Introduction

Are you dreading the tax season again? You’re not alone. Every year, millions of salaried individuals—especially government and non-government employees—scramble to gather forms, calculate taxes, and make sense of deductions. But what if you could make this process as easy as brewing a cup of tea?

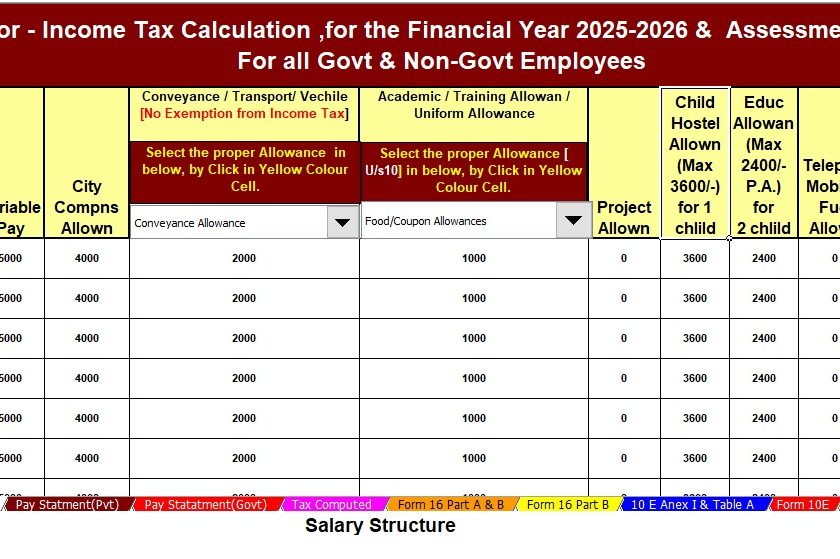

That’s where Automatic Income Tax Preparation Software in Excel with Form 10E comes in. Designed specifically for F.Y. 2025-26, this software helps you breeze through your tax filing by automating calculations, deductions, and more, right from your Excel sheet.

Table of Contents

| Sr# | Headings |

| 1 | Why Use Excel-Based Income Tax Software? |

| 2 | Key Features of the Software |

| 3 | What is Form 10E and Why Is It Important? |

| 4 | Who Should Use This Software? |

| 5 | How to Download the Income Tax Software in Excel |

| 6 | Step-by-Step Guide to Fill the Form |

| 7 | Benefits for Government Employees |

| 8 | Benefits for Non-Government Employees |

| 9 | Ensuring Accuracy in Tax Calculations |

| 10 | Compliance with Latest Tax Laws for FY 2025-26 |

| 11 | Common Mistakes to Avoid During Filing |

| 12 | Tips to Maximize Tax Savings |

| 13 | Is the Software Safe to Use? |

| 14 | Troubleshooting and Support |

| 15 | Final Thoughts |

1. Why Use Excel-Based Income Tax Software?

Using Income Tax Software in Excel is like having a personal tax assistant that doesn’t charge you. It’s lightweight, doesn’t need installation, and runs seamlessly on any system with Microsoft Excel. You avoid the hassle of learning complex portals or hiring expensive help.

2. Key Features of the Software

- Automatic Calculations: No need to worry about formulas.

- Pre-Built for FY 2025-26: Updated with the latest tax slabs and rules.

- Form 10E Integration: Automatically calculates and fills the form.

- Easy Navigation: Drop-down menus and guided steps.

- Printable Reports: Get summary sheets ready for submission.

