senior Citizens (60–80) | Up to ₹3 lakh | Nil |

| Super Senior Citizens (80+) | Up to ₹5 lakh | Nil |

With deductions under Sections 80C, 80D, and 24(b), this regime allows effective tax planning.

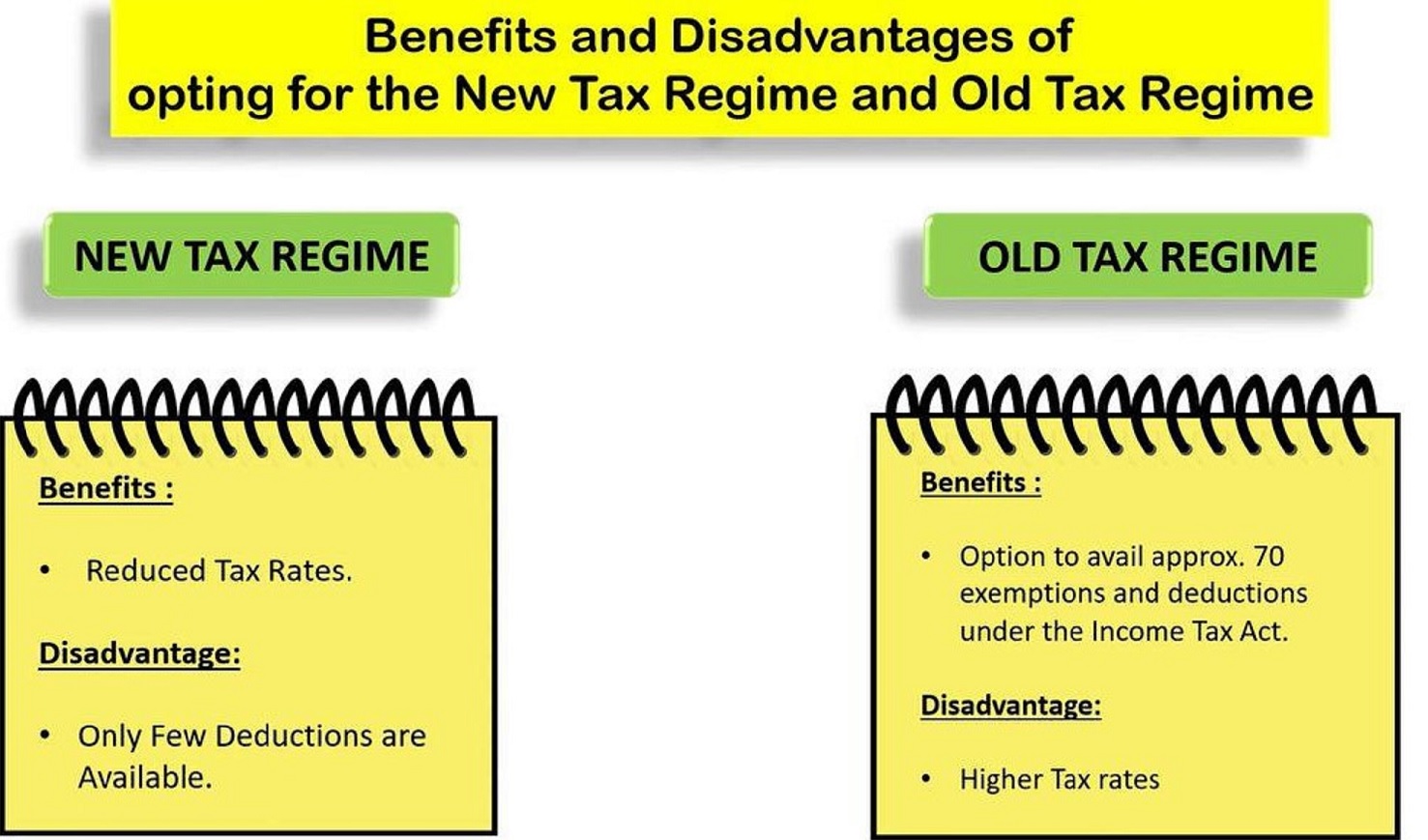

Major Differences Between Old and New Tax Regimes

Let’s examine what sets them apart:

- The Old Regime rewards investment-based savings, while the New Regime rewards simplicity and liquidity.

