To determine the best tax regime for the Financial Year (FY) 2025-26, you will need to perform a comparative calculation using your specific income and eligible deductions

. Many financial websites, including the Income Tax, like https://www.pranabbanerjee.com or www.caclubindia.com or www.apnataxplan.in or www.itaxsoftware.net, offer calculators to simplify this process.

The best regime for you depends entirely on your personal financial situation, especially the number of deductions you can claim.

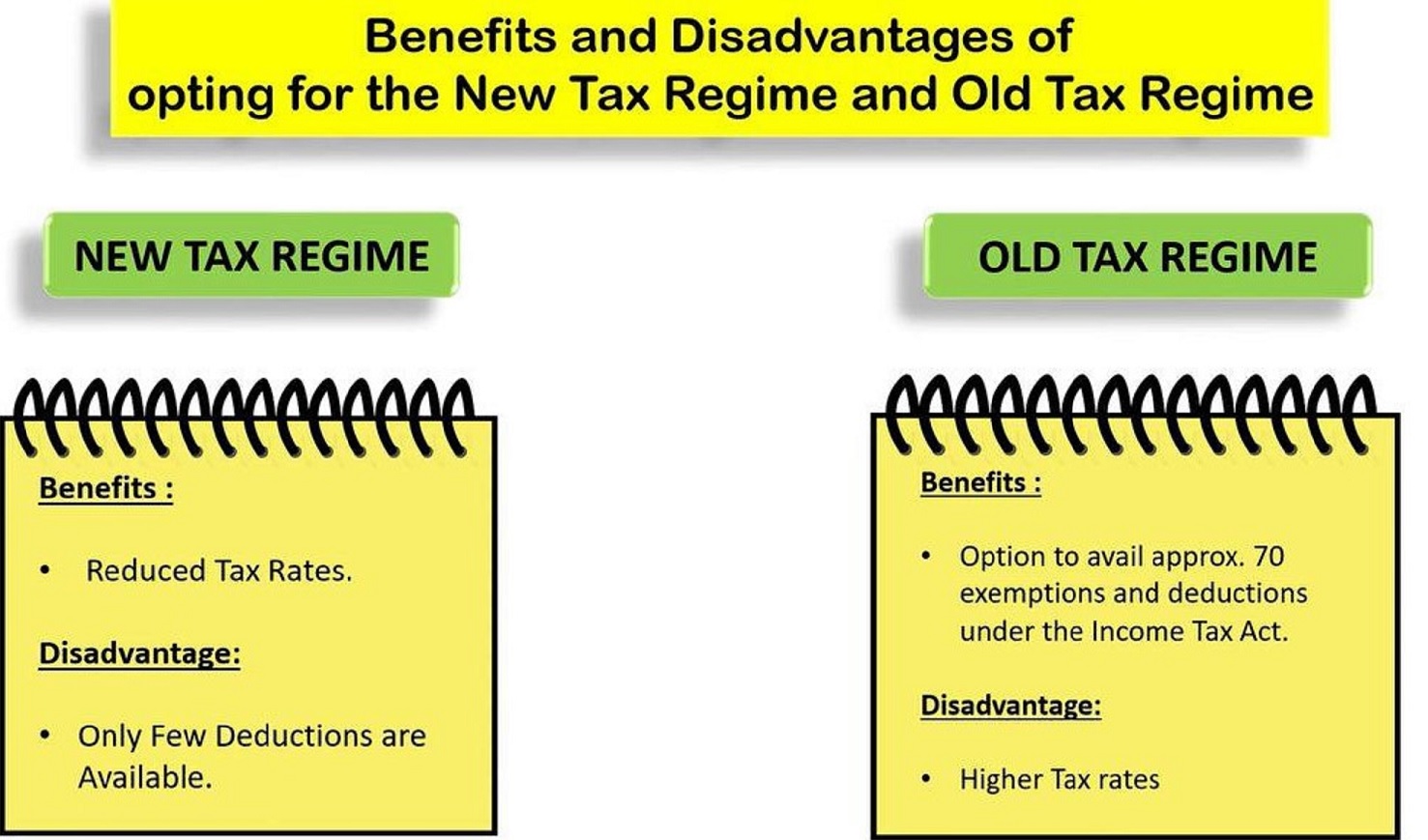

Key differences between old and new tax regimes (FY 2025–26)

| Feature | Old Tax Regime (Optional) | New Tax Regime (Default) |

| Deductions & exemptions | Allows over 70 deductions and exemptions, including House Rent Allowance (HRA), Leave Travel Allowance (LTA), and investments under Section 80C, 80D, etc. | Eliminates most deductions and exemptions, providing a simpler tax structure. |

| Tax slabs | Has a higher basic exemption limit for senior and super-senior citizens, but a lower one for individuals under 60. | Offers more and lower-rate tax slabs that are the same for all individuals, regardless of age. |

| Standard deduction (for salaried) | ₹50,000. | ₹75,000. |

| Tax rebate (Section 87A) | Full tax rebate on taxable income up to ₹5 lakh. | Full tax rebate on taxable income up to ₹12 lakh. For salaried individuals, this is effectively ₹12.75 lakh after the standard deduction. |

| Default status | Not the default option. You must actively choose to opt in when filing your tax return. | The default option. If you do not make a choice, you will automatically be taxed under this regime. |

| Complexity & paperwork | High, due to the need to track investments and allowances and submit proof. | Low, requiring minimal paperwork. |

How to use a tax calculator to find the best regime

To determine the best option for your specific circumstances, you should follow these steps:

- Access the Automated calculator. Use a tax calculator on a financial website or the official Income Tax Department portal.

