Starting today, September 22, 2025, India has entered a new phase of tax reforms with the introduction of GST 2.0. On the very first day of Navratri, the government released a revised GST Price List for 2025. These reforms affect almost every household product—from groceries and dairy to electronics and automobiles. While essential goods have become cheaper, some luxury and harmful items are now costlier.

So, what does this mean for you and your family? Imagine your monthly budget as a balloon—you keep filling it with expenses. Now, with GST 2.0, some of the air (costs) have been let out, making it easier to handle. But on the flip side, the balloon gets tighter if you go for luxury indulgences.

In this detailed guide, we’ll walk you through the complete GST Price Cut List 2025, highlighting what’s cheaper, what’s costlier, and how these changes impact your everyday spending.

Table of Contents

| Sr# | Headings |

| 1 | Overview of GST 2.0 Reforms |

| 2 | Why the Government Introduced GST Price List 2025 |

| 3 | Key Highlights of the New GST Rates |

| 4 | Essential Goods That Became Cheaper |

| 5 | Daily Household Items Under 0% GST |

| 6 | Food and Beverage Items in GST-Free Category |

| 7 | Educational Products Now Tax-Free |

| 8 | Appliances and Electronics Under Reduced GST |

| 9 | Automobiles: Cars and Bikes with Lower Prices |

| 10 | Medicines and Healthcare Relief |

| 11 | Items That Became More Expensive |

| 12 | Luxury Products with Higher GST |

| 13 | Environmental and Harmful Goods with Increased Taxes |

| 14 | Impact on Middle-Class Families |

| 15 | How the GST Price List 2025 Will Affect Your Monthly Budget |

| 16 | Expert Opinions on GST 2.0 |

| 17 | Conclusion: Will GST 2.0 Ease Your Life? |

| 18 | FAQs on GST Price List 2025 |

1. Overview of GST 2.0 Reforms

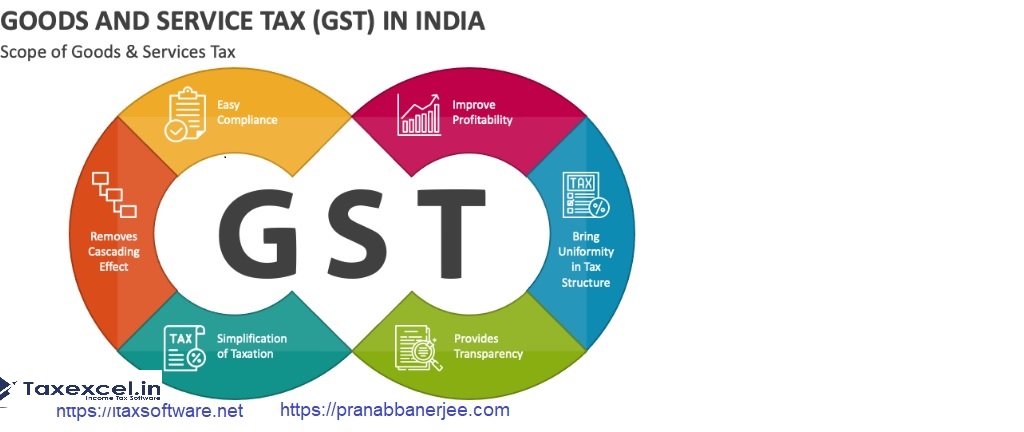

The government launched GST 2.0 to simplify taxation and bring relief to common households. This reform reduces taxes on essential products while increasing rates on luxury and harmful goods. Essentially, the goal is to make daily living affordable while discouraging the overuse of luxury items.

2. Why the Government Introduced the GST Price List 2025

The government designed the GST Price List 2025 to address inflation and ease household budgets. By cutting GST on essentials like milk, oil, and education-related items, it directly benefits middle and lower-income families. Simultaneously, raising GST on luxury cars and tobacco discourages excessive consumption.