- The Old Regime involves more paperwork but greater flexibility.

- The New Regime offers less compliance, automatic calculation, and quicker return filing.

In essence, if your deductions exceed ₹2.5 lakh, the Old Regime often saves more. Otherwise, the New Regime proves more beneficial.

Advantages of the Old Tax Regime

- Encourages Savings: Deductions under Section 80C promote long-term investment.

- Supports Families: 80D and 80E deductions help manage medical and educational expenses.

- Home Loan Benefits: Section 24(b) allows up to ₹2 lakh interest deduction.

- Charitable Relief: Donations under 80G remain deductible.

Example: Imagine the Old Regime as a “well-equipped toolbox”—it offers many instruments (deductions) but requires you to know how to use them efficiently.

Benefits of the New Tax Regime

Conversely, the New Tax Regime is like a ready-to-drive car—no setup, just start and go!

Key benefits include:

- Reduced Complexity: No need for proofs or documentation.

- Faster Filing: Simplifies income tax return (ITR) submission.

- Enhanced Deductions: ₹75,000 standard deduction + ₹60,000 rebate under 87A.

- Zero Tax Liability: Up to ₹12.75 lakh income may become tax-free.

Thus, this regime benefits those seeking convenience and clarity over multiple exemptions.

Tax-Saving Strategies for Both Regimes

Under the Old Regime:

- Maximise 80C deductions (PPF, ELSS, NSC, Life Insurance).

- Claim 80D medical insurance and 24(b) home loan interest.

- Utilise HRA, LTA, and NPS contributions for extra relief.

Under the New Regime:

- Structure salary smartly for lower tax brackets.

- Claim employer’s NPS contribution (up to 14%).

- Benefit from family pension and leave encashment exemptions.

Transition words like additionally, furthermore, moreover, and consequently emphasise how each approach can optimise returns.

Who Should Choose Which Regime?

Choose the Old Regime if:

- You invest regularly in PPF, ELSS, or Life Insurance.

- You have housing loans or HRA benefits.

- Your deductions exceed ₹2.5 lakh annually.

Choose the New Regime if:

- You prefer hassle-free filing.

- You don’t claim major exemptions.

- You want faster, transparent tax calculation.

Therefore, the choice depends on your lifestyle, income pattern, and investment strategy.

Pro Tips to Maximise Tax Savings

- Maximise Retirement Contributions: Use NPS, PPF, and EPF to build security.

- Maintain Accurate Records: Keep receipts for all eligible deductions.

- Stay Updated: Monitor annual budget changes and tax reforms.

- Seek Professional Guidance: Use Excel-based Automatic Income Tax Preparation Software for easy comparisons.

- File On Time: Timely ITR filing ensures peace of mind and compliance.

Final Thoughts

Choosing between the Old and New Tax Regime depends entirely on your financial habits and goals.

If you value investment-led savings, the Old Regime continues to shine.

However, if you desire simplicity, speed, and no paperwork, the New Regime is clearly your best companion.

Remember, whichever you choose, the ultimate goal is to plan smartly, save efficiently, and comply effortlessly.

FAQs: Understanding the Old and New Tax Regime

Q1. Can I switch between the Old and New Tax Regime every year?

Yes. Individuals without business income can switch annually before filing returns.

Q2. Which regime offers more deductions?

The Old Regime offers more deductions under Sections 80C, 80D, 24(b), and others.

Q3. Is the New Tax Regime mandatory in FY 2025–26?

No. It’s the default option, but you can still choose the Old Regime.

Q4. What is the new rebate limit under Section 87A?

A rebate of ₹60,000 applies for incomes up to ₹12 lakh under the New Regime.

Q5. Which regime benefits senior citizens the most?

The Old Regime still benefits those with high medical expenses and savings, but the New Regime simplifies compliance for moderate earners.