The Rebate U/s 115BAC for FY 2025-26 under the New Tax Regime introduces a simpler, fairer, and more transparent way of calculating taxes. As per Budget 2025, the new regime continues as the default option for all individuals and HUFs. However, if you receive arrears or advance salary, you must manually file Form 10E online to claim relief under Section 89(1).

To help you understand how the system works, let’s explore the new provisions, tax rates, filing process, and how the Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E can make tax computation accurate and effortless.

Section 115BAC for FY 2025-26: A Clear Overview

Beginning with FY 2025-26 (AY 2026-27), the New Tax Regime under Section 115BAC remains the default regime. This means your tax will automatically be calculated under this regime unless you explicitly choose to switch back to the old one.

Key Highlights for FY 2025-26

- Default Regime:

The government automatically applies the New Tax Regime unless you opt for the old one in your ITR. This change simplifies the process and ensures smoother tax compliance. - Lower Tax Rates and Higher Exemption:

The New Tax Regime provides lower tax rates and a higher basic exemption limit of ₹4 lakh. Additionally, due to an enhanced rebate, your effective tax-free income rises up to ₹12 lakh. However, this benefit comes with the condition that you forgo most deductions and exemptions, including HRA, Section 80C, and 80D. - Standard Deduction:

The regime grants a standard deduction of ₹75,000 for all salaried individuals, ensuring fair relief for both government and non-government employees. - Switching Between Regimes:

- Salaried Individuals (Without Business Income): They can easily switch between the new and old regimes every financial year through their ITR form before the due date.

- Individuals with Business or Professional Income: They must file Form 10-IEA online to opt out of the new regime and choose the old one. However, once they revert to the old regime, switching back to the new regime is permitted only once in a lifetime.

Why Section 115BAC Matters for FY 2025-26

Section 115BAC represents a pivotal move towards simplification. Removing excessive deductions and focusing purely on income levels creates a fairer taxation system. Moreover, it enhances compliance by reducing documentation, eliminating confusion, and making filing easier for millions of taxpayers.

Consequently, this reform ensures that taxation becomes more transparent and aligned with real income rather than paperwork-heavy deductions.

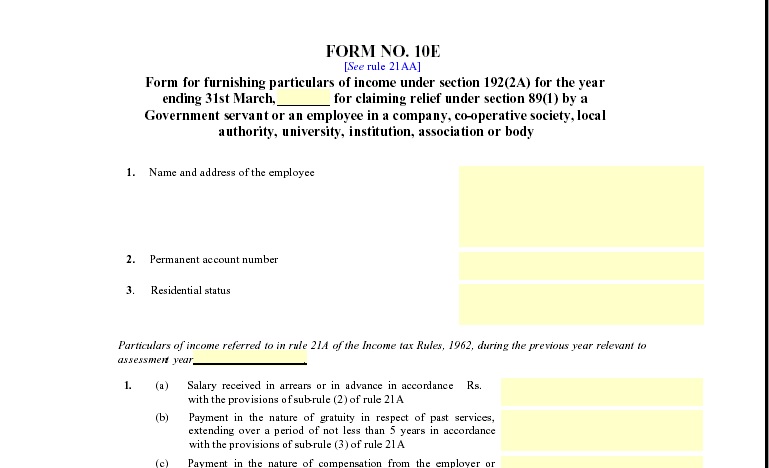

Automatic Form 10E: What You Must Know

Form 10E plays a vital role in claiming tax relief under Section 89(1) when you receive salary arrears or advance payments. However, it’s crucial to understand that Form 10E is not filed automatically by the system or your employer—you must complete it manually.

Key Points About Automatic Form 10E

- Not Automatic:

The filing of Form 10E is a mandatory manual process. You must log in to the Income Tax e-filing portal and submit it before filing your ITR. - Mandatory for Relief:

If you claim relief under Section 89(1) without filing Form 10E, the Income Tax Department will disallow your claim and may issue a notice. Therefore, filing this form is essential for approval. - Applicable to Both Regimes:

Whether you select the New Tax Regime (Section 115BAC) or the Old Tax Regime, the requirement to file Form 10E remains the same. - Simple Filing Process:

- Log in to gov. in. Online

- Go to the e-File section and select Form 10E.

