Introduction

1. Understanding Advance Tax

Advance Tax, often called “Pay As You Earn”, is a way to pay your income tax in parts instead of a lump sum. Therefore, you don’t need to wait until the end of the financial year to clear your tax bill. In other words, it’s like paying your tuition fees in instalments rather than struggling to pay them all at once.

Moreover, Advance Tax applies when your net tax liability after deductions and TDS is above ₹10,000. Thus, if your annual liability crosses this threshold, you are legally required to comply.

2. Why is Advance Tax Important

Why does the government emphasise advance tax? Firstly, it guarantees a steady flow of income for public projects such as roads, healthcare, and education. Secondly, it ensures that taxpayers don’t feel overwhelmed during the annual return filing. Finally, it acts as a safety net against penalties.

Consequently, both taxpayers and the government benefit. From a taxpayer’s perspective, spreading payments is convenient. From the government’s side, it reduces the risk of tax evasion.

3. Who is Liable to Pay Advance Tax?

Advance Tax liability is not limited to one group. Instead, it covers:

- Salaried employees with additional income, like rent or capital gains.

- Business owners who earn through trade, consultancy, or services.

- Freelancers and professionals such as doctors, lawyers, and content creators.

- Companies, irrespective of profit margins.

Therefore, if you belong to any of these categories and your liability exceeds ₹10,000, you must pay Advance Tax.

4. Who is Exempted from Advance Tax?

Not every taxpayer is bound by the Advance Tax. For instance, if you are a senior citizen above 60 years with no business income, you are exempt. Similarly, those with a liability of less than ₹10,000 need not worry. Additionally, salaried employees whose employers deduct TDS accurately are also safe.

Hence, exemptions make it fair for those with lower incomes or fully covered through TDS.

5. Calculation of Advance Tax

To calculate the Advance Tax correctly, follow these steps:

- Firstly, estimate your gross annual income (salary, rent, capital gains, business, interest).

- Next, apply deductions under Sections 80C, 80D, and other relevant provisions.

- Then, calculate your taxable income and determine liability as per the slabs.

- Afterwards, subtract the TDS already deducted.

- Finally, if the net liability exceeds ₹10,000, you must pay Advance Tax.

For example, if your total liability is ₹50,000 and TDS covers ₹35,000, you still owe ₹15,000 as Advance Tax. Thus, you must pay this in instalments.

6. Advance Tax Due Dates

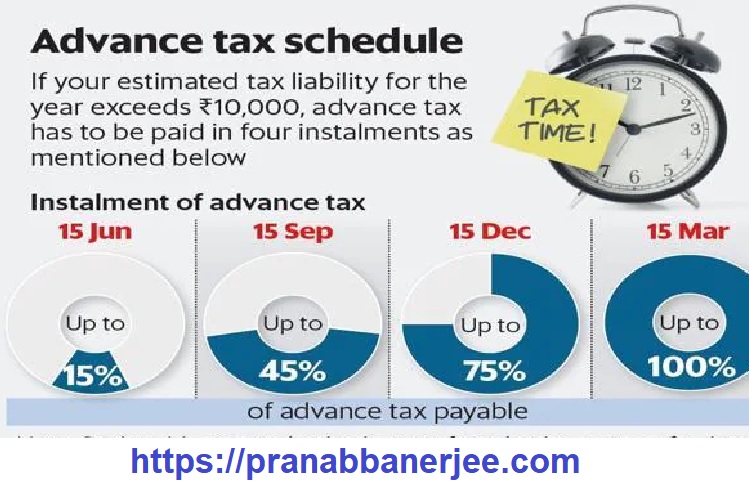

The payment is divided into four parts. Accordingly, taxpayers must adhere to the schedule:

- 15th June – At least 15% of liability

- 15th September – At least 45% of liability

- 15th December – At least 75% of liability

- 15th March – 100% of liability

Therefore, paying on time avoids unnecessary interest. In fact, even if you miss by a day, you may be charged penalties.