3. What is Form 10E and Why Is It Important?

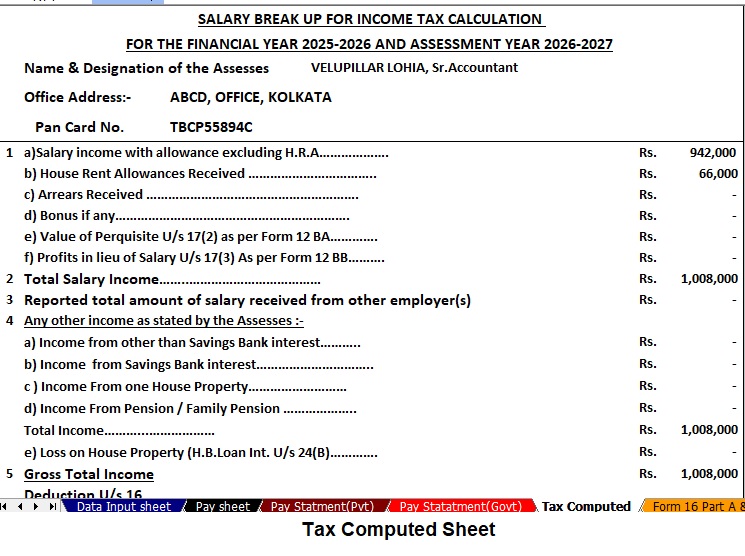

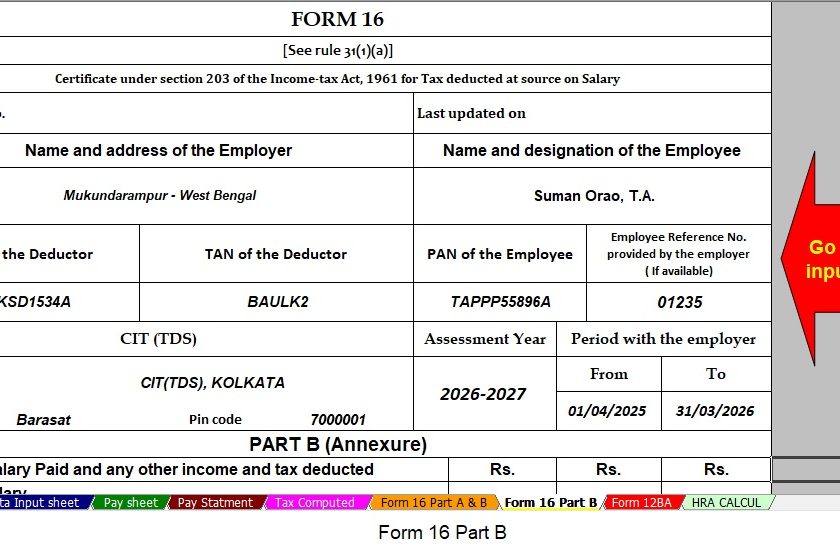

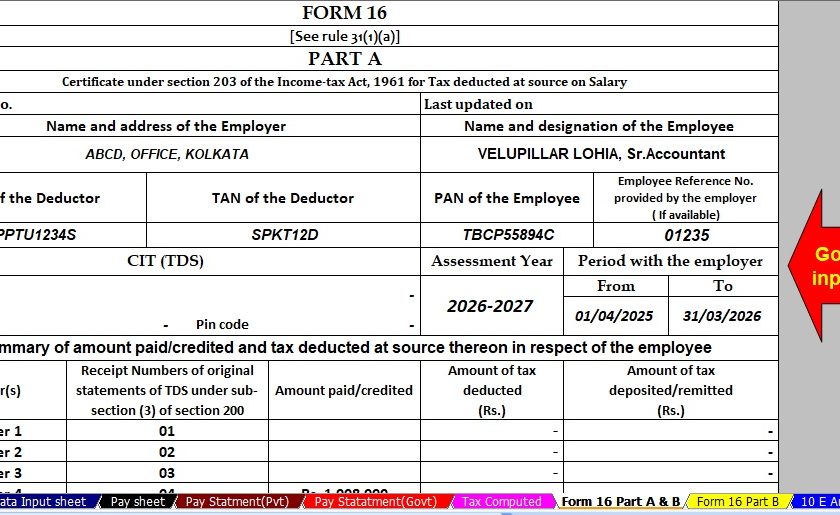

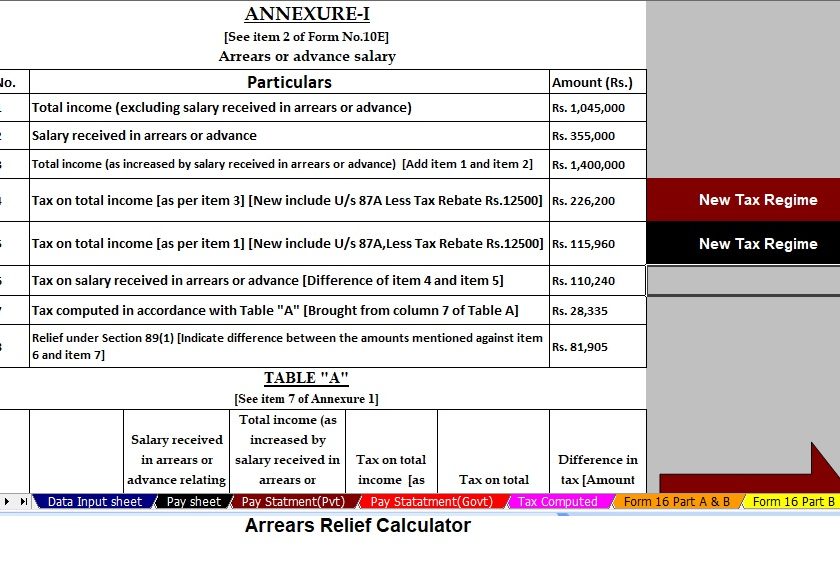

Form 10E allows employees to claim tax relief under Section 89(1) if they received arrears or advance salary. Not submitting it could mean losing your rightful refund or paying excess tax. This software includes automatic Form 10E preparation, saving you from the tricky math.

4. Who Should Use This Software?

Whether you’re a government teacher, a railway employee, or a private sector accountant, this tool is for you. Especially useful for salaried individuals, it simplifies tax filing for those with allowances, arrears, and deductions.

5. How to Download the Income Tax Software in Excel

Downloading is easy:

- Look into the link below for the Download

- Click on the “Download Excel Utility” link.

- Save and open the file in Microsoft Excel.

- Enable macros if prompted.

Be sure you download the F.Y. 2025-26 version to ensure accuracy.

6. Step-by-Step Guide to Fill the Form

- Open the Excel file and input your basic details.

- Enter your salary income, deductions, and allowances.

- Navigate to the Form 10E tab and follow the guide.

- Preview your final tax summary.

- Print or submit as required.

Think of it as filling in a simple questionnaire that turns into a tax-ready document.

7. Benefits for Government Employees

Government employees often deal with salary arrears and DA hikes, which make tax filing confusing. This software handles such complexities automatically. Plus, it’s tailored with government salary structures in mind.

8. Benefits for Non-Government Employees

For private-sector employees juggling multiple deductions, HRA, and performance bonuses, this Excel-based software simplifies everything. It ensures you’re not missing out on any eligible exemptions or deductions.

9. Ensuring Accuracy in Tax Calculations

Manual entry and math errors can cost you big time. This software:

- Auto-validates entries

- Cross-checks totals

- Alerts you to missing fields

Accuracy matters when dealing with the Income Tax Department, and this tool ensures just that.

10. Compliance with Latest Tax Laws for FY 2025-26

