Relief on bank and post office savings interest as per Budget 2025 includes an increased Tax Deducted at Source (TDS) threshold for interest on deposits, tax-free withdrawals from the National Savings Scheme (NSS), and continued tax exemption on

Post Office Savings Account interest under both old and new tax regimes.

Details of interest relief from Budget 2025:

- Increased TDS Threshold: The limit for TDS on interest income from fixed deposits, savings accounts, and other deposits has been doubled for senior citizens, from ₹50,000 to ₹1,00,000 per annum. For non-senior citizens, this TDS threshold was increased from ₹40,000 to ₹50,000. These changes became effective from April 1, 2025.

- Tax-free NSS withdrawals: Withdrawals from National Savings Scheme (NSS) accounts were made tax-free for withdrawals made on or after August 29, 2024. This applies to senior and super senior citizens who have older NSS accounts where no interest is payable.

- Post Office Savings Account (POSA)exemption: Interest earned on a Post Office Savings Account (POSA) continues to be exempt from tax under both the old and new tax regimes. The exemption limits remain ₹3,500 for a single account and ₹7,000 for a joint account.

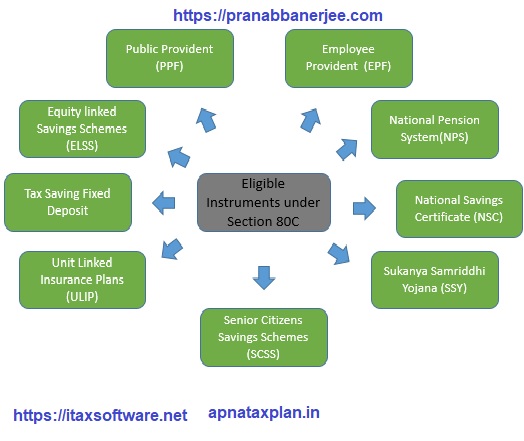

- Continued Tax Exemption (Old Regime): For taxpayers opting for the old tax regime, deductions under Section 80TTA and 80TTB are still available in addition to the exemption under Section 10(15) for Post Office Savings Accounts.

- Section 80TTA: Allows individuals and Hindu Undivided Families (HUFs) to claim a deduction of up to ₹10,000 on interest income from savings accounts held with banks, co-operative banks, or post offices.

- Section 80TTB: Allows senior citizens to claim a deduction of up to ₹50,000 on interest income from deposits held with banks and post offices, including savings accounts, fixed deposits, and recurring deposits.