- Enter your personal details. Select the Financial Year 2025–26 and provide your age and residential status.

- Input your income details . Enter your gross salary and any other income you may have from sources like house property or interest.

- Enter your deductions (for old regime calculation).Input all potential deductions you are eligible for under the old regime, such as:

- Section 80C: Up to ₹1.5 lakh for investments like PPF, ELSS, and life insurance premiums.

- Section 80D: For medical insurance premiums.

- HRA: House Rent Allowance, based on your rent payments.

- Section 24(b): Interest on a home loan for a self-occupied property.

- View the comparison. The calculator will automatically compute your tax liability under both the old and new regimes. It will show you a side-by-side comparison, highlighting which option results in a lower tax payable.

General guidance on choosing a regime

While a calculator provides a precise comparison, here is a simple rule of thumb for deciding which regime is right for you:

- Choose the New Regime if:

- You have minimal or no tax-saving investments or deductions.

- Your total annual income is below ₹12.75 lakh (for salaried individuals), as your tax liability will likely be zero.

- You prefer a simpler tax-filing process with minimal documentation.

- Choose the Old Regime if:

- You have substantial deductions through tax-saving investments under Section 80C, a home loan, and medical insurance premiums.

- Your total eligible deductions are large enough to bring your taxable income into a lower bracket than the new regime would allow.

Download Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) for Government and Non-Government Employees

Key Features of the Excel-Based Tax Preparation Utility

- Dual Regime Option:

You can effortlessly choose between the New or Old Tax Regime under Section 115BAC. Furthermore, the tool automatically compares both regimes to help you identify the most tax-saving option. - Customised Salary Structure:

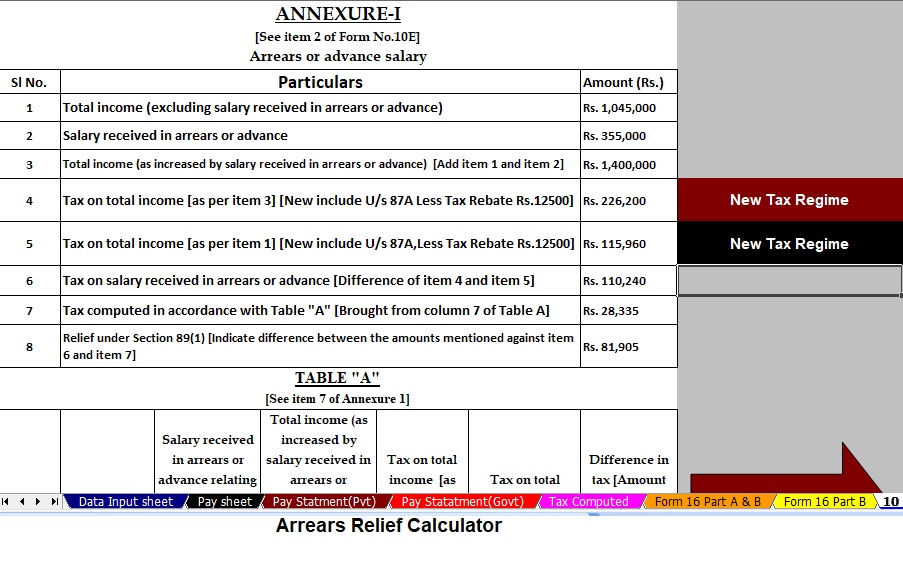

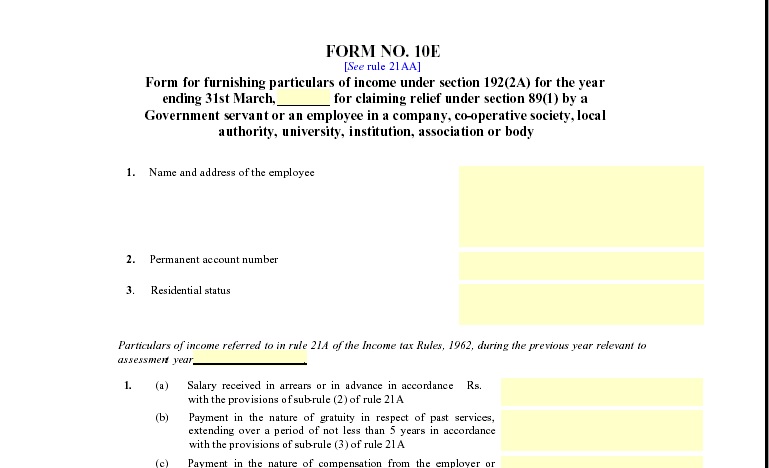

It automatically adjusts according to your salary format, whether you belong to a Government or Non-Government organisation. Additionally, this customisation reduces manual entry and saves valuable time. - Automatic Arrears Relief Calculator [Section 89(1) + Form 10E]:

It accurately calculates arrears relief for the financial years ranging from 2000–01 to 2025–26. In addition, it instantly generates Form 10E for submission, ensuring precise tax relief computations. - Updated Form 16 (Part A & B):

This tool automatically generates Revised Form 16 (Part A & B) for the Financial Year 2025–26. Likewise, it ensures that your Form 16 remains compliant with the latest tax formats. - Simplified Compliance:

It ensures quick and error-free tax computation through advanced built-in formulas. Furthermore, you can confidently prepare your return with zero manual intervention, enhancing both speed and accuracy.