Introduction to Form 16 Part B for F.Y. 2025-26 Form 16 Part B plays a crucial role in salary taxation. In simple terms, it gives a detailed breakdown of salary, exemptions, deductions, and taxable income. Moreover, it acts like a financial mirror for employees. Therefore, employers must prepare it carefully. Additionally, for the Financial Year 2025-26, compliance expectations have increased. Consequently, preparing Form 16 Part B for multiple employees at once becomes essential. Instead of preparing one by one, smart employers now prefer preparing Form 16 Part B for 50…

Automatic Form 16 Part B Generator in Excel (Individual Preparation)

Preparing salary and tax details often feels like walking on a tightrope. One small mistake, and everything feels unbalanced. However, with an Automatic Form 16 Part B Generator in Excel (Individual Preparation), that pressure reduces instantly. In other words, Excel becomes your personal assistant, working quietly yet efficiently. Moreover, this method suits the general public because it is simple, affordable, and reliable. So, why struggle with manual calculations when automation can make life easier? Table of Contents Sr# Headings 1 Understanding Form 16 Part B 2 Why Form 16 Part…

All-in-One Income Tax Preparation Software in Excel with Form 10E (FY 2025-26)

Paying income tax often feels like solving a puzzle without the picture on the box. However, what if one Excel file could guide you step by step? That is exactly where All-in-One Income Tax Preparation Software in Excel with Form 10E (FY 2025-26) comes in. Moreover, this tool simplifies calculations, reduces errors, and saves time. Therefore, whether you are a salaried employee, pensioner, or consultant, this solution functions like a reliable calculator that never tires. So, let us explore how this Automatic Income Tax Preparation Software in Excel can make…

Automatic Form 16 Generator in Excel for FY 2025-26 (One-by-One)

Preparing Form 16 manually often feels like counting grains of rice one by one—slow, tiring, and risky. However, what if you could simplify the entire process using Automatic Form 16 in Excel? Thankfully, with the Automatic Form 16 Generator in Excel for FY 2025-26 (One-by-One), even complex tax details become manageable. Moreover, this Excel-based solution is designed for the general public, employers, accountants, and small offices who want accuracy without confusion. Therefore, let’s explore how this tool transforms tax compliance into a smooth, stress-free experience. Table of Contents Sr# Headings…

Complete Guide to Income Tax in India for FY 2025-26 (With Examples & Calculator)

