Introduction

The Goods and Services Tax (GST) cut has sparked a wave of optimism across India’s retail industry. With festive sales on the rise and reduced GST rates for everyday items, many had hoped for a broad-based boom in consumption. Yet, the story isn’t entirely uniform. While some sectors like electronics and jewellery have benefited from the GST cuts, others, such as footwear and quick-service restaurants (QSRs) continue to face uneven demand.

In this detailed article, we will explore how these GST reforms are reshaping the retail landscape, what experts like Nuvama are projecting for Q2FY26, and how various retail segments are responding to both opportunities and challenges.

Table of Contents

| Sr# | Headings |

| 1 | Introduction |

| 2 | GST Cuts: A Festive Season Blessing |

| 3 | Retail Sector Outlook: A Mixed Bag |

| 4 | Nuvama’s Q2FY26 Retail Insights |

| 5 | Impact of GST on Electronics |

| 6 | Jewellery Sector: Glittering Yet Challenging |

| 7 | Footwear Industry: Premium Gains, Volume Pains |

| 8 | QSR Market: Expansion Amid Soft Demand |

| 9 | Apparel & Innerwear: Uneven But Promising |

| 10 | Key Performances: Company-Wise Breakdown |

| 11 | The Big Risks in the Retail Space |

| 12 | How GST Shapes Future Consumption Patterns |

| 13 | Expert Opinions on the Way Forward |

| 14 | Challenges Still Lurking Under the Surface |

| 15 | Conclusion |

| 16 | FAQs |

GST Cuts: A Festive Season Blessing

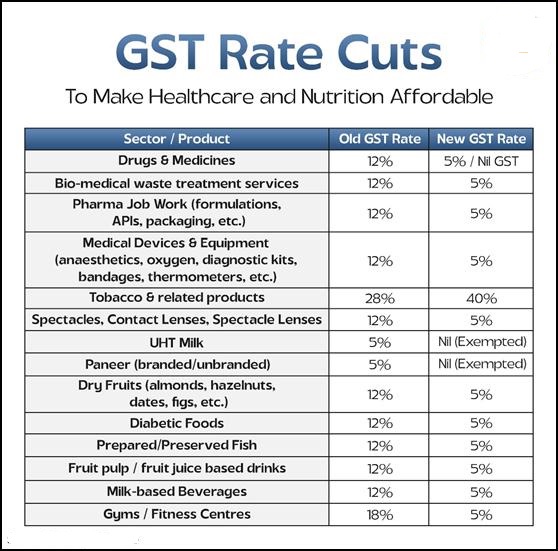

The recent GST rate cuts have directly lifted the festive spirit across India, energising both consumers and retailers alike. Consequently, shoppers are spending more confidently, while retailers are experiencing renewed momentum across several product categories. Moreover, lower taxes on leather goods, footwear, textiles, handicrafts, and toys have made products far more affordable, thereby enticing budget-conscious buyers to flock back to both stores and e-commerce platforms.

As a result, footfall in physical and digital marketplaces has risen sharply, and retailers are recording higher conversions than in previous quarters. However, even though the GST reduction has encouraged stronger spending, its benefits vary significantly across sectors. While certain industries have immediately experienced a surge in consumption, others still struggle with high inventories, fluctuating raw material costs, and cautious consumer sentiment. Therefore, although the policy has created a positive atmosphere, its overall impact remains uneven across the retail spectrum.

Retail Sector Outlook: A Mixed Bag

The retail sector’s performance now appears promising, yet demand patterns remain unevenly distributed. For instance, high-value segments such as jewellery and electronics continue to display remarkable resilience, whereas daily consumption goods and essentials are recovering more slowly.

At the same time, the retail industry must constantly balance rising operating costs, volatile gold prices, and changing consumer moods. Furthermore, as Nuvama’s analysis reveals, while GST cuts have enhanced affordability, discretionary spending—particularly on premium and lifestyle products—still lags behind expectations. Hence, the market reflects a dual trend: enthusiasm among urban consumers contrasts with cautious optimism in smaller towns.

Ultimately, retailers must align inventory, pricing, and promotions carefully to sustain recovery while navigating dynamic challenges.

