Choosing the best tax regime for the Financial Year 2025-26 is one of the most important financial decisions for every taxpayer. Since the Government of India has introduced both the Old Tax Regime with deductions and the New Tax Regime with lower slab rates, taxpayers now have more flexibility. However, this flexibility also creates confusion. Many salaried employees, pensioners, and professionals ask the same question: Which tax regime will be more beneficial for me in FY 2025-26?

Therefore, to answer this, you need to compare both regimes carefully. In addition, you can also use an Automatic Income Tax Calculator for FY 2025-26 to estimate your actual tax burden. With this tool, you can quickly calculate whether the Old or the New Tax Regime saves you more money.

Old Tax Regime – A Traditional Approach

The Old Tax Regime allows taxpayers to claim various exemptions and deductions. These include:

- House Rent Allowance (HRA)

- Leave Travel Allowance (LTA)

- Standard Deduction

- Section 80C deductions (up to ₹1.5 lakh)

- Section 80D deductions for medical insurance

- Interest on housing loan deduction under Section 24(b)

Because of these benefits, taxpayers with higher investments and multiple deductions usually find the Old Regime more profitable. However, the slab rates under the Old Regime are comparatively higher.

New Tax Regime – A Simplified Option

In other words, the New Tax Regime offers reduced tax slab rates and does not require you to claim most exemptions or deductions. This regime is simple and transparent. Salaried employees who do not have many investments or deductions may find it more beneficial.

However, the Key points of the New Regime:

- Lower slab rates

- No complex calculations for deductions

- Easy filing process

- Standard Deduction of ₹75,000 available from Budget 2025

Thus, the New Regime is best suited for taxpayers who prefer simplicity and do not want to depend on tax-saving investments.

Tax Slab Comparison for FY 2025-26

Let us compare the income tax slabs under both regimes:

Old Regime:

- Up to ₹2.5 lakh – Nil

- ₹2.5 lakh to ₹5 lakh – 5%

- ₹5 lakh to ₹10 lakh – 20%

- Above ₹10 lakh – 30%

New Regime:

- Up to ₹3 lakh – Nil

- ₹3 lakh to ₹6 lakh – 5%

- ₹6 lakh to ₹9 lakh – 10%

- ₹9 lakh to ₹12 lakh – 15%

- ₹12 lakh to ₹15 lakh – 20%

- Above ₹15 lakh – 30%

From the above, it is clear that the New Regime has lower slab rates, whereas the Old Regime offers taxpayers more deductions.

Which Tax Regime is Better for FY 2025-26?

The answer depends on your income pattern and eligible deductions.

- If you have high investments in PPF, ELSS, Life Insurance, Housing Loan, and Medical Insurance, the Old Regime may be better.

- If you prefer lower tax rates without paperwork, then the New Regime is likely to suit you.

In addition, the role of the Automatic Income Tax Calculator FY 2025-26

Instead of making assumptions, taxpayers should use the Automatic Income Tax Calculator in Excel for FY 2025-26. With this calculator:

- You can enter your income details.

- You can add deductions like 80C, 80D, housing loan, and more.

- You can compare tax liability under both regimes instantly.

- You can decide which regime saves more tax in your case.

Above all, the Benefits of the Old Tax Regime in Detail

After that, the Old Tax Regime remains popular among taxpayers who prefer claiming deductions and exemptions. Under this system, you can reduce your taxable income by using various tax-saving instruments. For example, if you invest in Public Provident Fund (PPF), Employee Provident Fund (EPF), Life Insurance Premiums, or Equity Linked Saving Schemes (ELSS), you can claim deductions under Section 80C. In addition, deductions under Section 80D for health insurance premiums, Section 80E for education loans, and Section 24(b) for home loan interest make the Old Regime attractive.

Another advantage is that taxpayers with housing loans and children’s tuition fees can save a significant amount of tax. Moreover, salaried individuals also get the Standard Deduction and HRA benefits, which further reduce their tax liability. Therefore, if your investments and expenses align with these deductions, the Old Regime will generally reduce your tax burden.

Advantages of the New Tax Regime in Detail

On the other hand, the New Tax Regime offers simplicity and lower tax rates. This regime does not require you to declare multiple investments or expenses. As a result, taxpayers who do not invest heavily or who prefer financial freedom without committing money to long-term instruments may prefer this option.

