Introduction

Filing income tax often feels like solving a puzzle with too many missing pieces. However, when you add multiple allowances, deductions, and frequent rule changes, the process becomes even more confusing for non-government employees. Yet, wouldn’t it be easier if you had a tool that handled all of this automatically? Fortunately, the Automatic Income Tax Preparation Software All-in-One in Excel does exactly that.

In fact, this smart tool works as your personal tax assistant, guiding you step by step, crunching your numbers, and saving you valuable time. Moreover, instead of worrying about manual errors or flipping through endless forms, you can prepare your taxes confidently. Consequently, this article will act as your complete guide to downloading, understanding, and using the software effectively for the Financial Year 2025-26.

Table of Contents

| Sr# | Headings |

|---|---|

| 1 | Understanding Income Tax for Non-Government Employees |

| 2 | Why Use Excel-Based Income Tax Software? |

| 3 | Features of Automatic Income Tax Preparation Software |

| 4 | How This Software Simplifies Tax Filing |

| 5 | Step-by-Step Process to Download the Software |

| 6 | Installing and Opening the Excel Tool |

| 7 | Inputting Salary Details |

| 8 | Auto Calculation of Deductions and Exemptions |

| 9 | Preparing Form 16 Instantly |

| 10 | Comparing Old vs. New Tax Regimes |

| 11 | Benefits for Non-Government Employees |

| 12 | Security and Accuracy of the Excel Tool |

| 13 | Common Mistakes to Avoid While Using the Software |

| 14 | Updates as per Budget 2025 |

| 15 | Conclusion and Final Thoughts |

1. Understanding Income Tax for Non-Government Employees

Income tax rules in India constantly evolve, and therefore, non-government employees often face more complexity than government workers. Since they receive varying allowances, flexible salary components, and changing deductions, calculating tax liability becomes a real challenge. Therefore, this software provides a structured, reliable solution that handles everything automatically.

2. Why Use Excel-Based Income Tax Software?

You might ask, Why should I rely on Excel? Well, the answer is simple: Excel is lightweight, user-friendly, and does not require constant internet access. Moreover, Excel-based tax tools allow you to save, edit, and update data at your convenience. Unlike online portals that may time out or crash, this tool works offline and ensures you always have control. As a result, it makes tax preparation practical and stress-free.

3. Features of Automatic Income Tax Preparation Software

The Income Tax Calculation Software for Non-Government Employees in Excel comes loaded with features:

-

It creates an automatic salary structure sheet.

-

It calculates the HRA exemption under Section 10(13A) instantly.

-

It prepares Form 16 automatically in both Part A and Part B.

-

It supports both old and new tax regimes for easy comparison.

-

It applies deductions under Sections 80C, 80D, and 80CCD(1B).

-

It offers a user-friendly design to simplify calculations.

Consequently, employees can save time, avoid errors, and file taxes without confusion.

4. How This Software Simplifies Tax Filing

Filing taxes is often compared to cooking a complicated dish. Normally, you have to gather ingredients, measure them, and follow a tricky recipe. However, with this software, all the ingredients are pre-measured and organised. Therefore, you only follow a few simple steps, and your final dish—your completed tax return—is ready. As a result, you eliminate confusion, errors, and paperwork.

5. Step-by-Step Process to Download the Software

To download the Excel software:

-

First, go to the bottom to download the Software.

-

Next, look for “Download Automatic Income Tax Software All in One.”

-

Then, click the link and save the file to your computer.

-

Finally, ensure you have the latest Excel version installed so it works smoothly.

By following these steps, you gain access to the tool in just a few minutes.

6. Installing and Opening the Excel Tool

Since this is an Excel-based program, you don’t need a traditional installation. Instead:

-

Open Excel.

-

Enable Macros to activate automated calculations.

-

Begin entering your details, and the software runs instantly.

Thus, the process remains straightforward and quick.

7. Inputting Salary Details

You start by entering your salary components, including:

-

Basic Pay

-

Dearness Allowance

-

HRA

-

Special Allowances

Immediately, the tool organises and structures the information. As a result, you get a clear, formatted salary sheet without extra effort.

8. Auto Calculation of Deductions and Exemptions

Next, the tool automatically applies:

-

Standard deduction as per Budget 2025

-

HRA exemptions

-

Section 80D deductions (Health Insurance Premiums)

-

Section 24(b) deductions for housing loan interest

Consequently, it feels like you have a tax consultant built into Excel.

