The GST reforms introduced in September 2025 have completely redefined India’s taxation system, focusing on affordability, innovation, and youth empowerment. Indeed, these reforms represent a paradigm shift that aims to simplify taxes, reduce costs, and promote inclusive economic growth. Moreover, they align with India’s broader vision of fostering self-reliance, entrepreneurship, and equitable prosperity for all.

Introduction: A Transformative Step Toward an Empowered Economy

The Government of India introduced comprehensive GST reforms in 2025 to build a new tax ecosystem that nurtures innovation, supports employment, and boosts affordability. Through these changes, the government seeks to empower youth-led industries, simplify compliance for MSMEs, and improve ease of living for households. Furthermore, by reducing GST rates across key sectors such as education, healthcare, automobiles, textiles, food, and technology, the reforms directly benefit both consumers and entrepreneurs.

Consequently, the GST 2025 structure reflects the government’s dedication to transparency, efficiency, and inclusivity. Additionally, the rate cuts in high-growth sectors have the potential to stimulate consumption, encourage startups, and attract global investors, making India one of the most competitive economies in the world.

GST Reforms to Boost Jobs, Startups, and Businesses

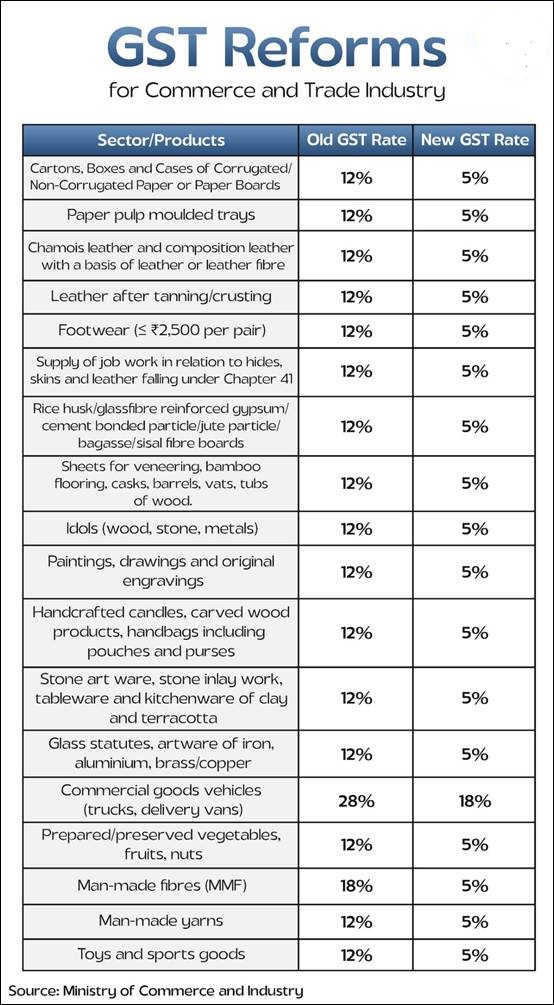

The 2025 GST reform package simplifies taxation for emerging sectors while creating fertile ground for startups and small enterprises. By lowering rates to 5% on essential industries like leather, footwear, textiles, packaging, and handicrafts, the government directly reduces the cost of doing business. Furthermore, the streamlined structure encourages young entrepreneurs to enter competitive markets with greater confidence and lower compliance burdens.

Additionally, these reforms enhance export competitiveness by rationalising rates on goods manufactured in India. Therefore, MSMEs across manufacturing, logistics, and design sectors can scale faster, access global markets, and generate employment for millions of skilled youth.

GST Rationalisation for the Leather and Footwear Industry

The leather and footwear industry plays a pivotal role in India’s export economy. Thus, GST rationalisation in this sector directly benefits young manufacturers, artisans, and traders.

- GST reduced from 12% to 5% on chamois leather and composition leather.

- Footwear priced up to ₹2,500 per pair now attracts just 5% GST.

- Job work related to hides and leather reduced from 12% to 5%, easing MSME costs.

As a result, the industry becomes more globally competitive while domestic affordability rises. Moreover, this move creates new opportunities for youth employment and supports the Make in India initiative.

