When you receive arrears or past salary payments, your tax liability may increase significantly. However, the Income Tax Act offers relief under Section 89(1) to reduce the burden. To claim this relief, you must submit Form 10E. Calculating arrears manually can be time-consuming, but an automatic Income Tax Arrears Calculator in Excel makes the process quick, accurate, and stress-free.

What is Income Tax Arrears Relief Under Section 89(1)?

Section 89(1) provides relief when employees receive salary arrears or advances in a lump sum, which pushes them into higher tax brackets. Without this relief, you may end up paying excess tax. The arrears relief ensures fair taxation by spreading the additional income over the years it actually pertains to.

Why Do You Need Form 10E for Arrears Calculation?

Form 10E is mandatory when you claim relief under Section 89(1). The Income Tax Department will not accept your claim unless you submit it online. This form provides detailed year-wise arrears information, helping the department verify your calculation. By using the automatic arrears calculator in Excel, you can generate accurate figures to fill out Form 10E correctly.

Benefits of Using the Automatic Income Tax Arrears Calculator in Excel

The Income Tax Arrears Calculator offers multiple benefits:

- Accuracy: It reduces errors in arrears and relief calculations.

- Time-Saving: It computes results instantly without manual effort.

- User-Friendly: Even non-technical employees can use it easily.

- Compliant: It follows the latest tax rules for FY 2025-26.

- Automatic Integration: It prepares a ready-to-use sheet for quick reference.

Step-by-Step Guide to Download and Use the Calculator

- Download the Excel File: Get the Automatic Arrears Calculator for FY 2025-26.

- Enter Your Salary Details: Input your basic salary, arrears received, and other allowances.

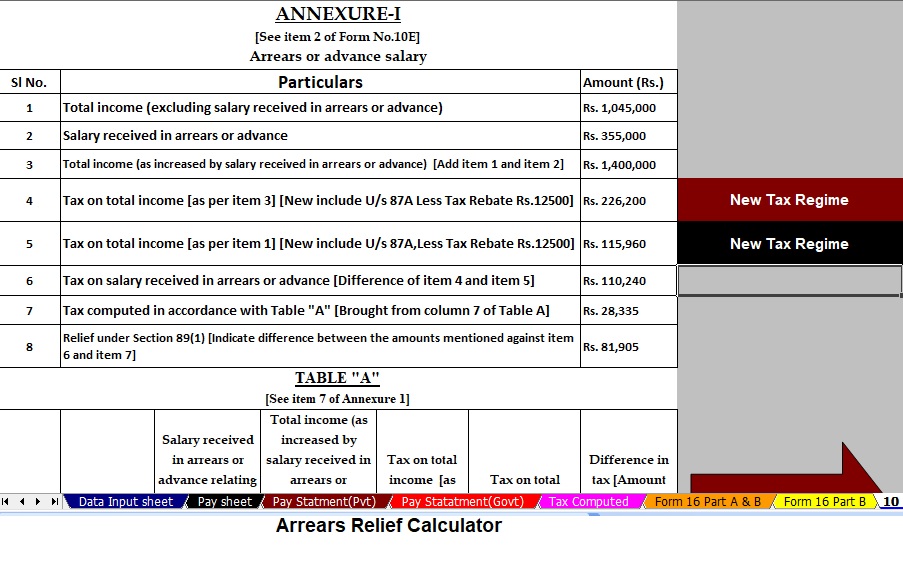

- Check Automatic Computation: The calculator automatically computes your arrears relief under Section 89(1).

- Generate Ready Sheet: It prepares a Tax Computed Sheet, which you can use as a reference while filing Form 10E.

- Submit Form 10E Online: Use the figures generated by the Excel tool to file the form with confidence.

Key Features of the Excel Arrears Calculator for FY 2025-26

- Inbuilt Salary Structure for Government and Non-Government employees.

- Automatic calculation of arrears relief under Section 89(1).

- Ready-made format aligned with Form 10E.

- Error-free, fast, and reliable computation.

- Updated as per Budget 2025 provisions.

Final Thoughts: Save Time with an Automatic Tax Calculator

Calculating arrears manually can be confusing and error-prone. Instead, use the Income Tax Arrears Calculator U/s 89(1) with Form 10E in Excel to save time and ensure accuracy. By relying on this tool, you can file your returns with confidence, claim relief correctly, and avoid unnecessary tax burdens.

Frequently Asked Questions (FAQs) on Income Tax Arrears Relief

Q1. Who can claim relief under Section 89(1)?

Employees who receive arrears, advances, or past salary payments in a lump sum can claim relief. In other words, if delayed salary payments push you into a higher tax bracket, you qualify for this benefit.

Q2. Is it compulsory to file Form 10E?

Yes, filing Form 10E is mandatory. Without this form, the Income Tax Department will reject your relief claim, even if you qualify.

Q3. Can I submit Form 10E offline?

No, you must file Form 10E online through the official income tax portal. Consequently, using an Excel calculator makes the online process smoother and more accurate.

Q4. Does the calculator apply to both Government and Non-Government employees?

Yes, the calculator works for both categories. Since it has an inbuilt salary structure, employees from all sectors can use it confidently.

Example of Arrears Relief Calculation

Suppose you received ₹1,20,000 as arrears in FY 2025-26, which belonged to FY 2022-23. Naturally, this amount increases your taxable income in the current year, pushing you into a higher slab. Without relief, you would pay extra tax.

However, Section 89(1) allows you to calculate the tax as if the arrears were received in the earlier year. Therefore, you compare the tax liability for both years and claim relief for the excess paid. By using the automatic arrears calculator in Excel, this entire process takes minutes instead of hours.

Why an Automatic Calculator is Better than Manual Calculation

When you calculate arrears manually, you need to check slab rates, distribute arrears over multiple years, and ensure accurate entries. As a result, the process often becomes confusing and error-prone.

On the other hand, the Excel arrears calculator handles everything automatically. It applies the correct tax rules, generates accurate figures, and prepares a ready sheet for Form 10E. In addition, it prevents mistakes that could otherwise lead to notices or penalties from the department.

Advantages of Filing with Accuracy

Accurate filing not only ensures that you claim relief but also protects you from future complications. Because the Income Tax Department cross-verifies every entry, accuracy is essential. When you use the automatic calculator, you minimise risks, maximise savings, and simplify your compliance.

Furthermore, precise filing boosts your financial planning. As a result, you can forecast future tax liabilities better and manage your salary structure more effectively.