In addition, the Budget 2025 increased the Standard Deduction to ₹75,000, making the New Regime more attractive for salaried individuals and pensioners. With lower tax slabs and less compliance burden, the New Regime is especially useful for young professionals, freelancers, consultants, and those with straightforward salary income.

Step-by-Step Guide to Decide the Perfect Tax Regime

To make an informed decision, you can follow these steps:

- Calculate your gross income from salary, business, pension, or other sources.

- Check your eligible deductions under 80C, 80D, 80E, and other sections.

- Estimate your tax liability under the Old Regime with deductions.

- Estimate your tax liability under the New Regime with lower slab rates.

- Compare both calculations side by side.

- Choose the regime that gives you maximum savings and fits your financial goals.

How the Automatic Income Tax Calculator Helps

While manual calculations can be confusing, the Automatic Income Tax Calculator in Excel for FY 2025-26 makes the process simple. It is pre-programmed with tax slabs, deductions, and exemptions. You just need to fill in your details, and the calculator automatically shows:

- Tax under the Old Regime

- Tax under the New Regime

- Net savings difference between the regimes

With this, you can quickly identify the more beneficial regime for you.

Case Study 1: Salaried Employee with Investments

Let us take an example. Mr Sharma earns ₹12,00,000 annually. He invests ₹1.5 lakh in PPF, pays ₹25,000 in health insurance premiums, and claims ₹2,00,000 as home loan interest.

- Under the Old Regime, after deductions, his taxable income falls to around ₹8,25,000, and his tax liability is lower.

- Under the New Regime, he cannot claim deductions, so his taxable income remains ₹12,00,000. Even though the slab rates are lower, his final tax liability is higher compared to the Old Regime.

Thus, in this case, the Old Regime is better.

Case Study 2: Young Professional with No Major Deductions

Now consider Ms Riya, who earns ₹8,00,000 annually. She does not invest in tax-saving instruments.

- Under the Old Regime, her taxable income remains ₹8,00,000, and after slab rates, she pays more tax.

- Under the New Regime, her taxable income is the same ₹8,00,000, but the lower slab rates reduce her tax liability significantly.

Therefore, in her case, the New Regime is more beneficial.

Key Takeaway

The right tax regime depends on your individual income, deductions, and financial planning style. Similarly, if you are disciplined with investments and like using tax-saving schemes, the Old Regime may still save you more. But if you prefer simplicity and flexibility, the New Regime will likely be the better option.

In addition, Common Mistakes Taxpayers Make While Choosing a Tax Regime

Many taxpayers make mistakes when deciding between the Old and New Regime. Some assume that the New Regime is always better because of lower rates, while others blindly stick to the Old Regime without comparing both. However, both approaches are risky. You must analyse your income, deductions, and financial plans.

After that, another common mistake is failing to use a reliable Automatic Income Tax Calculator. Manual calculations may lead to errors, which can result in higher tax payments or even penalties. Therefore, using the calculator is the safest way to avoid mistakes.

Similarly, Expert Tips for Choosing the Right Tax Regime in FY 2025-26

Financial experts suggest that every taxpayer should:

- Review their income and deductions every year because tax benefits can change with budgets.

- Use digital tools like Excel-based calculators for quick comparisons.

- Avoid emotional decisions like sticking to old habits without analysis.

- Consider long-term financial goals while selecting the regime.

- Consult a tax advisor if you have multiple sources of income.

By following these tips, you can maximise savings and minimise risks.