GST Rationalisation for the Wood and Sustainable Material Industry

In 2025, the government prioritised eco-friendly manufacturing through GST reforms in the wood and substitute sectors.

- GST reduced from 12% to 5% on rice husk boards, bamboo flooring, and jute particle boards.

- This move encourages the production of green alternatives and supports sustainable MSMEs.

- Entrepreneurs now find it easier to produce eco-conscious furniture, packaging, and décor products.

Consequently, India takes a progressive step toward sustainability-driven growth, reducing dependence on non-renewable materials.

GST Rationalisation for Handicrafts: Empowering Young Artisans

The handicrafts sector, long recognised as India’s cultural and creative backbone, receives significant relief under GST 2025.

- GST on idols, paintings, handcrafted candles, and stone art has been reduced from 12% to 5%.

- Traditional goods such as terracotta ware and carved wood products also benefit from the lower tax.

- The measure promotes local artisans, exports, and tourism-related sales.

Additionally, these reforms empower young artists to sustain traditional livelihoods while integrating modern business models and digital marketplaces. Therefore, India’s art economy stands revitalised under the new GST era.

GST Rationalisation for Textiles: Strengthening India’s Global Competitiveness

Recognising the textile industry as a major youth employer, the government drastically reduced GST rates:

- Man-made fibres reduced from 18% to 5%.

- Yarns cut from 12% to 5%.

- Ready-made apparel up to ₹2,500 is taxed at 5%.

Furthermore, carpets and floor coverings now fall under the 5% bracket, making Indian products more price-competitive globally. As a result, these reforms not only enhance exports but also sustain domestic jobs across weaving, dyeing, and garment manufacturing units.

GST Reduction in Packaging: Lowering Business Costs

Packaging plays a vital role in logistics, trade, and exports. Hence, the government reduced GST to 5% on:

- Packing paper, corrugated boxes, and pulp trays.

- Cartons used by small-scale producers and retailers.

Consequently, the reforms reduce input costs, make goods more affordable, and help startups compete effectively in e-commerce and retail.

GST Rationalisation for Transport and Logistics: Lower Freight Costs

Transportation drives economic growth, and the 2025 reforms prioritise logistics efficiency:

- GST on commercial vehicles (trucks, vans, etc.) reduced from 28% to 18%.

- Third-party insurance on goods carriages dropped from 12% to 5% with ITC.

Therefore, freight becomes cheaper, supply chains become smoother, and young logistics entrepreneurs gain better profit margins.

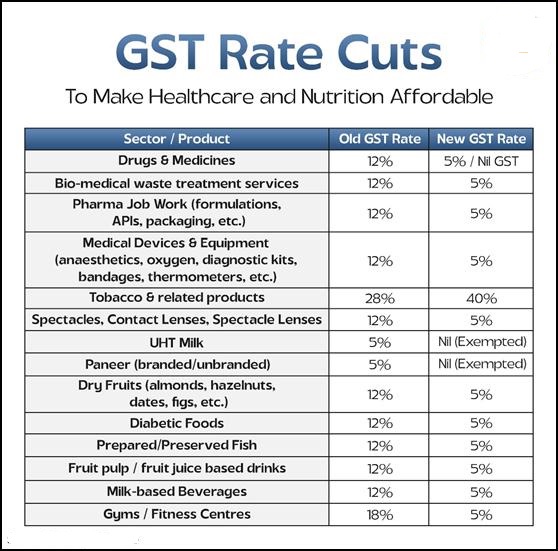

GST Reforms for Healthcare: Making Treatment Affordable

Healthcare affordability lies at the heart of the 2025 reforms. While hospital services remain exempt, the government has reduced GST on essential medicines and equipment.

- Drugs and medicines now attract 5% or Nil GST instead of 12%.

- Health insurance premiums are fully exempted from GST.

- Preventive healthcare receives a boost as fitness and wellness services become cheaper.

Furthermore, by raising GST on tobacco from 28% to 40%, the government discourages harmful habits while funding better healthcare infrastructure.

