Introduction

Imagine working hard all year and finally seeing that you get to keep more of your salary instead of paying it away in taxes. Sounds like a breath of fresh air, right? Budget 2025 has turned this into a reality for India’s salaried class. With the new tax rebate limit raised to ₹12 lakh, millions of middle-class employees now enjoy zero tax liability. On top of that, the basic exemption limit has been lifted to ₹4 lakh, and thanks to the standard deduction, salaried individuals earning up to ₹12.75 lakh don’t need to worry about income tax.

This article breaks down the key highlights of Budget 2025, explains how much you can save, and shows how the Automatic Income Tax Preparation Software in Excel can simplify tax calculations for non-government employees.

📑 Table of Contents

| Sr# | Headings |

| 1 | Overview of Budget 2025 Tax Relief |

| 2 | What Does No Tax up to ₹12 Lakh Mean? |

| 3 | Basic Exemption Limit Raised to ₹4 Lakh |

| 4 | Standard Deduction Benefit for Salaried Employees |

| 5 | Revised Tax Slabs Under Budget 2025 |

| 6 | How Much Tax Can You Save with New Rules? |

| 7 | Real-Life Examples of Tax Savings |

| 8 | New Income Tax Bill 2025 – Simplifying Rules |

| 9 | Impact on Middle-Class Disposable Income |

| 10 | Effect on Investors and Mutual Funds |

| 11 | Why This Budget Matters for Salaried Employees |

| 12 | Role of Automatic Income Tax Preparation Software |

| 13 | Features of Excel-Based Tax Calculator |

| 14 | Benefits of Using Automatic Tax Software |

| 15 | Final Thoughts on Budget 2025 Reforms |

1. Overview of Budget 2025 Tax Relief

On February 1, 2025, Finance Minister Nirmala Sitharaman presented her eighth Union Budget. The most eye-catching announcement was the massive income tax relief for the middle class. By increasing the tax rebate limit to ₹12 lakh, the government ensured that individuals with monthly earnings of up to ₹1 lakh won’t pay any tax. This move directly benefits millions of non-government employees, senior citizens, and students.

2. What Does No Tax up to ₹12 Lakh Mean?

Previously, the rebate limit under the new regime was ₹7 lakh. Now, it has been pushed to ₹12 lakh. This means if your annual income is ₹12 lakh or less, you won’t owe a single rupee in taxes. For salaried employees with standard deductions, the effective tax-free income goes up to ₹12.75 lakh. This is like getting an instant pay raise without asking your employer!

3. Basic Exemption Limit Raised to ₹4 Lakh

The basic exemption limit was ₹3 lakh earlier, but Budget 2025 raised it to ₹4 lakh. This directly reduces the taxable income base, giving breathing room to taxpayers. For many individuals, this change alone can save thousands of rupees annually.

4. Standard Deduction Benefit for Salaried Employees

The standard deduction acts like a protective shield, lowering your taxable income even further. Salaried taxpayers earning up to ₹12.75 lakh annually now fall under the zero-tax bracket because of this deduction. This is a huge step toward reducing the financial pressure on the working class.

5. Revised Tax Slabs Under Budget 2025

The government introduced new income tax slabs to simplify taxation. While earlier slabs caused confusion, the new ones reduce the burden across income groups. The emphasis is on ensuring that taxpayers retain more money for personal use.

6. How Much Tax Can You Save with New Rules?

Savings vary depending on your income level. Let’s see:

- Earning ₹12 lakh? Save ₹80,000 (100% of the earlier tax).

- Earning ₹18 lakh? Save ₹70,000 (30% reduction).

- Earning ₹25 lakh? Save ₹1.1 lakh (25% reduction).

7. Real-Life Examples of Tax Savings

Think of it this way: if you spent your Sundays shopping with ₹70,000 in hand, what would you do differently? That’s the amount an ₹18 lakh earner saves under the new regime. Similarly, ₹25 lakh earners get enough savings to fund a family vacation abroad. These practical examples show how Budget 2025 puts real money back into people’s pockets.

8. New Income Tax Bill 2025 – Simplifying Rules

The government is also preparing a new Income Tax Bill to make rules easier and reduce disputes. By simplifying tax filing, both taxpayers and administrators will benefit. This step shows that reforms are not just about saving money but also about improving the system.

9. Impact on Middle-Class Disposable Income

With higher rebates and exemptions, middle-class families now enjoy more disposable income. This means more spending power for essentials, education, healthcare, and even leisure. Think of it as the government putting fuel in the engine of household budgets.

10. Effect on Investors and Mutual Funds

Higher disposable income often leads to more investments. While taxpayers may direct savings toward mutual funds, stocks, or insurance, some expectations—like restoration of indexation benefits for debt mutual funds—were not fulfilled. Still, the overall effect on markets is expected to be positive as people have more money to invest.

