Introduction

Budget 2025 has completely reshaped how salaried taxpayers in India view Income Tax. With zero tax up to ₹12.75 lakh, countless middle-class families now breathe a sigh of relief. However, despite this welcome relief, taxpayers still struggle with Income Tax calculations, which often feel like solving a puzzle with missing pieces. Wouldn’t life be simpler if a personal assistant handled all the numbers for you?

That’s exactly what the Income Tax Calculator All-in-One in Excel for FY 2025-26 delivers. Think of it as a digital tax buddy—you enter your salary, deductions, and other details, and it instantly reveals your tax liability under both the old and new regimes. Therefore, instead of stressing over formulas, you simply rely on automation.

Before we dive deeper, let’s explore what this Excel tool does, how you can use it effectively, and why it saves you hours of stress during tax season.

Table of Contents

| Sr# | Headings |

| 1 | Overview of Budget 2025 and Taxpayer Benefits |

| 2 | Why an Excel-Based Income Tax Calculator Makes Sense |

| 3 | New Income Tax Slabs for FY 2025-26 (AY 2026-27) |

| 4 | Old Regime vs New Regime: Which Should You Pick? |

| 5 | Key Features of the All-in-One Excel Tax Calculator |

| 6 | How to Download and Use the Excel Calculator |

| 7 | Step-by-Step Guide to Entering Salary and Deduction Details |

| 8 | Practical Example: Calculating Your Tax Liability |

| 9 | Salary Structure Adaptability for Govt & Private Employees |

| 10 | Arrears Relief Calculator U/s 89(1) with Form 10E |

| 11 | Automatic HRA (House Rent Allowance) Exemption |

| 12 | Preparing Form 16 (Part A & B) Made Easy |

| 13 | Security Features in the Excel Utility |

| 14 | Common Mistakes to Avoid While Using the Calculator |

| 15 | Final Thoughts and Why You Should Try This Tool |

1. Overview of Budget 2025 and Taxpayer Benefits

The Union Budget 2025 introduced historic reforms for salaried taxpayers. It increased the basic exemption limit to ₹4 lakh, raised rebates to ₹60,000, and made income up to ₹12.75 lakh completely tax-free.

As a result, families now enjoy more disposable income. Therefore, they can spend, save, or invest more freely. Moreover, this shift reduces financial stress and boosts overall economic activity across the nation.

2. Why an Excel-Based Income Tax Calculator Makes Sense

Manual tax calculations often create frustration. Even a single error leads to overpaying or underpaying Income Tax. However, the Excel-based calculator solves this challenge effortlessly.

- It works like a digital assistant for your taxes.

- It compares the old and new regimes instantly.

- It saves time and reduces costly errors.

Consequently, with just a few clicks, you discover the most tax-efficient route without confusion. In fact, you avoid the struggle of complex formulas.

3. New Income Tax Slabs for FY 2025-26 (AY 2026-27)

Here’s a clear look at the updated slabs:

| Income Range (₹) | Tax Rate |

| Up to 4,00,000 | Nil |

| 4,00,001 – 8,00,000 | 5% |

| 8,00,001 – 12,00,000 | 10% |

| 12,00,001 – 16,00,000 | 15% |

| 16,00,001 – 20,00,000 | 20% |

| 20,00,001 – 24,00,000 | 25% |

| Above 24,00,000 | 30% |

Clearly, these slabs favour middle-income earners, ensuring they retain more of their hard-earned money.

4. Old Regime vs New Regime: Which Should You Pick?

Many taxpayers feel confused when comparing regimes. However, the choice becomes simple:

- Old Regime: Best if you claim multiple deductions such as LIC, PPF, home loan, or HRA exemptions.

- New Regime: Ideal if you prefer lower slab rates without claiming deductions.

Consequently, the Excel calculator compares both options side by side, helping you select the smarter regime.

5. Key Features of the All-in-One Excel Tax Calculator

This tool acts as an all-in-one solution with standout features:

- Unified platform for old and new regimes.

- Displays tax liability as a percentage of income.

- Specially designed for salaried employees.

- Includes Arrears Relief Calculator under Section 89(1).

- Prepares Form 16 (Parts A & B) automatically.

- Offers password-protected security.

- Uses a simple, colour-coded design for easy input.

Therefore, the calculator not only saves time but also improves accuracy.

6. How to Download and Use the Excel Calculator

The tool remains lightweight and easy to access:

- You don’t install anything.

- You download the Excel file directly.

- You enable macros if required.

- You start entering your details right away.

Consequently, there’s no complicated setup. Instead, you just plug in numbers and get results instantly.

7. Step-by-Step Guide to Entering Salary and Deduction Details

Follow these steps to make full use of the tool:

- Download the Excel file from the above link

- Enter basic salary details in the given fields.

- Fill in deductions like 80C, 80D, and others.

- Add exemptions such as HRA or housing loan interest.