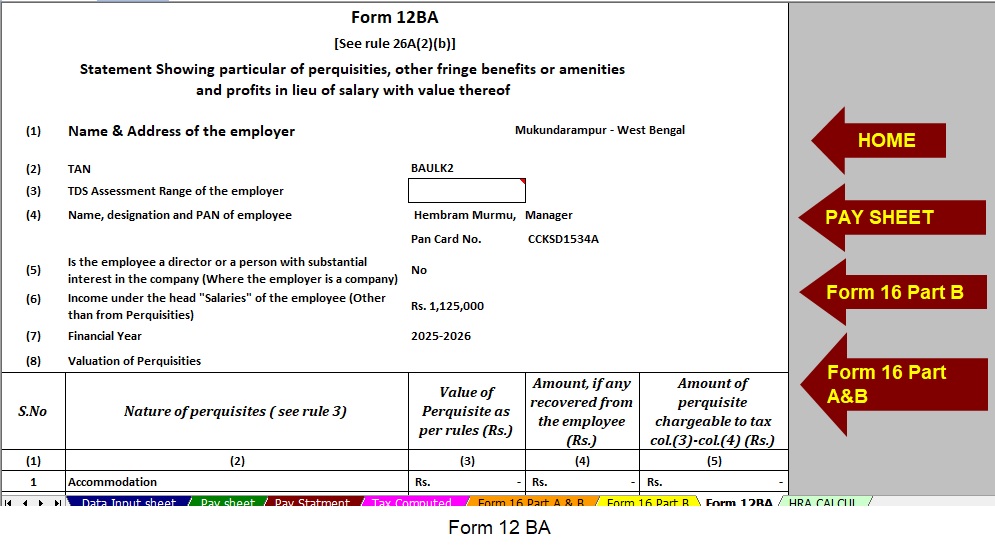

9. Preparing Form 16 Instantly

Form 16 is often the most stressful part of tax filing. However, this software generates it instantly. Once you input your data, it formats a professional Form 16 (Parts A and B) for immediate use. Therefore, you save both effort and time.

10. Comparing Old vs. New Tax Regimes

Choosing between the old and new regimes often confuses taxpayers. Nevertheless, this tool displays both side by side. As a result, you can clearly see which regime offers greater savings. Thus, you make an informed decision effortlessly.

11. Benefits for Non-Government Employees

For non-government employees, the software offers several advantages:

-

It saves hours of manual work.

-

It reduces costly errors in calculations.

-

It works offline, keeping you independent of internet access.

-

It clarifies tax liability instantly.

-

It generates professional reports for HR or self-filing.

Therefore, employees gain peace of mind while filing.

12. Security and Accuracy of the Excel Tool

You may wonder, is my data safe? Since the software operates offline, your salary details remain on your device, not on any external server. Moreover, the formulas built into the tool guarantee accuracy. Consequently, you enjoy both privacy and precision.

13. Common Mistakes to Avoid While Using the Software

When using the tool, you must avoid these errors:

-

Forgetting to enable macros

-

Entering incorrect salary details

-

Choosing the wrong tax regime

-

Ignoring Budget 2025 updates

By paying attention, you ensure flawless results.

14. Updates as per Budget 2025

The Automatic Income Tax Preparation Software All-in-One integrates the latest Budget 2025 updates, such as:

-

Revised standard deduction

-

Updated income tax slabs for FY 2025-26

-

Modified HRA and professional tax rules

-

New provisions under Section 80CCD(1B)

Therefore, you always calculate taxes with the latest information.

15. Conclusion and Final Thoughts

Ultimately, filing income tax doesn’t need to be stressful. With Income Tax Calculation Software for Non-Government Employees in Excel, you simplify the process entirely. Furthermore, you enjoy speed, accuracy, and peace of mind. Just as a GPS helps you navigate confusing roads, this software guides you through complex tax rules and leads you to error-free tax filing.

FAQs

1. Is this Excel-based tax software free to use?

Yes, many versions are free, while some advanced versions may require a small fee.

2. Can I use this software for both old and new regimes?

Absolutely! It compares both regimes and highlights which one benefits you more.

3. Do I need internet access to run this tool?

No, it works completely offline in Excel.

4. Can I generate Form 16 using this software?

Yes, it instantly prepares a professional Form 16.

5. Is this software only for salaried employees?

Primarily, it serves non-government salaried employees, though others can adapt it with minor changes.

Download Automatic Income Tax Preparation Software All in One in Excel for the Non-Government Employees for the F.Y.2025-26

-

To begin with, the Excel Calculator prepares your Tax Computed Sheet instantly as per Budget 2025.

-

Moreover, it offers an inbuilt Salary Structure designed for non-government employees.

-

In addition, it creates an automatic Salary Sheet in seconds.

-

Furthermore, it calculates HRA Exemption under Section 10(13A) accurately.

-

Along with that, it generates Income Tax Form 12BA automatically.

-

Not only that, it prepares Form 16 Part A and Part B ready for use.

-

Finally, it produces Form 16 Part B automatically, completing your tax documentation effortlessly.