Nuvama’s Q2FY26 Retail Insights

Interestingly, Nuvama’s Q2FY26 preview provides an in-depth snapshot of how GST reforms are reshaping India’s retail landscape. The firm reported that its coverage universe revenue grew from ₹13,215 crore to ₹15,914.7 crore, marking a 20% year-on-year (YoY) and a 9% quarter-on-quarter (QoQ) growth. Therefore, these figures highlight the immediate impact of policy tailwinds like GST rate cuts and an early festive calendar.

Nevertheless, profit margins have tightened, mainly due to aggressive promotional campaigns, discount-led strategies, and intense competition across categories. Consequently, while revenues expand, profitability remains under pressure. Thus, the retail market stands at a crossroads—enjoying policy-driven growth yet grappling with long-term stability concerns.

Impact of GST on Electronics

Without a doubt, the electronics sector has emerged as the biggest winner after the GST revision. Specifically, lower tax rates have boosted sales of televisions, mobile accessories, and smartphones. According to Nuvama, Electronics Mart India Ltd and Aditya Vision both posted double-digit revenue growth, while margins stabilised between 6% and 7%, indicating a healthy balance between pricing and profitability.

Furthermore, strong iPhone demand, festive offers, and Uttar Pradesh expansion have fueled regional momentum. Clearly, the GST relief has acted as a catalyst, enabling middle-class consumers to upgrade devices without exceeding budgets. Ultimately, this demonstrates how tax reform can stimulate affordability, encourage modernisation, and accelerate technology adoption across Indian households.

Jewellery Sector: Glittering Yet Challenging

In contrast, the jewellery sector tells a story of both triumph and tension. The festive season, supported by GST consistency, has offset the challenges of a high comparative base from the prior year. Brands such as Titan and Kalyan Jewellers have successfully leveraged Navratri and Dussehra demand, reporting 20% and 31% YoY growth, respectively.

However, despite these glittering numbers, the industry still faces volatility in gold prices, which have surged over 35% YoY. Even so, PN Gadgil achieved record-breaking sales of ₹618 crore, representing a 65% YoY surge. Therefore, GST adjustments on gold jewellery transactions have empowered customers to make faster purchases during auspicious festivals. In essence, the sector shines brightly, yet it still grapples with price instability and consumer hesitation.

Footwear Industry: Premium Gains, Yet Volume Pains

The footwear industry is currently transitioning, balancing optimism and caution. Indeed, the recent GST rate cut on footwear priced below ₹2,500 has enhanced affordability and rekindled consumer interest. Nevertheless, even though prices have dropped and accessibility improved, overall volume recovery remains slower than anticipated.

At the same time, companies like Metro Shoes and Bata have shifted focus to premium lines to protect margins. Moreover, as competition intensifies and consumer preferences evolve, these brands are strategically leveraging GST benefits to launch value-driven collections. Consequently, this illustrates how firms prioritise quality over quantity, particularly when volume growth is limited.

Additionally, Nuvama’s analysis shows that premiumisation has stabilised margins, yet volumes remain subdued because discretionary spending remains restricted. Still, as GST-led affordability widens and consumer sentiment strengthens, brands like Campus and Bata are expected to gain momentum soon. Therefore, while short-term pain persists, the industry is laying groundwork for long-term transformation. Ultimately, GST reforms could rejuvenate mass-market demand, provided that the economy remains stable and confidence grows steadily.

QSR Market: Expansion Despite Soft Demand

Meanwhile, the Quick Service Restaurant (QSR) segment continues to expand rapidly, even though same-store sales growth (SSSG) remains modest. For example, Jubilant FoodWorks recorded a 15.8% YoY increase, while Devyani International diversified with brands like New York Fries, Tea Live, and Sanook Kitchen. Consequently, these moves strengthened market presence and broadened consumer reach.

Moreover, QSR players have demonstrated agility, opening new outlets even amid soft demand. However, margins remain tight, mainly because of higher input costs and reduced dining frequency. Thus, although GST reforms have eased tax burdens, urban consumers still spend cautiously. Nevertheless, as incomes improve and economic confidence returns, dining trends will likely rebound. In conclusion, the QSR growth trajectory will depend on evolving preferences, price sensitivity, and lifestyle priorities.