- Instantly view tax liability under both regimes.

In short, the process feels as simple as filling out a paper form, only faster and smarter.

8. Practical Example: Calculating Your Tax Liability

Suppose your annual salary is ₹14,00,000 and you claim deductions worth ₹2,00,000.

- Under the old regime, you reduce taxable income after deductions.

- Under the new regime, you apply slab rates directly without deductions.

Consequently, the Excel calculator generates both outcomes. Moreover, it presents a side-by-side comparison. Therefore, you avoid manual struggles and simply rely on automation. In fact, the tool acts like your financial guide. Furthermore, it eliminates guesswork, offering clarity. Meanwhile, you stay stress-free because results appear instantly. Ultimately, you choose the option that saves you the most.

9. Salary Structure Adaptability for Govt & Private Employees

The utility adapts to both government and private employees. For instance, it adjusts salary heads such as HRA, DA, basic pay, and allowances.

Consequently, employees across sectors benefit. Moreover, it saves you from manual spreadsheet adjustments. In addition, it ensures accuracy beyond traditional methods. As a result, government staff enjoy correct calculations, while private employees gain precision for variable pay. Therefore, the tool proves versatile. Likewise, it eliminates confusion. Finally, every salaried individual enjoys a customised experience.

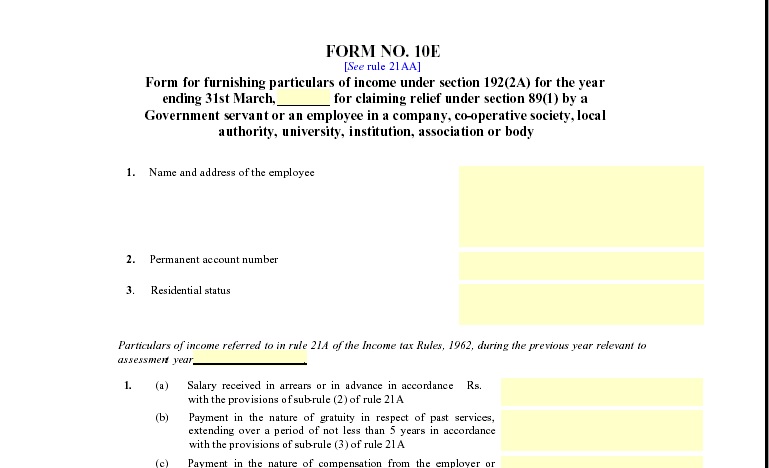

10. Arrears Relief Calculator U/s 89(1) with Form 10E

If you received arrears, you often face confusion about taxation. However, the tool simplifies everything. It automatically prepares Form 10E and ensures relief under Section 89(1).

Thus, instead of worrying about excess tax, you secure relief. In fact, the tool ensures compliance with rules. Moreover, it prevents missed benefits. Consequently, arrears no longer cause anxiety. Ultimately, the calculator ensures fair taxation.

11. Automatic House Rent Allowance (HRA) Exemption

You simply enter rent, city type, and salary details. Immediately, the calculator computes the HRA exemption under Section 10(13A).

Therefore, you avoid manual errors. Moreover, the tool applies rules accurately. In addition, it highlights potential savings. For example, metro residents often enjoy higher exemptions than non-metro residents. Thus, every factor gets considered. Consequently, you claim the rightful exemption. Finally, you benefit from precision and peace of mind.

12. Preparation of Form 16 (Part A & B)

Traditionally, generating Form 16 creates stress. However, this Excel tool automates the process. It prepares both Part A and Part B in minutes.

Consequently, you save hours of formatting. Moreover, the output remains professional. Instead of struggling with paperwork, you allow automation to work for you. In fact, the form aligns with official standards. Therefore, Income Tax filing becomes effortless. Ultimately, this feature ensures compliance and reduces stress.

.

13. Security Features of the Excel Utility

The calculator is password-protected, ensuring no one tampers with formulas. You only need to update the yellow cells; all other fields are locked.

14. Common Mistakes to Avoid While Using the Calculator

- Don’t overwrite locked cells.

- Always enable macros (if required).

- Enter only correct values—typos can affect final tax liability.

15. Final Thoughts and Why You Should Try It

The Income Tax Calculator All in One for FY 2025-26 is more than just a tool—it’s like a tax guidebook inside Excel. By making calculations faster, simpler, and more accurate, it takes the stress out of tax filing.

16. How Does the Excel Calculator Compare to Online Tax Portals?

Many people today rely on online portals for tax calculations. However, Excel-based tools still have a major advantage. Why? Because unlike online portals, Excel works offline, requires no internet connection, and ensures data privacy. You don’t need to worry about your salary details being shared online. Moreover, the Excel calculator is customizable—you can tweak it based on your personal salary structure.