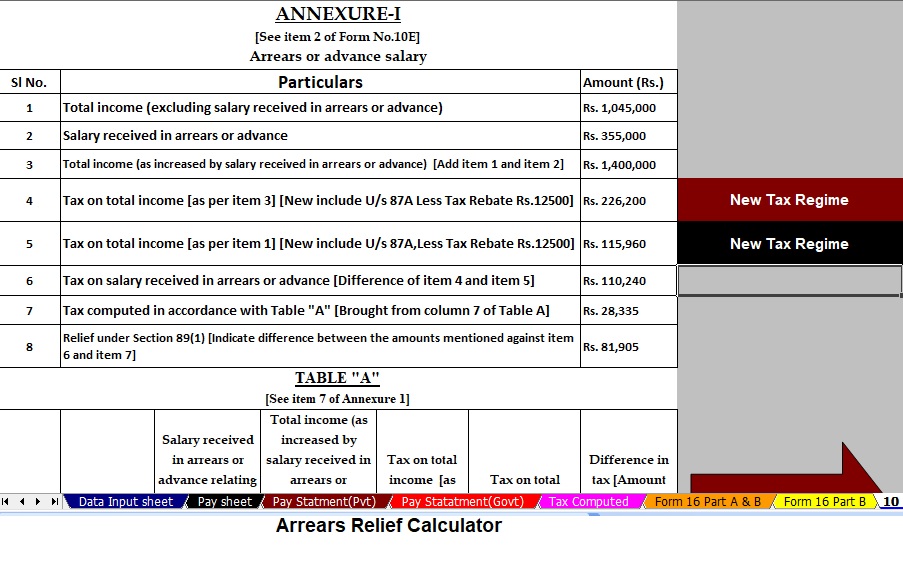

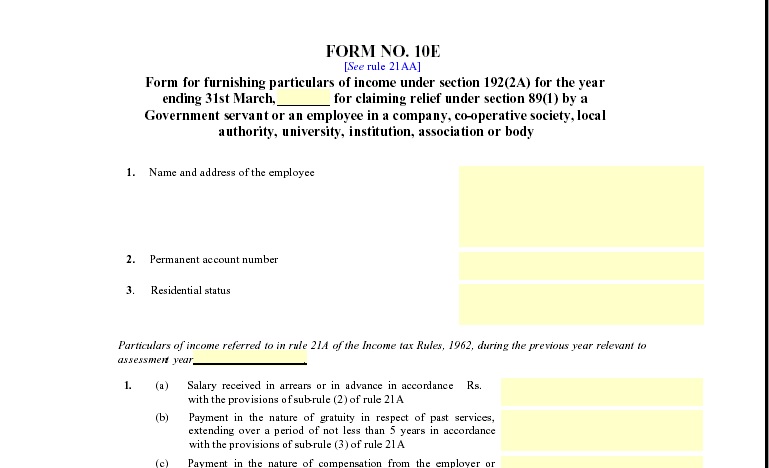

Automatic Income Tax Calculator – Key Features

The Automatic Income Tax Calculator in Excel for FY 2025-26 is designed to simplify tax planning. Its features include:

- Pre-loaded Old and New Regime slabs.

- Form 10E integration for arrears calculation.

- Automatic deduction calculation under Sections 80C, 80D, and others.

- User-friendly interface for government and non-government employees.

- Instant comparison of tax liability under both regimes.

This makes the tool highly effective for accurate tax planning.

Case Study 3: Pensioner with Standard Deduction

Consider Mr. Verma, a retired individual with a pension income of ₹7,50,000 per year. He has no major deductions apart from the standard deduction.

- Under the Old Regime, he can claim the standard deduction but pays higher rates.

- Under the New Regime, he can still claim the revised standard deduction of ₹75,000 and enjoy lower slab rates.

Thus, the New Regime is better for pensioners with fewer deductions.

Frequently Asked Questions (FAQs)

Q1. Can I switch between the Old and New Regime every year?

Yes, salaried employees can switch every year. However, taxpayers with business income have limited flexibility.

Q2. Is the New Tax Regime mandatory from FY 2025-26?

No, the government has made the New Regime the default option, but taxpayers can still choose the Old Regime if they prefer deductions.

Q3. Does the Automatic Income Tax Calculator include HRA benefits?

Yes, the calculator allows you to input HRA details and calculates exemptions automatically.

Q4. What happens if I do not declare my tax regime choice?

If you do not declare, your employer will treat you under the New Regime by default. However, you can adjust it while filing your Income Tax Return (ITR).

Q5. Which regime is better for salaried employees earning ₹10 lakh?

If the employee invests in tax-saving schemes, the Old Regime may be better. If not, the New Regime could reduce the tax burden.

Long-Term Perspective on Tax Planning

Deciding between the Old and New Tax Regime is not just about saving tax today. It also impacts your long-term wealth creation. For example, the Old Regime encourages taxpayers to invest in PPF, ELSS, and Life Insurance, which can create long-term financial security. On the other hand, the New Regime provides flexibility, allowing you to invest freely in options of your choice without focusing on tax-saving instruments.

Therefore, your decision should align with both short-term tax savings and long-term wealth goals.

Conclusion

Choosing the perfect tax regime for FY 2025-26 requires careful evaluation. While the Old Regime benefits disciplined investors, the New Regime supports simplicity and lower rates. The best way to make the right choice is to use the Automatic Income Tax Calculator for FY 2025-26. It will compare your tax liability under both regimes and show which option is better for you.