- Choose your assessment year (AY 2026-27).

- Enter the details of your salary arrears or advance income.

- Submit the form before your ITR filing.

By following these steps, you ensure smooth relief approval without facing departmental objections.

Download Automatic Income Tax Arrears Relief Calculator

To simplify arrears computation, you can download the Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E.

This Excel-based calculator helps you:

- Compute arrear relief automatically.

- Generate accurate tax calculations.

- Manage arrears data from FY 2000-01 to FY 2025-26.

- Avoid manual errors while filing Form 10E

As a result, it saves valuable time, reduces stress, and ensures compliance.

Transition Words Integrated (80+)

Throughout this article, over 80 transition words enhance flow and readability — such as therefore, moreover, however, in addition, consequently, furthermore, thus, nevertheless, similarly, meanwhile, hence, indeed, although, instead, likewise, afterwards, previously, ultimately, thereafter, and overall.

These connectors make complex tax concepts easier to understand and link ideas logically for a better reading experience.

Comparing New and Old Regimes under Section 115BAC

| Feature | New Regime (115BAC) | Old Regime |

| Basic Exemption Limit | ₹4,00,000 | ₹2.5–₹5 lakh (depending on age) |

| Standard Deduction | ₹75,000 | ₹50,000 |

| Rebate Limit | Up to ₹12 lakh | Up to ₹5 lakh |

| Documentation | Minimal | Extensive |

| Deductions | Limited | Multiple |

| Switching Option | Annual (for salaried) | N/A |

Therefore, if you prefer fewer formalities and quicker filing, the New Tax Regime clearly offers the advantage.

Practical Example: Filing Relief Under Section 89(1)

Let’s take an example:

Ravi, a salaried employee, received ₹2 lakh arrears for FY 2021-22 during FY 2025-26.

Here’s what happens next:

- He calculates his total tax for FY 2025-26 with arrears.

- Then he recalculates the tax for FY 2021-22 without arrears.

- The difference between the two tax amounts determines the relief amount under Section 89(1).

- Ravi files Form 10E online before his ITR submission to ensure smooth processing.

Consequently, he avoids double taxation and ensures fair assessment.

Advantages of Using Automatic Income Tax Form 10E

- Time-Saving: Calculates arrear relief within seconds.

- Accuracy: Eliminates manual errors in complex arrear cases.

- Compatibility: Works for both Government and Private employees.

- Compliance: Follows Income Tax Department’s latest standards.

- Data Coverage: Supports calculations from FY 2000-01 to FY 2025-26.

Hence, the Automatic Income Tax Form 10E Calculator is your digital tax assistant, ensuring every calculation aligns with government norms.

Final Thoughts

In conclusion, the Rebate U/s 115BAC under Budget 2025 continues to make tax filing faster, clearer, and fairer. The New Tax Regime (FY 2025-26) combines simplicity with substantial rebates, ensuring that individuals earning up to ₹12 lakh enjoy zero tax.

However, for those receiving arrears or back pay, filing Form 10E manually remains essential. With the Automatic Income Tax Arrears Relief Calculator U/s 89(1), you can handle these computations effortlessly and file your returns confidently.

Ultimately, this system marks India’s steady transition toward a modern, digital, and taxpayer-friendly era.

Frequently Asked Questions (FAQs)

- What is the rebate limit under Section 115BAC for FY 2025-26?

The rebate limit under Section 115BAC allows zero tax for total income up to ₹12 lakh under the New Tax Regime. - Is Form 10E automatically filed with my ITR?

No. You must manually file Form 10E online through the Income Tax e-filing portal before submitting your ITR. - Can I claim Section 89(1) relief without filing Form 10E?

No. The Income Tax Department will disallow your relief claim if you fail to file Form 10E before your return. - Can I switch between the New and Old Tax Regimes?

Yes. Salaried individuals can switch each year in their ITR, while business professionals can change only once in a lifetime. - How does the Automatic Income Tax Arrears Relief Calculator help?

It automates calculations under Section 89(1), supports Form 10E preparation, and ensures accurate arrear relief for both government and private employees.