17. Importance of Choosing the Right Tax Regime

Choosing between the old and new tax regimes is like deciding between two different investment strategies. The old regime works well for those who actively invest in tax-saving schemes, while the new regime benefits people who prefer simplicity and higher take-home pay without worrying about deductions.

The Income Tax Preparation Software in Excel solves this dilemma by showing side-by-side calculations. That way, you can confidently pick the regime that saves you the most money.

18. Who Should Use the All-in-One Excel Tax Calculator?

This software is best suited for:

- Salaried employees (both government and private).

- Middle-class taxpayers are looking for quick solutions.

- Employees who receive HRA, DA, or arrears.

- Is anyone confused about which tax regime is better?

It may not be ideal for self-employed professionals or those with business income, since it is tailored for the salaried class.

19. Example Case Studies

Let’s make things more practical.

Case 1: Mr A (Private Employee)

- Annual Salary: ₹10,00,000

- Deductions under 80C: ₹1,50,000

- HRA claimable: ₹80,000

The Excel calculator shows:

- Old Regime Tax: ₹28,600

- New Regime Tax: ₹36,000

👉 Mr A should stick to the old regime.

Case 2: Ms B (Government Employee)

- Annual Salary: ₹13,50,000

- Deductions under 80C: Nil

- No home loan or HRA claim

The Excel calculator shows:

- Old Regime Tax: ₹1,14,400

- New Regime Tax: ₹75,000

👉 Ms B benefits more from the new regime.

See how easy it becomes? Instead of guessing, you get clear numbers instantly.

20. Why Security Matters in an Excel-Based Tool

When it comes to taxes, your personal financial details are sensitive. This is why the tool is password-protected. You only input your numbers in the designated yellow cells. All formulas remain hidden, ensuring accuracy and safety. Unlike some random online calculators, no one else has access to your data.

21. Additional Features You Will Love

Apart from tax calculations, the Excel software also includes:

- Automatic computation sheet (ideal for record-keeping).

- Salary Sheet integration (separate tab for structured input).

- Form 16 auto-preparation is a major time-saver for both employees and employers.

- Custom salary heads for allowances and deductions.

It’s like having an all-in-one tax preparation package—not just a calculator.

22. Common Questions About the Excel Calculator

Many people hesitate before using a new tool. Here are some clarifications:

- Will I need advanced Excel skills?

Not at all. If you can type numbers in a spreadsheet, you can use this calculator. - Can the calculator handle arrears from old financial years?

It prepares relief calculations from FY 2000-01 to FY 2025-26. - Can employers use it for bulk employees?

Yes, employers can use the tool for multiple employees by preparing separate sheets.

23. Avoiding Errors While Filing Taxes

Even with a calculator, mistakes can happen. Some common errors include:

- Forgetting to declare all deductions.

- Not updating the employer about the regime choice.

- Entering wrong salary figures.

By double-checking your entries and cross-verifying with your Form 16, you can avoid these issues.

24. How to Make the Most of the Calculator

To maximise benefits:

- Always keep your salary slips

- Maintain records of all deductions and exemptions.

- Run the calculator under both regimes before finalising.

- Save a copy of the computation sheet for your records.

This way, filing your ITR will be a breeze.

25. Advantages of Using Income Tax Preparation Software in Excel

Here’s why this tool stands out:

- Saves time – No manual calculations.

- Error-free – Predefined formulas ensure accuracy.

- Offline tool – Works without internet.

- Easy to compare regimes – Old vs new in one glance.

- Designed for salaried employees – Tailor-made features.

Think of it as your tax season shortcut.

26. Future of Tax Filing in India

With every budget, the government is moving toward the simplification of taxes. Excel tools like these serve as a bridge for taxpayers who still find online portals confusing. Eventually, AI-driven tax systems may take over, but for now, Excel remains the most practical, offline, and reliable solution.

Conclusion

The Income Tax Calculator All in One for FY 2025-26 (AY 2026-27) Excel Download is more than just software—it’s your financial guide during tax season. Instead of scratching your head over complex formulas, you simply enter your data and let the tool do the work. Whether you’re a government or private employee, this tool ensures accuracy, saves time, and gives peace of mind.

With features like the arrears relief calculator, HRA exemption, and Form 16 preparation, it feels less like a calculator and more like a mini tax office in Excel.

So, if you’re a salaried taxpayer looking for an easy and reliable way to file taxes, this is the solution you’ve been waiting for.

FAQs

- Is the Excel calculator valid for both government and private employees?

Yes, it supports both salary structures. - Can I use this tool to calculate long-term capital gains tax?

No, this tool is designed only for salaried income. - Will the Excel calculator automatically prepare Form 16?

Yes, it generates Form 16 (Part A & B) instantly. - Do I need to submit the Excel calculator file to the Income Tax Department?

No, it’s only for your personal use and record-keeping. You file your return on the official e-filing portal. - How do I ensure accuracy while using this calculator?

Enter data carefully in yellow fields, avoid altering protected cells, and always cross-check with Form 16.