Ever felt the panic of the approaching financial year-end with tax documents scattered everywhere? If you’re a government employee in Maharashtra, we’ve got some good news for you. This year, managing your taxes just got easier with an automatic income tax preparation software in Excel, tailored just for you. Think of it as your personal tax assistant, minus the fees.

With the latest updates from Budget 2025, this tool ensures you’re compliant and relaxed. Wondering how this works and where to get it? Let’s break it down together.

Table of Contents

| Sr# | Headings |

| 1 | What is Automatic Income Tax Preparation Software? |

| 2 | Why Maharashtra State Employees Need It? |

| 3 | Key Features of the Excel Tool |

| 4 | What’s New in Budget 2025 for Maharashtra Employees? |

| 5 | Who Can Use This Software? |

| 6 | How to Download and Install the Tool? |

| 7 | How to Use the Software Step-by-Step |

| 8 | Understanding the Tax Calculator for the Maharashtra State Employees |

| 9 | 5 Benefits of Using the Excel Tax Tool |

| 10 | Common Mistakes to Avoid While Filing Taxes |

| 11 | Security & Data Privacy of Your Information |

| 12 | Comparison with Online Tax Filing Tools |

| 13 | Updates to Expect in Future Versions |

| 14 | Where to Get Support if You Need Help? |

| 15 | Final Thoughts and Next Steps |

1. What is Automatic Income Tax Preparation Software?

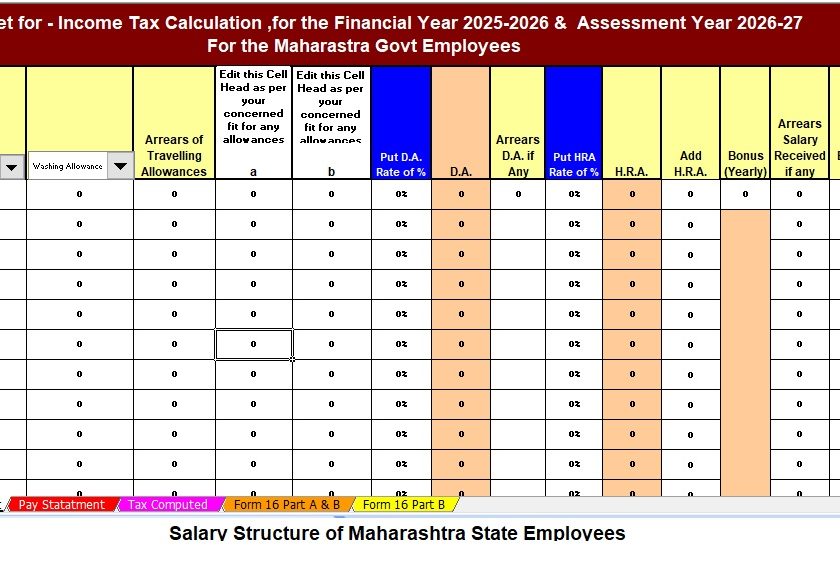

This Excel-based software is a pre-designed sheet that calculates your taxes based on your inputs. No coding, no complicated formulas—just enter your details, and the sheet takes care of the math. It follows the latest Budget 2025 rules and simplifies everything.

2. Why Maharashtra State Employees Need It?

As a Maharashtra State Employee, you face specific tax slabs and exemptions. Using general software may not capture those nuances. This tool is customised for your salary structure, allowances, and deductions. Why risk errors when there’s a tool made just for you?

3. Key Features of the Excel Tool

- User-friendly interface – Just fill in the blanks.

- Auto calculations – Avoid manual errors.

- Section-wise input fields – Makes tracking easier.

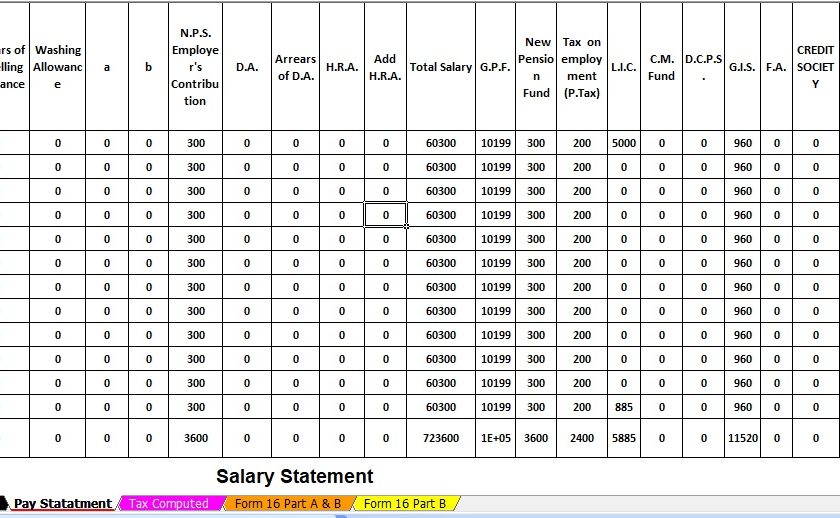

- Includes multiple salary structures for various departments.