Apparel & Innerwear: Uneven Yet Promising

Similarly, the apparel and innerwear sector presents an uneven yet encouraging scenario. While value-driven retailers like V-Mart recorded 22% revenue growth and 11% SSSG, premium brands like ABFRL faced margin pressure due to rising ad costs and rapid expansion. Meanwhile, Trent grew more gradually, whereas V-Mart leveraged festive timing and store expansion for stronger performance.

Indeed, the lower GST rate on mid-premium apparel has improved affordability, stimulated purchases, and intensified competition. Nevertheless, the sector still grapples with rising costs and evolving consumer behaviour. Altogether, these factors emphasise innovation and efficiency. Still, GST-led affordability and strategic agility are positioning the market for sustainable recovery. Hence, the industry stands on the edge of transformation, propelled by policy support and demand evolution.

Key Performances: Company-Wise Breakdown

To summarise, Nuvama’s retail performance data reveals both momentum and disparity:

- Titan grew 20% YoY, maintaining 11% EBIT margin.

- Kalyan Jewellers posted 31% growth, with 15 new stores.

- PN Gadgil achieved ₹618 crore in festive sales, up 65% YoY.

- Jubilant FoodWorks rose 8% YoY with steady margins.

- V-Mart saw 22% revenue growth and EBITDA margin expansion.

- Shoppers Stop improved its EBITDA margin from 7% to 14.3%.

- VIP Industries, despite a 5% drop, expanded gross margin to 47%.

Collectively, these performances demonstrate that GST reforms, combined with festive demand and promotions, have revived short-term retail growth. Nevertheless, pricing pressure and cautious sentiment still test long-term resilience.

The Big Risks in the Retail Space

Despite the positives, several risks persist. According to Nuvama, factors like the high base effect, volatile gold prices, weather disruptions, and festival timing distortions continue to challenge stable growth. Moreover, rising competition from quick-commerce platforms forces traditional retailers to adapt quickly.

Therefore, the GST cuts, while beneficial, serve more as a temporary boost than a permanent fix. Consequently, sustainable growth will depend heavily on macroeconomic stability, consumer confidence, and ongoing structural reforms.

How GST Shapes Future Consumption Patterns

Undoubtedly, the GST framework has transformed Indian consumption patterns. It has reduced price gaps, enhanced supply efficiency, and fostered formalisation in the retail chain. Moreover, its transparency has empowered small retailers to integrate into the organised economy.

However, the true challenge lies in maintaining momentum after the festive season fades. Ultimately, retail growth will depend on how well the industry combines GST-driven affordability with innovation, adaptability, and economic resilience.

Expert Opinions on the Way Forward

Experts remain cautiously optimistic, yet they stress the need for consistent momentum. Indeed, while GST reforms have enhanced affordability, sustained demand recovery will require wage growth, rural revival, and inflation control. Moreover, analysts highlight that these factors must align to secure long-term progress.

Furthermore, Nuvama’s analysts assert that GST’s role will stay transformational if the government maintains policy consistency and the industry fosters cooperation. Therefore, the path forward demands collaboration, adaptability, and innovation at every level of the retail ecosystem.

Challenges Still Lurking Under the Surface

Even though optimism prevails, significant challenges remain. Retailers face margin pressure, logistical inefficiencies, and volatile input costs. Consequently, businesses must rethink strategies and embrace efficiency. At the same time, the digital revolution continues to reshape consumer behaviour, compelling traditional stores to reinvent themselves.

Additionally, AI-driven marketing and omnichannel platforms have raised expectations, pushing brands to deliver seamless experiences. Nonetheless, resilience and reinvention remain the keys to survival. Thus, while GST cuts ignite growth, they alone cannot ensure long-term success. Ultimately, sustainable progress will depend on innovation, adaptability, and government support.

Conclusion

In conclusion, GST cuts have revitalised the retail landscape, though recovery remains uneven. While sectors like electronics and jewellery have thrived, others—like footwear, QSRs, and apparel—are still regaining pace. Even so, policy reforms have set the stage for stronger growth.

Looking ahead, the next few quarters will determine whether GST reforms can convert optimism into stability. Therefore, retailers must stay agile, balance promotions with profits, and leverage festive demand strategically. Above all, success will depend on innovation, efficiency, and customer focus.