Have you ever felt the excitement of waiting for your Income Tax Refund after filing your return? It feels a little like waiting for a friend to arrive with a long-promised gift. Everyone who files income tax for FY 2024-25 wants to know the same thing: When will the refund arrive? Thankfully, with the help of Automatic Income Tax Preparation Software in Excel All-in-One for FY 2025-26, as per Budget 2025, tracking, filing, and planning your refund has become easier than ever.

In this article, we’ll break down refund timelines, reasons for delay, and how smart tax software can make the whole process smooth, quick, and stress-free. Let’s dive in step by step.

Table of Contents

| Sr# | Headings |

| 1 | Importance of Income Tax Refund |

| 2 | When to Expect Your ITR Refund for FY 2024-25 |

| 3 | How the Refund Process Works |

| 4 | Key Factors Affecting Refund Timelines |

| 5 | Common Reasons for Refund Delays |

| 6 | How to Track Your Income Tax Refund Online |

| 7 | Role of Form 10E in Refund Claims |

| 8 | Benefits of Using Automatic Income Tax Preparation Software |

| 9 | Features of Excel All-in-One Tax Software |

| 10 | Impact of Budget 2025 on Refund Timelines |

| 11 | Refunds for Salaried Employees |

| 12 | Refunds for Self-Employed Individuals |

| 13 | Quick Tips to Get Faster Refunds |

| 14 | Future of Income Tax Refund Automation |

| 15 | Conclusion |

1. Importance of Income Tax Refund

An Income Tax Refund represents more than just money; it returns your hard-earned amount when you pay extra tax. Moreover, this refund acts as a financial breather for many. It not only supports savings but also aids debt repayment and encourages small investments.

2. When to Expect Your ITR Refund for FY 2024-25

Generally, you receive your refund within 20–45 days once the ITR is processed. However, the timeline may vary depending on accuracy, assessment, and verification. Furthermore, when you file your return early, you often secure faster refunds.

3. How the Refund Process Works

The refund journey begins as soon as you file and verify your ITR. Afterwards, the CPC (Central Processing Centre) processes your return. If the system detects excess tax paid, it directly credits the refund to your bank account.

4. Key Factors Affecting Refund Timelines

Several elements influence refund speed. These include:

-

Filing date

-

Accuracy of details

-

Pending verifications

-

Bank account pre-validation

Even minor mistakes can cause delays in the refund process.

5. Common Reasons for Refund Delays

Refund delays frequently occur due to:

-

Mismatch in income details

-

Incorrect bank information

-

Non-filing of Form 10E for arrears relief

-

Technical errors in the system

Therefore, when you stay accurate and updated, you reduce refund delays.

6. How to Track Your Income Tax Refund Online

You can track your refund easily through:

-

The Income Tax e-filing portal

-

The NSDL refund tracking website

Both platforms only require your PAN and assessment year, and with a single click, you can check your refund status.

7. Role of Form 10E in Refund Claims

If you claim arrears relief under Section 89(1), you must submit Form 10E before filing ITR. Otherwise, your refund may face delays or even denial. Hence, always attach Form 10E when necessary.

8. Benefits of Using Automatic Income Tax Preparation Software

Manual calculations consume time and invite errors. In contrast, Automatic Excel-based tax software simplifies tax filing by:

9. Features of Excel All-in-One Tax Software

This all-in-one software comes packed with features, such as:

-

Salary sheet preparation

-

Automatic tax calculation under both old and new regimes

-

Pre-built Form 16 generation

-

Support for salaried and self-employed taxpayers

10. Impact of Budget 2025 on Refund Timelines

Budget 2025 clearly focused on faster refund processing. With upgraded technology and quicker validation, taxpayers now receive refunds more promptly than in earlier years.

11. Refunds for Salaried Employees

Salaried taxpayers generally obtain refunds faster because employers already deduct TDS. With accurate filing, they can receive refunds within a month.

12. Refunds for Self-Employed Individuals

Self-employed individuals often experience longer scrutiny. Their refunds may take extra time due to detailed income checks. Nevertheless, automation now speeds up their refund process.