- Built-in Tax Calculator for the Maharashtra State Employees – optimised and accurate.

4. What’s New in Budget 2025 for Maharashtra Employees?

Budget 2025 brought new tax slabs, updated HRA exemptions, and changed standard deduction values. This Excel tool reflects all the changes, so you don’t have to interpret budget jargon. It’s like a GPS that’s already updated with the new roadmaps.

5. Who Can Use This Software?

Whether you’re in education, police services, health, or administration, this software suits all Maharashtra government departments. It also adjusts to employee grade levels, ensuring correct tax liability across positions.

6. How to Download and Install the Tool?

It’s super simple:

- Click on “Download Excel File as given link below.”

- Save and open the file using Microsoft Excel or similar software.

- Enable macros if prompted.

Important Tip: Always download from reliable sources to protect your data.

7. How to Use the Software Step-by-Step

Here’s how to get started:

- Open the Excel file.

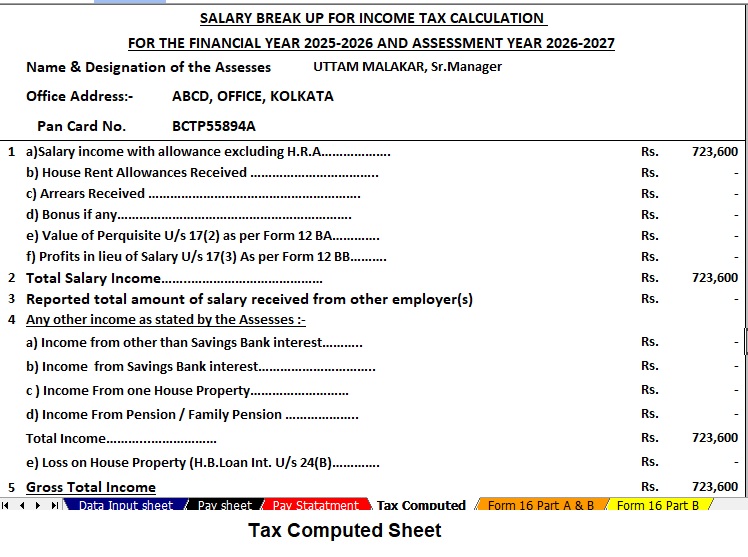

- Enter your PAN, personal details, and salary breakup.

- Choose your tax regime (Old/New).

- Input your investments (80C, 80D, etc.).

- Let the tool auto-calculate your tax liability and refund.

Just like making instant noodles—just follow the steps, and you’re good to go.

8. Understanding the Tax Calculator for the Maharashtra State Employees

This isn’t just any calculator. It’s a dedicated tax calculator for the Maharashtra State Employees—one that understands your unique deductions and benefits. It takes into account your DA, TA, medical allowance, and even GPF contributions.

So, no more guesswork—just clarity.

9. 5 Benefits of Using the Excel Tax Tool

- Time-Saving – Get tax computation in minutes.

- Zero Errors – Built-in formulas reduce manual errors.

- Custom-Tailored – Specifically for Maharashtra state employees.

- Free of Cost – Most versions are available for free.

- Updated With Budget 2025 – You’re always compliant.

10. Common Mistakes to Avoid While Filing Taxes

- Ignoring the latest tax regime rules

- Failing to declare HRA or standard deductions

- Inputting the wrong salary or investment figures

- Skipping the tax calculator for the Maharashtra State Employees

- Not double-checking the final tax computation

Avoid these, and you’re golden.

11. Security & Data Privacy of Your Information

Many ask: Is my data safe? The answer is yes—as long as you use a trusted source and save your file locally. Your information doesn’t go online, which means no data breaches or leaks.

12. Final Thoughts and Next Steps

Don’t wait for the financial year-end rush. This automatic Excel-based tax software is like having a personal assistant who knows the tax code by heart. It’s simple, reliable, and tailor-made for Maharashtra employees.

So why make tax season stressful? Download the tool, enter your details, and let the software handle the rest.

FAQs

1. Where can I download the automatic income tax Excel software for FY 2025–26?

You can download it from the link below or www.pranabbanerjee.com catering to Maharashtra state employees. Ensure it’s updated as per Budget 2025.

2. Is the tax calculator in the software suitable for all departments?

Yes, the built-in Tax Calculator for the Maharashtra State Employees adjusts for various departments and salary grades.

3. Do I need to be good at Excel to use this software?

Not at all. It’s designed for ease—just enter the values where required, and the rest is automated.

4. Can I use this tool for the Old and New Tax Regimes?

Yes, the tool supports both tax regimes and lets you compare which is more beneficial for you.

5. Is it safe to store my tax data on this file?

As long as you keep the file on your personal device and don’t share it online, it is secure and private.

Download Automatic Income Tax Preparation Software in Excel for the Maharashtra State Employees for the F.Y. 2025–26 as per Budget 2025

[This Excel Utility can prepare at a time your Tax Computed Sheet as per Budget 2025, including the salary structure as per the Maharashtra State Employees + Automatic H.R.A. Calculate U/s 10(13a) + Form 16 Part A&B and Part B for the F.Y. 2025- 26]