7. The Deduction Process Explained

The deduction process is simple. First, estimate your income. Then, subtract exemptions, deductions, and TDS. Next, pay the percentage of tax due according to the deadlines.

Because this is systematic, you avoid a large tax bill at year-end. Hence, proper planning ensures compliance and peace of mind.

8. Modes of Payment for Advance Tax

You can pay the Advance Tax online and offline. For example:

- Through Challan 280 on the Income Tax Department website.

- Using net banking or a debit card

- By visiting authorised bank branches.

Thus, taxpayers have multiple convenient options. Moreover, online payment generates instant receipts for recordkeeping.

9. Consequences of Not Paying Advance Tax

Failing to pay the Advance Tax has consequences. First of all, you may face interest under Sections 234B and 234C. Secondly, non-compliance can lead to income tax notices. Furthermore, it might impact your creditworthiness.

Therefore, staying disciplined saves you from trouble later.

10. Penalties and Interest on Non-Payment

Non-payment or delayed payment of Advance Tax attracts:

- Interest under Section 234B at 1% per month for defaults.

- Interest under Section 234C for delays in instalments.

- In extreme cases, penalty proceedings.

Consequently, paying on time not only avoids financial loss but also builds trust with tax authorities.

11. Benefits of Paying Advance Tax on Time

Paying on time has multiple benefits. Firstly, it removes last-minute stress. Secondly, it reduces the risk of penalties. Thirdly, it helps in smoother ITR filing. Additionally, banks and financial institutions view disciplined taxpayers positively.

Hence, Advance Tax is not just an obligation but also a smart financial habit.

12. Common Mistakes to Avoid While Paying Advance Tax

Taxpayers often make mistakes, such as:

- Underestimating income and paying less tax.

- Forgetting additional income sources like rent or savings interest.

- Missing deadlines due to a lack of reminders.

- Assuming TDS is enough without verifying actual liability.

Thus, being mindful of these errors saves unnecessary penalties.

13. Advance Tax vs Self-Assessment Tax

Advance Tax and Self-Assessment Tax differ in timing. On one hand, Advance Tax is paid during the year. On the other hand, Self-Assessment Tax is paid after you calculate the final liability at the end of the year.

Therefore, both are important but serve different purposes.

14. Advance Tax for Salaried Employees

Many salaried people assume that TDS covers everything. However, if you earn extra from rental income, capital gains, or freelancing, you must pay Advance Tax. Otherwise, you risk penalties.

Thus, salaried employees must check their actual liability beyond TDS.

15. Advance Tax for Business Owners and Freelancers

Business owners and freelancers often have irregular incomes. Therefore, Advance Tax ensures they still contribute on time. Additionally, it helps them track cash flows and stay compliant.

For instance, a freelancer earning through multiple clients may not have TDS deducted. Hence, Advance Tax becomes mandatory.

16. Final Thoughts and Conclusion

In conclusion, Advance Tax is not a burden but a structured way to ease tax payments. Instead of waiting for one big payment at year-end, you pay in smaller, manageable instalments. Therefore, if you are liable, comply with due dates and avoid penalties.

Ultimately, Advance Tax is like watering a plant regularly—it grows healthier when cared for in parts rather than neglected until it wilts.

17. Practical Example of Advance Tax Calculation

Sometimes, theory feels complicated until you see a real example. Therefore, let’s break it down step by step:

- Step 1: Assume Mr Arjun, a freelancer, expects an annual income of ₹12,00,000.

- Step 2: He claims deductions of ₹1,50,000 under Section 80C and ₹25,000 under Section 80D.

- Step 3: His taxable income becomes ₹10,25,000.

- Step 4: According to the slab, his tax liability is around ₹1,17,000 (excluding cess).

- Step 5: He has no TDS deducted since clients don’t deduct it.

- Step 6: Since his tax liability is more than ₹10,000, he must pay Advance Tax.

Accordingly, he will pay:

- ₹17,550 by 15th June (15%)

- ₹52,650 by 15th September (45%)

- ₹87,750 by 15th December (75%)

- ₹1,17,000 by 15th March (100%)

Thus, spreading out the tax payment makes it manageable.