GST on Vision Correction and Childcare Products

- Spectacles and lenses now carry 5% GST, improving affordability.

- Baby napkins, feeding bottles, and thermometers are reduced to 5%, supporting young families.

- UHT milk is GST-free, ensuring affordable nutrition.

Consequently, these reforms ease household costs and promote healthier lifestyles for youth and children alike.

GST Reforms for Education and Learning Materials

Education remains GST-exempt, but the 2025 update extends relief to learning essentials:

- Pencils, erasers, exercise books, charts, and maps now fall under Nil GST.

- Toys and sports goods reduced to 5% GST.

- Bicycles also taxed at 5%, enhancing student mobility in rural regions.

Therefore, education becomes more accessible, and parents face fewer financial constraints. Moreover, the domestic stationery and toy manufacturing sectors receive renewed growth momentum.

GST for Fitness and Wellness: Promoting Healthy Living

Fitness centres and gyms now enjoy a GST cut from 18% to 5%. This move significantly improves access to health facilities.

- Gym memberships become more affordable.

- Preventive health awareness increases among urban youth.

- Fitness startups experience growth in demand and investment.

Additionally, this aligns perfectly with India’s Fit India Movement, encouraging citizens to adopt healthier lifestyles.

GST Rationalisation on Automobiles: Mobility for All

Two-Wheelers (≤350cc): Affordable Transport for Youth

GST reduced from 28% to 18%, making two-wheelers cheaper for students, gig workers, and rural commuters.

Small Cars: Enhancing Middle-Class Mobility

GST lowered from 28% to 18%, driving higher sales and supporting auto MSMEs.

Large Cars and Buses

- Large cars are now taxed at a flat 40% without cess, ensuring price clarity.

- Buses (10+ seating capacity) reduced from 28% to 18%, improving public transport affordability.

Consequently, the reforms not only expand access to affordable vehicles but also stimulate job creation across manufacturing, sales, and logistics sectors.

GST Reduction for Cement and Building Materials

To promote housing and infrastructure, GST on cement dropped from 28% to 18%.

- Lower construction costs will support Pradhan Mantri Awas Yojana

- Youth workers in construction benefit from expanded job opportunities.

- Affordable cement prices directly reduce housing costs.

Moreover, GST on marble and granite has also fallen from 12% to 5%, further lowering real estate costs.

GST on Drones: Empowering Tech Entrepreneurs

Recognising drones as the future of innovation, the government implemented a uniform 5% GST across all drone categories.

- This move supports tech startups and promotes Make in India.

- It encourages agricultural, industrial, and emergency applications.

- It aligns with India’s PLI Scheme for drone manufacturing.

Consequently, these reforms empower tech-savvy youth to participate in the fast-growing drone economy, ensuring skill development and employment generation.

GST on Essential Food Items: Easing Everyday Living

Daily food items like milk, roti, paneer, paratha, and packaged snacks are now under 5% or Nil GST.

- This reform reduces grocery bills and supports household affordability.

- Farmers, small dairies, and local brands benefit from lower input costs.

- Processed food industries gain stronger market competitiveness.

Therefore, the reforms improve ease of living, promote nutrition, and enhance consumer spending power.

Conclusion: A New Era of Simplified, Youth-Focused Taxation

The GST Reforms 2025 signify a new era of affordable living, sustainable business, and inclusive growth. By reducing rates across key sectors—education, healthcare, housing, mobility, and MSMEs—the government builds an economy where youth can thrive.

Moreover, these changes reinforce India’s commitment to ease of doing business, fiscal transparency, and social equity. Consequently, startups flourish, industries expand, and citizens enjoy a higher quality of life.

Indeed, GST 2025 sets the foundation for a New India — where taxation fuels growth, innovation, and national prosperity.

References:

Ministry of Finance | Ministry of Education | Ministry of MSME | Ministry of Health and Family Welfare | Ministry of Commerce & Industry | Ministry of Textiles | Ministry of Rural Development | Ministry of Road Transport & Highways | Ministry of Youth Affairs & Sports | Ministry of Housing & Urban Affairs | Ministry of Civil Aviation | Ministry of Heavy Industries