Updated according to Budget 2025, this tool reflects:

- Latest tax slab changes

- Standard deduction updates

- New rules for senior citizens and exemptions

Stay compliant without reading the entire tax law book!

11. Common Mistakes to Avoid During Filing

- Forgetting to submit Form 10E

- Claiming deductions not allowed under the new regime

- Entering the wrong PAN or TAN

- Skipping the verification step

The software warns you in real-time, just like a helpful colleague pointing out errors.

12. Tips to Maximise Tax Savings

- Use 80C, 80D, 80E, and HRA exemptions wisely.

- Enter exact details for education loan, medical bills, and insurance.

- Compare the old vs the new regime in the built-in comparison tab.

Every rupee saved in tax is a rupee earned!

13. Is the Software Safe to Use?

Yes! Excel-based tools are offline and don’t store your data on a server. Just make sure:

- You’re downloading from a reliable source

- Macros are from a trusted publisher

Safety is built in—just like a seatbelt in your car.

14. Troubleshooting and Support

Having trouble? Check:

- If macros are enabled

- You’re using Microsoft Excel, not other spreadsheet apps

- Follow the FAQ or help file inside the tool

Still stuck? Reach out to the publisher’s support team.

15. Final Thoughts

Filing taxes doesn’t have to be stressful. With this Income Tax Software in Excel, you gain control, accuracy, and peace of mind. Whether you’re a government or non-government employee, this tool simplifies everything and ensures you file correctly, every single time.

FAQs

1. Can I use this Excel-based software on my mobile phone?

No, it’s best used on a computer with Microsoft Excel installed.

2. Is Form 10E compulsory for everyone?

No, only if you’re claiming relief under Section 89(1) for salary arrears or an advance.

3. Do I need to be a tax expert to use this software?

Not at all! It’s beginner-friendly with a simple, guided process.

4. Can I switch between old and new tax regimes using this tool?

Yes, the software helps compare both regimes and suggests the best option.

Download Automatic Income Tax Preparation Software with Form 10E in Excel for the Government and Non-Government Employees for the F.Y. 2025-26