For the Financial Year (FY) 2025-26, the tax rules have significantly changed, making the new tax regime the default option. To determine your tax burden, you can use or download Excel-based calculators from the link below.

Here is a breakdown of the two tax regimes for F.Y. 2025–26, which you will need to input into a calculator to compare your burden.

Tax slabs for F.Y. 2025–26

| Income Range | New Tax Regime (Default) | Old Tax Regime (Optional) |

| Up to ₹2.5 lakh | Nil | Nil (for individuals below 60) |

| Up to ₹3 lakh | Nil | Nil (for senior citizens 60–79) |

| Up to ₹4 lakh | Nil | — |

| Up to ₹5 lakh | Nil | Nil (for super senior citizens 80+) |

| ₹4 lakh to ₹8 lakh | 5% | — |

| ₹2.5 lakh to ₹5 lakh | — | 5% (for individuals below 60) |

| ₹5 lakh to ₹10 lakh | — | 20% |

| ₹8 lakh to ₹12 lakh | 10% | — |

| ₹10 lakh and above | — | 30% |

| ₹12 lakh to ₹16 lakh | 15% | — |

| ₹16 lakh to ₹20 lakh | 20% | — |

| ₹20 lakh to ₹24 lakh | 25% | — |

| Above ₹24 lakh | 30% | 30% |

Key differences and benefits

| Criteria | Old Tax Regime | New Tax Regime |

| Default regime | No. Taxpayers must opt for this regime explicitly when filing. | Yes. It is the default option. |

| Standard deduction (salaried) | ₹50,000. | ₹75,000. |

| Basic exemption limit | Up to ₹2.5 lakh (age-dependent). | Up to ₹4 lakh for all individuals. |

| Effective tax-free income (salaried) | Up to ₹5.5 lakh with standard deduction. | Up to ₹12.75 lakh, including a standard deduction of ₹75,000 and enhanced rebate under Section 87A. |

| Section 87A rebate | For taxable income up to ₹5 lakh. | Enhanced, offering zero tax liability on taxable income up to ₹12 lakh. |

| Tax-saving deductions | Allows over 70 exemptions and deductions, including Section 80C (investments), 80D (health insurance), and HRA. | Allows very limited deductions, primarily the standard deduction and the employer’s contribution to NPS. |

| Which is better? | Often beneficial for those with significant deductions and investments. | Generally better for taxpayers with fewer investments or deductions, as it offers lower tax rates. |

How to use an Excel tax calculator for F.Y. 2025–26

Excel calculators are available for download from various financial websites, which are pre-programmed with the correct formulas for both regimes.

- Download a calculator. Download from the link below

- Open the file. Make sure to enable editing in Excel to input your data.

- Enter your income details. Input your gross salary, house property income, income from other sources, etc.

- Add deductions (if applicable).In the section for the Old Regime, enter your investments and exemptions, such as those under Section 80C (PPF, ELSS), Section 80D (medical insurance), and any House Rent Allowance (HRA).

- Compare your tax liability. The sheet will automatically compute and display your tax burden for both the old and new regimes side-by-side, allowing you to see which is more beneficial for your specific situation.

Key points for decision-making

- Income level matters: For most salaried individuals earning up to ₹12.75 lakh, the new regime is likely to be more beneficial due to the higher standard deduction and enhanced rebate.

- Investments vs. rates: Your decision depends on the extent of your tax-saving investments. If your deductions under the old regime (e.g., 80C, 80D, home loan interest) are substantial, it may still offer a lower tax liability.

- Simplicity: The new regime is simpler with fewer documents required, while the old regime necessitates paperwork for all your investment and expenditure claims.

- Annual choice: Salaried taxpayers can switch between the two regimes every year when filing their tax return. Individuals with business income, however, have restrictions on switching once they opt out of the new regime.

Download Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) for Government and Non-Government Employees

Key Features of the Excel-Based Tax Preparation Utility

1. Dual Regime Option

You can now easily select between the New and Old Tax Regimes under Section 115BAC. Moreover, the software instantly compares both regimes, thereby helping you choose the most tax-saving option. As a result, you can make better financial decisions without spending hours analysing tax slabs. In addition, the system highlights the optimal regime automatically, ensuring you never miss out on potential savings.

