Introduction to Income Tax Preparation Software

Filing income tax returns has always been a stressful task for both government and non-government employees. Every financial year, employees face the hassle of calculating their tax liability, exemptions, deductions, and compliance with the latest rules. Therefore, for the financial year 2025-26, the demand for an automatic income tax preparation software in Excel has surged dramatically. Why? Excel-based tools provide a simple, offline, and user-friendly solution that allows employees to prepare, calculate, and plan taxes without complex technical knowledge.

In other words, this software is designed for everyone—teachers, clerks, private company employees, and even small business owners—who want to avoid the burden of manual tax computation. Since it is based on Excel, it doesn’t require heavy installation or advanced computer skills. You simply download, input your income details, and the sheet automatically calculates taxable income, deductions, and the final tax payable.

Unlike online portals that sometimes face downtime or technical glitches, Excel-based tax software is lightweight and runs smoothly on any computer. Moreover, it adheres to the latest Indian Income Tax Rules for FY 2025-26, making it highly reliable for both salaried and non-salaried employees.

Why Use Excel-Based Automatic Income Tax Preparation Software?

The Excel-based tax preparation software is not just another spreadsheet; it is a complete tax assistant. Employees often struggle with manual calculations, missing deductions, or misinterpreting tax slabs. With this automated tool, such mistakes are almost eliminated.

However, here are some major reasons why employees prefer this solution:

- Simplicity: No need to learn new software. If you know basic Excel, you can use this tool effectively.

- Accuracy: The software uses updated formulas aligned with the Income Tax Act for FY 2025-26.

- Time-saving: Instead of hours of manual calculations, you get instant results after entering your income details.

- Cost-effective: Unlike paid software or chartered accountant charges, this Excel file is often free or very affordable.

- Flexibility: Both government and private sector employees can use the same tool without limitations.

- Offline Access: You don’t need the internet to calculate your taxes.

In a fast-moving financial environment, where government policies and tax rules keep changing, an Excel-based automatic tax calculator is like a personal guide that keeps you updated without stress.

Features of the All-in-One Excel Tax Software for FY 2025-26

The All-in-One Excel Tax Preparation Software is packed with features designed to simplify the entire tax filing process. Whether you are a central government employee, state government worker, or non-government professional, this tool fits your needs.

Some key features include:

- For instance, Pre-loaded Tax Slabs for FY 2025-26: No need to worry about outdated rules; the sheet is updated with the latest rates.

- Salary Structure Compatibility: Supports various salary structures for different job categories.

- Automatic HRA Exemption Calculation: Saves time by auto-calculating exemptions based on your salary and rent details.

- Standard Deduction and Other Allowances: Automatically applied as per current tax laws.