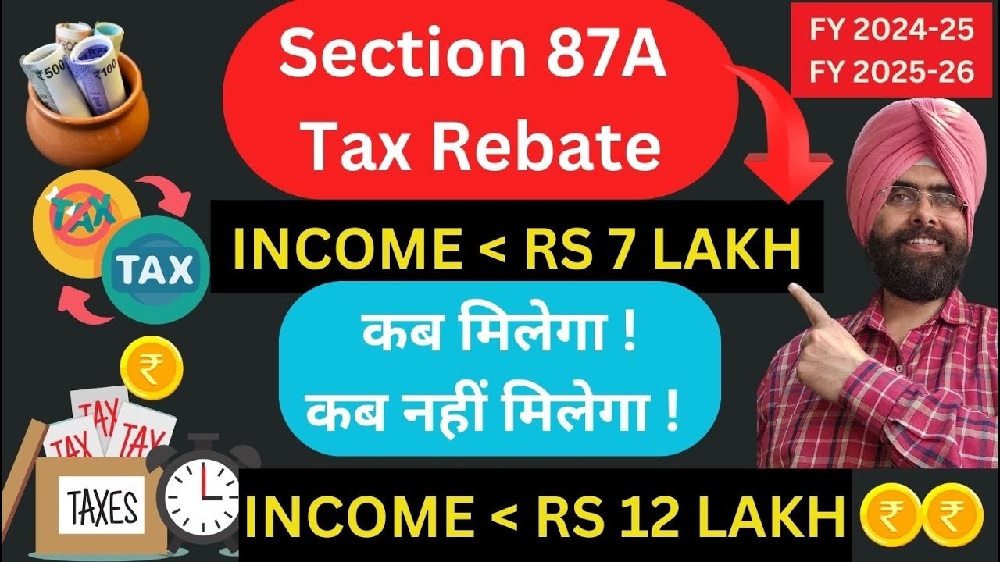

Income tax often feels like a complicated maze, doesn’t it? However, once you understand the basics, everything becomes clearer. In fact, this Complete Guide to Income Tax for FY 2025-26 explains income tax in India using simple language, real-life examples, and practical tips. Whether you are a salaried employee, a pensioner, or a freelancer, this guide helps you calculate tax confidently. Think of income tax like a yearly health check-up for your finances—slightly uncomfortable at first, but extremely useful in the long run. Table of Contents Sr# Headings 1 What…

Automatic All in One Tax Preparation Software in Excel for Government and Non-Government Employees FY 2025-26

Introduction Paying income tax often feels like walking through a maze, doesn’t it? However, with the Automatic All-in-One Tax Preparation Software in Excel for both Government and Non-Government employees, FY 2025-26, the journey becomes smooth, clear, and stress-free. Instead of juggling multiple calculators, forms, and rules, you can now rely on one powerful Excel-based solution. Moreover, this all-in-one tax calculator in Excel works like a trusted financial assistant, guiding you step by step. So, whether you are a salaried employee or a tax professional, this tool helps you stay confident and…

Download Automatic Income Tax Master of Form 16 in Excel for FY 2025-26

Introduction Preparing Form 16 manually often feels like carrying water in a leaking bucket—no matter how careful you are, something spills. Therefore, salaried employees, accountants, and employers constantly look for a smarter way. That is why the Automatic Income Tax Form 16 in Excel has become a game-changer. Moreover, it saves time, reduces errors, and simplifies compliance. So, if you want to download the Automatic Income Tax Master of Form 16 in Excel that can prepare 50 employees’ Form 16 at one time for FY 2025-26, you are in the…

Download Automatic Income Tax Form 16 Part A&B and Part B in Excel for the FY 2025-26

Introduction Preparing income tax documents often feels like climbing a steep hill with paperwork on your back. However, what if that hill turned into a smooth road? That is exactly what the Automatic Income Tax Form 16 Part A&B and Part B in Excel for FY 2025-26 offers. Today, more employers, accountants, and even individuals want a simple, reliable, and accurate way to prepare One by One Form 16 in Excel. Therefore, this article explains everything in plain language so that even a first-time user can understand it comfortably. Table…

Download Automatic Master of Tax Form 16 Part B in Excel to Prepare 50 Employees at a Time for FY 2025-26

Firstly, managing employee taxation efficiently has become an essential responsibility for employers, accountants, and payroll professionals. In today’s scenario, accuracy, speed, and compliance matter more than ever. Therefore, organisations increasingly prefer automated tools to simplify complex tax documentation. One such powerful solution, the Automatic Master of Tax Form 16 Part B in Excel, helps users prepare Form 16 Part B for up to 50 employees at a time for the Financial Year 2025-26. Undoubtedly, this Excel-based utility transforms tax compliance into a smooth and error-free process. What Is Form 16…

Download 8th Pay Commission Arrears Calculation of C.G.Employees: With Automatic Arrears Relief Calculator U/s 89(1) with Form 10E FY 2025-26

The 8th Pay Commission Arrears Calculation of C.G.Employees: With Automatic Arrears Relief Calculator U/s 89(1) with Form 10E FY 2025-26 has become one of the most discussed topics among Central Government employees. After all, arrears are not just numbers; they represent delayed earnings, future security, and long-awaited financial relief. So, how do you calculate these arrears correctly? More importantly, how do you save tax on them legally? Let’s break it down step by step, just like opening a locked savings box with the right key 🔑. Table of Contents Sr#…