2. Customised Salary Structure

The software automatically adapts to your unique salary format, whether you work in a Government or Non-Government organisation. Furthermore, it customises the structure according to your income components, which minimises manual entry and saves your valuable time. Consequently, you can focus more on your financial planning and less on tedious data input. Similarly, this adaptability enhances accuracy and simplifies the entire tax preparation process.

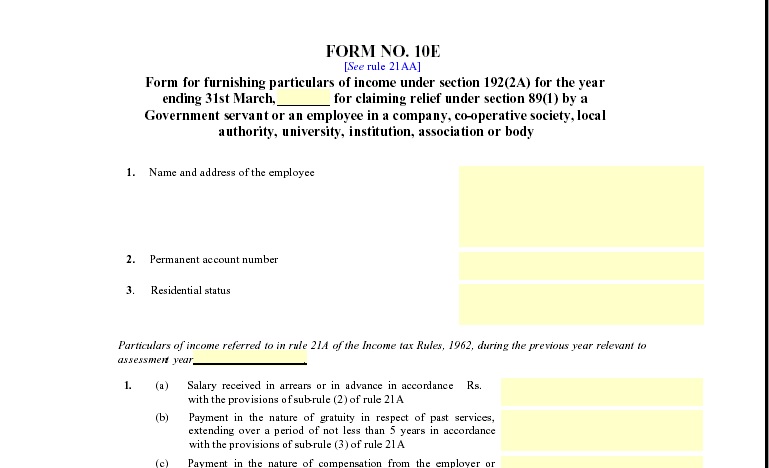

3. Automatic Arrears Relief Calculator [Section 89(1) + Form 10E]

This smart tool accurately calculates arrears relief under Section 89(1) for financial years from 2000–01 to 2025–26. In addition, it automatically generates Form 10E ready for submission, ensuring your tax relief computation remains precise and compliant. Therefore, you can eliminate errors, save time, and maintain accuracy throughout your filing process. Moreover, this automation ensures that your arrears and relief claims are perfectly aligned with current tax rules.

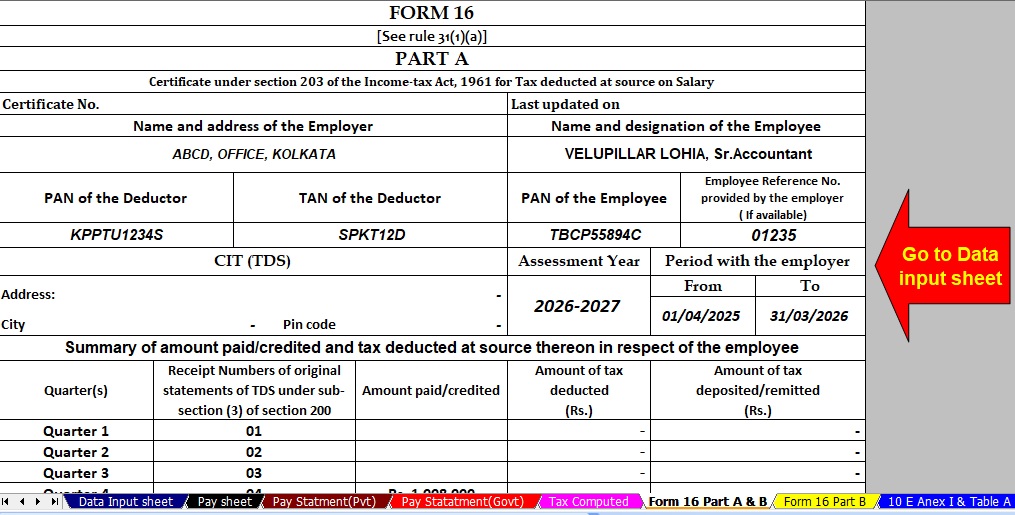

4. Updated Form 16 (Part A & B) and Part B

The software automatically creates an updated and revised Form 16 (Part A & B) and Part B for the Financial Year 2025–26..

5. Simplified Compliance

This advanced Excel utility guarantees quick and error-free tax computation through its built-in intelligent formulas. In addition, it reduces manual intervention to zero, thereby enhancing both speed and accuracy. Consequently, you can prepare and verify your income tax return with full confidence. Furthermore, since the tool follows all current tax regulations, it ensures 100% compliance while saving you from unnecessary penalties or corrections later.