18. Advance Tax for Capital Gains

Capital gains often create confusion. Why? Because they are unpredictable. For example, if you sell a property in October and earn a large capital gain, your Advance Tax liability will suddenly increase.

Therefore, you must:

- Estimate gains once the transaction occurs.

- Pay the tax in the next instalment date.

- Avoid assuming you can settle it only at year-end.

Hence, capital gains make Advance Tax planning crucial for investors.

19. Advance Tax for NRIs

Non-Resident Indians (NRIs) are also liable to pay Advance Tax if their Indian income exceeds the limit. For instance, rental income, fixed deposits, or capital gains in India are taxable.

Moreover, NRIs often face double taxation issues. Therefore, they must check DTAA (Double Taxation Avoidance Agreements) while calculating the Advance Tax.

20. Importance of Advance Tax for Startups and Small Businesses

Startups and small businesses often overlook Advance Tax due to fluctuating profits. However, compliance is vital. Because non-payment leads to penalties, startups may struggle with credibility during fundraising.

In fact, paying Advance Tax shows financial discipline. Consequently, it enhances investor confidence.

21. Myths About Advance Tax

Many people hold misconceptions about the Advance Tax. Let’s clear them:

- Myth 1: “Advance Tax is only for businesses.” → Reality: Salaried individuals with extra income also pay.

- Myth 2: “TDS means no Advance Tax needed.” → Reality: Extra income beyond TDS requires Advance Tax.

- Myth 3: “I can pay everything at the end.” → Reality: Late payment invites interest.

Thus, knowing the truth helps you stay compliant.

22. Advance Tax and Cash Flow Management

Some taxpayers fear Advance Tax drains cash. On the contrary, it encourages planning. Because you set aside money at intervals, you avoid the year-end crunch.

Therefore, it actually improves financial stability. For example, businesses can align Advance Tax payments with quarterly profits.

23. Legal Provisions Governing Advance Tax

Advance Tax is governed under the Income Tax Act, 1961. Specifically, Sections 207 to 211 cover:

- Who is liable?

- Due dates.

- Calculation methods.

- Penalties for default.

Therefore, having legal awareness ensures you don’t unintentionally miss compliance.

24. Tips to Make Advance Tax Easy

Paying taxes doesn’t have to be stressful. Instead, follow these tips:

- Use tax calculators on the Income Tax portal.

- Set reminders for due dates.

- Maintain records of income and deductions.

- Consult professionals if you have multiple income sources.

Thus, with small steps, Advance Tax becomes hassle-free.

25. Future of Advance Tax in India

With the government pushing for digitisation, Advance Tax payments may become fully automated in the future. For instance, AI-driven portals may estimate your liability and send reminders.

Moreover, as digital transactions rise, TDS and Advance Tax tracking will become easier. Therefore, compliance will be more transparent.

Additional FAQs

Q6. Is Advance Tax applicable to lottery or unexpected income?

Yes, if you earn through lottery, gambling, or unexpected winnings, you must pay Advance Tax once the income arises.

Q7. Can the Advance Tax be refunded if I overpay?

Yes, if you pay more than required, the extra amount is refunded after filing your Income Tax Return.

Q8. Do NRIs have to pay Advance Tax?

Yes, NRIs earning taxable income in India (like rent or capital gains) must pay Advance Tax.

Q9. Can I revise my Advance Tax payment if I make an error?

Yes, you can pay additional tax in the next instalment or adjust it while filing your return.

Q10. Is Advance Tax mandatory if my income is unpredictable?

Yes, you must estimate based on available data. However, adjustments can be made in the following instalments.

Final Conclusion

To sum up, Advance Tax is like a disciplined savings plan for your taxes. Instead of postponing the burden, you pay in parts, enjoy smoother cash flow, and avoid penalties. Therefore, whether you are salaried, a business owner, or a freelancer, staying compliant is both smart and rewarding.

Ultimately, remember this golden rule: If your tax liability crosses ₹10,000, Advance Tax is not optional—it’s mandatory.