3. Key Highlights of the New GST Rates

- 0% GST on essential food and educational products

- Reduced GST (5-12%) on appliances and electronics

- Lower rates on automobiles (cars and bikes)

- Higher GST on luxury goods and harmful products like tobacco, alcohol, and high-end gadgets

4. Essential Goods That Became Cheaper

Households will now spend less on kitchen and grocery shopping. Items like packaged flour, soap, edible oils, and dairy products have seen rate cuts. This directly impacts daily cooking and household chores, reducing monthly bills.

5. Daily Household Items Under 0% GST

The biggest relief comes in the form of zero GST on some widely used items. Products like bread, ready-to-eat parathas, paneer, UHT milk, and pizza bases are now completely tax-free. This will reflect directly in supermarket bills.

6. Food and Beverage Items in GST-Free Category

Food has always been a sensitive area for consumers. Under GST 2.0, items like fresh bread, packaged flour, dairy-based foods, and ready-to-eat snacks are GST-free. Families can now enjoy cost savings without compromising on nutrition.

7. Educational Products Now Tax-Free

To support students, GST has been removed from essential educational materials. Items such as notebooks, pencils, erasers, maps, globes, practice books, and lab notebooks are now at 0% GST. This move reduces the financial burden on parents.

8. Appliances and Electronics Under Reduced GST

Middle-class homes often struggle with high prices of appliances. With GST 2.0, items like televisions, refrigerators, washing machines, and air conditioners now attract lower GST rates. This makes them more affordable for households upgrading their essentials.

9. Automobiles: Cars and Bikes with Lower Prices

Buying a car or bike just became more attractive. The government reduced GST on popular categories of automobiles. Families looking for budget-friendly vehicles will now find more affordable options.

10. Medicines and Healthcare Relief

Healthcare products such as essential medicines and medical equipment are now taxed at reduced rates. This step ensures healthcare becomes more affordable, particularly benefiting senior citizens and patients with long-term treatments.

11. Items That Became More Expensive

Not everything is cheaper under GST 2.0. Products considered non-essential or harmful have moved to higher tax slabs. While this might pinch luxury buyers, it helps balance the revenue model for the government.

12. Luxury Products with Higher GST

High-end cars, luxury watches, premium gadgets, and jewellery now carry higher GST. The aim is to ensure that the wealthy contribute more, while common families enjoy relief on necessities.

13. Environmental and Harmful Goods with Increased Taxes

Products harmful to health or the environment—like tobacco, alcohol, and plastic goods—are now taxed heavily. The intention is not just revenue but also to promote a healthier, greener lifestyle.

14. Impact on Middle-Class Families

For the middle class, GST 2.0 feels like a double-edged sword. Essentials are cheaper, which means savings. However, if families indulge in lifestyle upgrades like branded electronics or high-end vehicles, they will end up paying more.

15. How the GST Price List 2025 Will Affect Your Monthly Budget

Imagine your household budget as a puzzle. With reduced GST on basics, some pieces fit more easily, leaving extra space for savings. But if you splurge on luxuries, the puzzle becomes tighter. Overall, the reform supports careful planners.

16. Expert Opinions on GST 2.0

Economists view GST 2.0 as a positive step toward consumer-friendly taxation. Analysts believe reduced costs on essentials will lower inflationary pressure, while higher taxes on luxuries will balance government revenue.

17. Conclusion: Will GST 2.0 Ease Your Life?

Yes, for most families, GST Price List 2025 means relief on essentials and household items. However, those who prefer luxury lifestyles will face higher costs. In the long run, GST 2.0 aims to create a balanced tax structure—fair for everyone.