13. Quick Tips to Get Faster Refunds

You can secure refunds faster by following these tips:

-

File your ITR early

-

Verify your ITR immediately

-

Provide the correct bank details

-

Pre-validate your bank account

-

Use reliable tax software

14. Future of Income Tax Refund Automation

The future of refunds looks promising. With AI-driven tax systems and Excel-based software, refunds may soon become near-instant, thus removing stress for taxpayers.

15. Conclusion

Your Income Tax Refund for FY 2024-25 largely depends on accuracy and timely filing. By using the Automatic Income Tax Preparation Software in Excel All in One for FY 2025-26 as per Budget 2025, you not only simplify tax filing but also boost your chances of receiving faster refunds. Ultimately, when you file smartly today, you ensure financial relief tomorrow.

FAQs

- How long does it take to receive an Income Tax Refund for FY 2024-25?

It usually takes 20–45 days after ITR processing, depending on accuracy and verification. - Why is my Income Tax Refund delayed?

Refunds delay due to incorrect details, unverified ITR, or missing Form 10E. - How can I check my Income Tax Refund status online?

You can check it on the Income Tax portal or the NSDL refund tracking site using your PAN and year. - Can I get a refund if I paid tax under the new regime?

Yes, refunds apply to both old and new regimes if you overpaid tax.

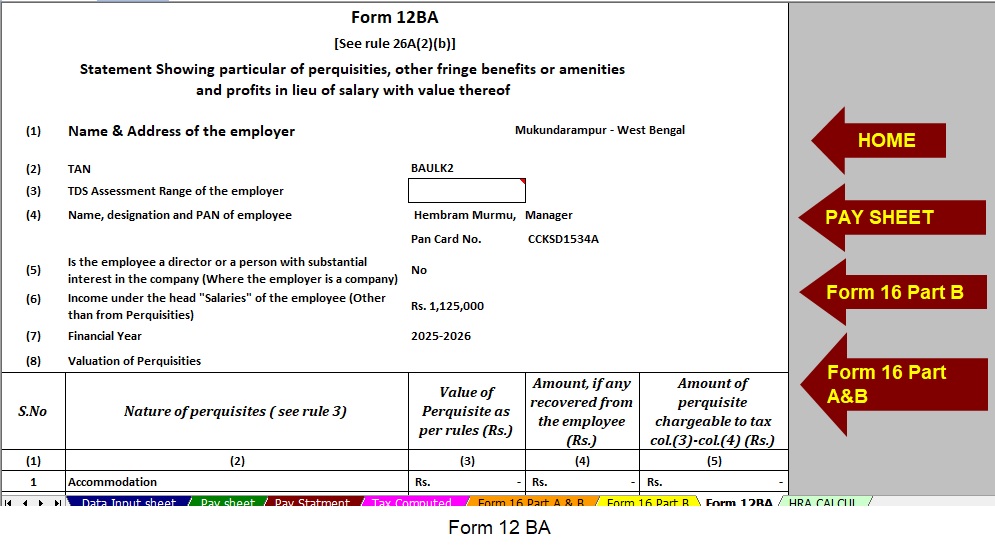

Download the Automatic Income Tax Calculator All-in-One for Non-Government Employees with Form 10E in Excel for F.Y. 2025-26

- This Excel-based calculator instantly prepares your Tax Computation Sheet as per the provisions of Budget 2025, ensuring quick results.

- Moreover, it offers an inbuilt salary structure for Non-Government employees, which makes the tool highly user-friendly.

- You can also depend on its Automatic Salary Sheet, as it ensures accuracy without requiring any manual effort.

- In addition, the calculator computes HRA exemption automatically under Section 10(13A) with just a few entries, saving your time.

- Furthermore, it simplifies your work by Form 12 BA

- As a bonus, the tool generates Form 16 Part A and Part B automatically, which reduces unnecessary paperwork.

- Finally, it provides an automatic Income Tax Form 16 Part B, making the entire filing process seamless and stress-free.