Section 115BAC of the Income Tax Act introduces an alternative, simplified “new tax regime“ for individuals, Hindu Undivided Families (HUFs), and other specified entities. This regime offers lower income tax rates across different income slabs in exchange for foregoing most of the common exemptions and deductions available under the traditional “old tax regime”.

Key Features of Section 115BAC

- Applicability: It applies to individuals, HUFs, Association of Persons (AOPs), Body of Individuals (BOIs), and Artificial Juridical Persons (AJPs).

- Default Regime: From the Financial Year 2023-24 (Assessment Year 2024-25) onwards, the new tax regime is the default option for all eligible taxpayers. Taxpayers must explicitly opt for the old regime if they wish to use it.

- Lower Tax Rates: The new regime has more income slabs with comparatively lower tax rates. For the Financial Year 2024-25, the basic exemption limit is ₹3 lakhs, and the tax rates range from 5% to 30%.

- Fewer Exemptions/Deductions: To use the lower rates, taxpayers must give up over 70 exemptions and deductions, including many popular ones like:

- Standard Deduction (though a standard deduction of ₹75,000 for salaried individuals is now allowed in the new regime from FY 2024-25).

- Deductions under Section 80C, 80D, 80E, 80G, etc. (except for employer’s contribution to NPS under Section 80CCD(2) and additional employee cost under Section 80JJAA).

- House Rent Allowance (HRA) and Leave Travel Allowance (LTA) exemptions.

- Interest on housing loans for self-occupied or vacant property (Section 24(b)).

- Professional tax and entertainment allowance.

- Flexibility:

- For individuals without business income: The option to switch between the old and new regimes is available every financial year, and can be chosen at the time of filing the Income Tax Return (ITR).

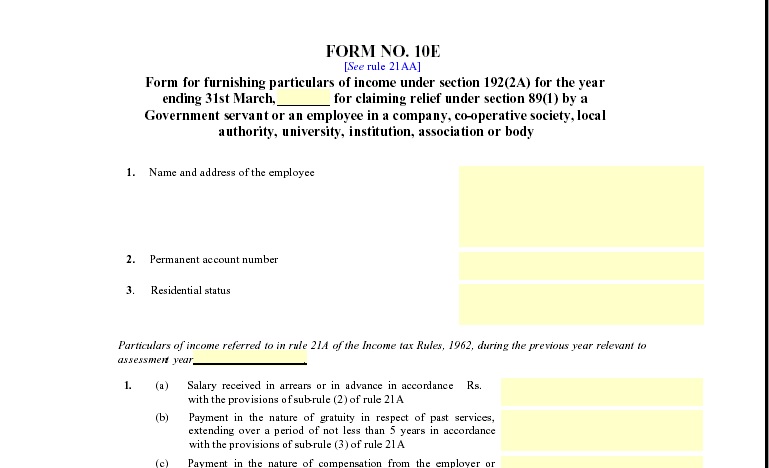

- For individuals with business income: The option to switch from the new to the old regime (by filing Form 10-IEA) is a one-time choice. Once they opt out of the new regime, they can never opt back in for future years.

Purpose

Section 115BAC was introduced to simplify the tax structure and compliance, especially for taxpayers who do not utilise many tax-saving investments or deductions. The choice between the regimes depends on an individual’s specific financial situation and the amount of deductions they can claim.