11. Why This Budget Matters for Salaried Employees

For salaried employees, tax relief is more than numbers. It’s about financial flexibility, security, and planning. Budget 2025 finally recognises their contribution to the economy and rewards them with meaningful savings.

12. Role of Automatic Income Tax Preparation Software

While the new rules bring relief, tax filing remains a technical task. Here’s where the Automatic Income Tax Preparation Software in Excel steps in. It helps non-government employees prepare accurate tax sheets without spending hours on manual calculations.

13. Features of Excel-Based Tax Calculator

This Excel software comes loaded with features:

- Built-in salary structure for non-Govt employees.

- Automatic Salary Sheet

- HRA exemption calculation under Section 10(13A).

- Arrears relief calculation under Section 89(1) with Form 10E.

- Automatic Form 16 Part A & B

- Tax computed sheets prepared as per the Budget 2025 updates.

14. Benefits of Using Automatic Tax Software

Why choose this tool? Because it saves time, eliminates errors, and ensures compliance with the latest tax rules. Imagine it as your personal assistant, quietly handling complex numbers while you focus on your work and life.

15. Final Thoughts on Budget 2025 Reforms

Budget 2025 has truly transformed India’s taxation landscape. By raising the tax-free income threshold to ₹12 lakh, increasing the basic exemption limit, and revising slabs, the government has offered much-needed relief to the salaried class. Combined with the Automatic Income Tax Preparation Software in Excel, taxpayers can now enjoy stress-free filing and better financial planning.

✅ FAQs

- What is the new income tax rebate limit under Budget 2025?

The rebate limit has been raised to ₹12 lakh, meaning incomes up to this level are tax-free. - How does the standard deduction benefit salaried employees?

It increases the tax-free income limit to ₹12.75 lakh, reducing liability further. - Can I save tax if my income is above ₹12 lakh?

Yes, you can still save significantly with revised slabs and deductions. For example, at ₹18 lakh income, you save ₹70,000. - What is the role of Automatic Income Tax Preparation Software?

It simplifies tax filing by auto-calculating exemptions, arrears relief, salary sheets, and Form 16. - Does Budget 2025 affect investments like mutual funds?

Yes, higher disposable income may increase investments, though expected reforms like indexation benefits for debt funds were not introduced.

Download Automatic Income Tax Calculator (All-in-One) in Excel for Non-Govt Employees – F.Y. 2025-26

Features of the Excel Tax Calculator

- ✅ Prepares your Tax Computed Sheet automatically as per Budget 2025.

- ✅ Includes an inbuilt salary structure for non-govt employees.

- ✅ Generates an Automatic Salary Sheet.

- ✅ Calculates HRA exemption under Section 10(13A).

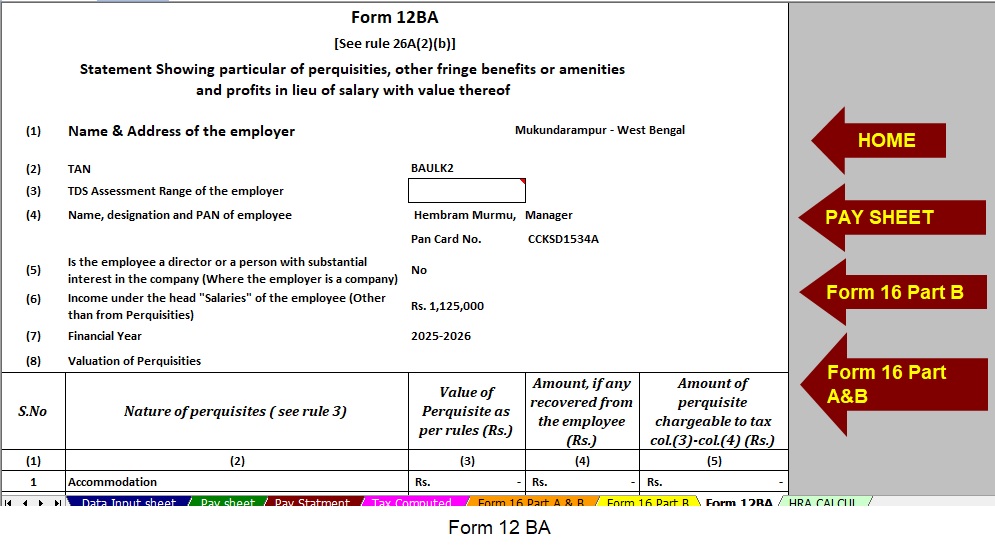

- ✅ Computes the value of perquisite for 12 BA.

- ✅ Generates Form 16 Part A and B

- ✅ Prepares Form 16 Part B with accuracy.

This Excel-based software ensures that taxpayers calculate their liabilities correctly and take full advantage of the reforms in Budget 2025.