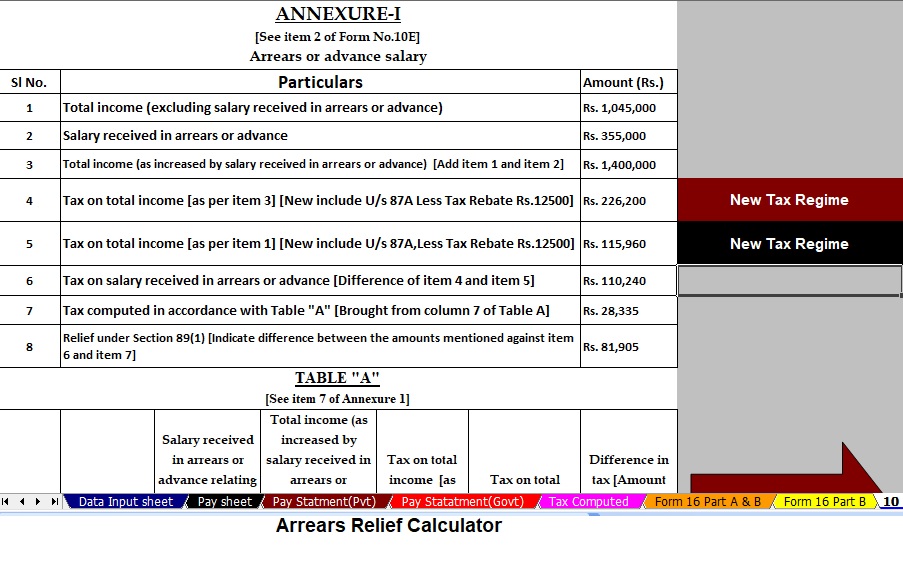

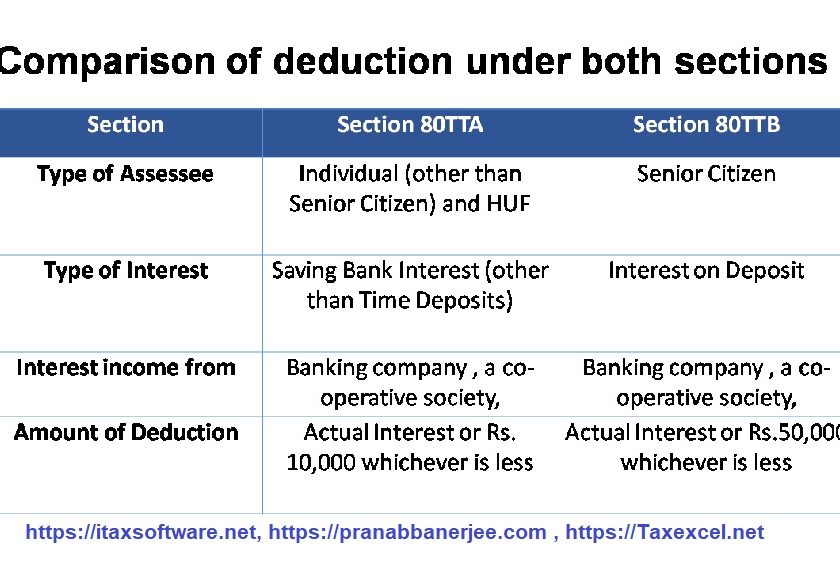

- Deductions under Chapter VI-A: Includes Section 80C, 80D, 80TTA, and more.

- Tax Calculation for Old and New Regimes: Employees can compare which regime benefits them most.

- Ready-to-Print Statement: Once complete, you can print your tax statement directly.

- Error-free Results: Automated formulas reduce the chances of wrong tax computation.

This “all-in-one” nature makes it perfect for both salaried individuals and professionals who want to avoid the complexities of using multiple tools or calculators.

Above all, Government Employees vs. Non-Government Employees: How It Helps Both

While the income tax rules apply universally, the income structure of government and private employees is different. That’s where this Excel software stands out—it caters to both categories.

For government employees, allowances like HRA, transport allowance, medical reimbursement, and pension contributions are automatically considered. It ensures compliance with government pay scales and allowances.

For non-government employees, the software accommodates flexible salary structures, bonuses, and performance-based income. It also adjusts tax deductions related to housing loans, investments, and savings plans.

By supporting both categories in one single Excel sheet, the software eliminates confusion and saves employees from searching for different calculators for their sector.

Step-by-Step Guide to Download and Use the Software

Downloading and using this Excel-based automatic income tax preparation software is straightforward. Follow these steps:

- Download the Excel File: Below is the download link

- Enable Macros (if required): Some Excel sheets may use macros for automation; enable them for full functionality.

- Fill in Personal Details: Enter name, PAN, age, and employment type.

- Input Income Details: Add salary, allowances, interest income, rental income, or any other earnings.

- Enter Investments/Deductions: Provide details under Section 80C, 80D, etc.

- Choose Tax Regime: The sheet automatically shows calculations for both regimes, and you can select the beneficial one.

- Review and Print: Once satisfied, print your statement for records or submission.

Download Automatic Income Tax Preparation Software in Excel for the Government and Non-Government Employees for the F.Y.2025-26 today.

Features of the Excel Utility

- User-Friendly Interface – The Excel Utility comes with a simple design that even beginners can use without technical knowledge.

- Automatic Tax Calculation – It calculates income tax instantly based on the latest financial year 2025-26 tax slabs.

- Both Old and New Regimes – The utility supports calculations under both regimes, helping users choose the most beneficial option.

- Pre-Loaded Deductions – It includes automatic deductions like standard deduction, HRA, Section 80C, 80D, and more.

- Custom Salary Structures – Government and non-government employees can input different salary formats easily.

- One-Click Comparison – Users can compare taxable income and tax payable under both regimes in seconds.

- HRA and Allowance Support – The tool auto-calculates House Rent Allowance and other allowances as per rules.

- Offline Access – Since it’s Excel-based, no internet connection is required once downloaded.

- Error-Free Computation – Built-in formulas reduce the risk of manual calculation mistakes.

- Printable Reports – Users can generate and print a ready-to-use tax statement for records or submission.