Thus, taxpayers should not guess or follow others blindly. Instead, they should analyse, compare, and decide smartly. With the right tax planning, you can reduce your tax burden and achieve better financial freedom.

Extended Case Studies for Better Understanding

Case Study 4: Government Employee with Allowances

Mr Kumar, a government employee, earns ₹9,50,000 annually. His salary includes HRA, transport allowance, and medical reimbursement. He also invests ₹1.5 lakh under Section 80C.

- Old Regime: He claims HRA exemption, standard deduction, and Section 80C deductions. His taxable income reduces significantly.

- New Regime: He cannot claim HRA or other exemptions, so his taxable income is higher.

👉 In this case, the Old Regime is more beneficial.

Case Study 5: Non-Government Employee Without Investments

Ms. Anjali works in the private sector and earns ₹7,20,000 annually. She does not invest in PPF, ELSS, or life insurance.

- Old Regime: She gets only a standard deduction, so her taxable income remains high.

- New Regime: With lower slab rates and the ₹75,000 standard deduction, her liability reduces.

👉 For her, the New Regime is a better choice.

Case Study 6: Business Professional with Multiple Deductions

Mr. Mehta, a self-employed professional, earns ₹15,00,000 per year. He pays housing loan interest, invests ₹1.5 lakh in ELSS, and contributes ₹50,000 to NPS.

- Old Regime: With deductions under 80C, 80CCD(1B), and Section 24(b), his taxable income reduces drastically.

- New Regime: None of these deductions apply, so his taxable income is ₹15,00,000.

👉 Clearly, the Old Regime is better for professionals with heavy deductions.

Case Study 7: Freelancer with No Deductions

Rohit, a freelancer, earns ₹6,50,000 annually. He does not claim any deductions or exemptions.

- Old Regime: Tax is calculated directly on his income.

- New Regime: Since he has no deductions, the lower slab rates save him tax.

👉 The New Regime is advantageous for freelancers and gig workers.

How the Automatic Income Tax Calculator Simplifies Tax Decisions

The Automatic Income Tax Calculator in Excel for FY 2025-26 eliminates guesswork. It provides:

- Instant comparisons between the Old and New Regimes.

- Error-free results because all slabs and deductions are pre-set.

- User-friendly input fields where you enter salary, allowances, and deductions.

- Form 10E integration, useful for arrears relief under Section 89(1).

By using this tool, taxpayers can confidently decide on the better regime in just a few minutes.

Why Choosing the Right Regime Matters for FY 2025-26

- Tax savings directly impact your disposable income.

- Wrong decisions may lock you into higher taxes for the entire year.

- Proper tax planning leads to long-term wealth creation.

- The regime choice can influence investment patterns.

Therefore, the decision between the Old and New Regimes should not be casual. Instead, it should be strategic, data-driven, and aligned with financial goals.

Advanced Tips for Smart Tax Planning

- Plan at the beginning of the financial year instead of waiting until March.

- Use both regimes for analysis before declaring to your employer.

- Avoid unnecessary investments only for tax savings—focus on long-term returns.

- Review tax changes every year because government budgets often revise slabs, deductions, and exemptions.

- Leverage Section 80CCD(1B) for NPS contributions if you stick with the Old Regime.

These advanced tips ensure that you do not just save tax but also build long-term financial discipline.

More FAQs on Choosing Between Old and New Regime

Q6. Can a senior citizen claim deductions under both regimes?

No, in the New Regime, most deductions are not available, though the higher exemption limit and standard deduction apply.

Q7. Is HRA available under the New Regime?

No, HRA is not allowed in the New Regime. It is only available in the Old Regime.

Q8. What if my employer deducts TDS under the wrong regime?

You can still choose your preferred regime while filing ITR. The excess TDS will be refunded.

Q9. Which regime is better for someone with no housing loan and no investments?

Usually, the New Regime is better because of lower tax rates.

Q10. Does the Automatic Calculator cover pension income?

Yes, the calculator includes options for salary, pension, and other income sources.

Long-Term Tax Strategy for FY 2025-26

- Old Regime strategy: Suitable for disciplined savers and investors. Encourages long-term financial security through PPF, insurance, and ELSS.

- New Regime strategy: Suitable for flexibility lovers who want to invest freely in mutual funds, stocks, or real estate without thinking about tax deductions.

Both regimes serve different purposes. Therefore, the taxpayer must align the choice with personal financial philosophy.