Detailed GST Price List 2025 – Quick Reference Table

The following table summarises the revised GST rates effective from September 22, 2025, under GST 2.0.

| GST Rate | Category of Items | Examples of Products |

| 0% (GST-Free) | Essential food and education products | UHT milk, paneer, fresh bread, ready-to-eat parathas, pizza bases, notebooks, pencils, erasers, maps, globes, graph books |

| 5% | Packaged essentials and low-cost goods | Packaged flour, edible oil, soaps, basic kitchen ingredients, medicines |

| 12% | Affordable household appliances and electronics | Small TVs, washing machines, refrigerators, air conditioners (basic models), bicycles |

| 18% | Mid-range appliances, automobiles, and consumer durables | Cars (mid-segment), two-wheelers, branded electronics, premium household gadgets |

| 28% | Luxury goods and harmful items | Luxury cars, high-end smartphones, premium watches, jewellery, alcohol, tobacco, plastic items |

18. Breakdown of Each GST Slab in GST Price List 2025

0% GST Slab – Relief for Households

The zero tax category directly benefits middle and lower-income groups. By removing GST from everyday food and education items, the government ensures affordability.

- Families save money on basic groceries.

- Students benefit from cheaper books and stationery.

- Ready-to-eat items like parathas and bread support working professionals with busy schedules.

5% GST Slab – Everyday Essentials

Products in this category are still affordable but include items that undergo processing or packaging.

- Examples: edible oils, packaged wheat flour, detergents, soaps

- This helps stabilise household budgets without burdening consumers.

12% GST Slab – Affordable Appliances

This slab supports families who want to upgrade their home appliances without overspending.

- Items like small refrigerators, entry-level TVs, and basic washing machines fall here.

- This is a step to make technology more accessible to middle-class families.

18% GST Slab – Automobiles and Mid-Range Goods

The 18% slab largely covers products that are important but not strictly essential.

- Examples include cars, bikes, branded electronics, and mid-range gadgets.

- These remain relatively affordable while still contributing to government revenue.

28% GST Slab – Luxury and Harmful Goods

To curb unnecessary luxury consumption and discourage harmful habits, the highest tax slab applies here.

- Luxury goods: high-end cars, premium gadgets, jewellery, luxury watches

- Harmful items: alcohol, tobacco, plastic goods

- These taxes encourage conscious spending and promote a healthier lifestyle.

19. GST Price List 2025 and Inflation Control

One of the main goals of GST 2.0 is inflation control. By cutting taxes on daily-use items, household expenses decrease. At the same time, higher rates on luxury products balance the government’s revenue collection. This two-sided approach keeps the economy stable while benefiting the majority population.

20. Who Benefits the Most from GST 2.0?

- Middle-Class Families: Lower grocery and household bills.

- Students & Parents: Affordable books, notebooks, and learning supplies.

- Patients & Elderly: Reduced cost of medicines and healthcare equipment.

- Small Businesses: Cheaper essentials reduce operational costs.

21. Practical Example – Before and After GST 2.0

Let’s consider an average monthly shopping list:

- Packaged flour: Earlier ₹300 (with 5% GST) → Now ₹285 (0% GST)

- UHT milk: Earlier ₹60 (with 5% GST) → Now ₹57 (0% GST)

- Notebook: Earlier ₹50 (with 12% GST) → Now ₹45 (0% GST)

- TV (mid-range): Earlier ₹25,000 (18% GST) → Now ₹22,500 (12% GST)

This shows how GST 2.0 reduces the overall bill significantly.

22. Long-Term Impact of GST Price List 2025

The reforms will:

- Boost consumption of essentials.

- Reduce financial stress on households.

- Encourage savings for middle-class families.

- Balance government income through luxury taxes.

FAQs on GST Price List 2025

- Which products are GST-free under GST 2.0?

Products like UHT milk, paneer, bread, ready-to-eat parathas, and school stationery items are now under 0% GST. - Will GST 2.0 make groceries cheaper?

Yes, grocery items such as packaged flour, soaps, dairy products, and edible oils are now cheaper under revised rates. - Are electronic items included in the GST price cut?

Yes, appliances like TVs, refrigerators, washing machines, and air conditioners now have reduced GST, making them more affordable. - Which items have become more expensive?

Luxury cars, premium electronics, tobacco, alcohol, and plastic goods have higher GST rates under GST 2.0. - How will the GST Price List 2025 affect middle-class families?

Middle-class households will save money on essentials but may spend more on luxury or harmful items due to higher GST rates.