[ad_1]

On the death of a person, his property is distributed among the persons specified in the will. However, if a person dies without leaving a will (i.e. he dies intestate), in such cases the property will be distributed according to the law on the basis of his religion.

The succession of Hindus, Jains, Buddhists and Sikhs is governed by the Hindu Succession Act. Muslim succession is governed by Muslim law and Christian is governed by the Indian Succession Act.

In this article, we will explore the mode of distribution of property in case of death of Hindu/Jain/Sikh/Buddhist, i.e. those who are governed by the Hindu Succession Act and they die without a will, i.e. without a will Death ensues.

In the Hindu Succession Act, the rules governing the distribution of property in the case of an intestate death of a woman are different than in the intestate death of a man. The manner of distribution of property in case of both male and female is discussed below.

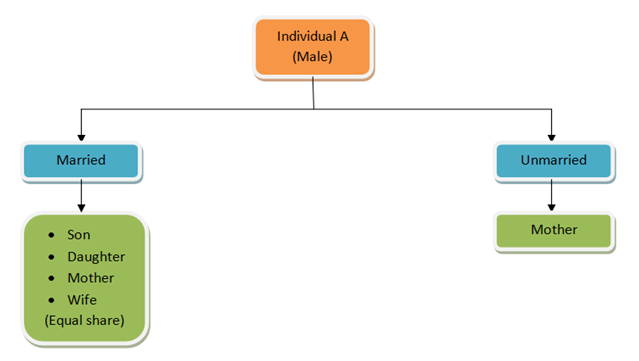

Intestate succession in case of death of male

If a man dies intestate, i.e. without a will, his property will be distributed as per the Hindu Succession Act and the property will be transferred to the legal heirs of the deceased. Legal heirs are further classified into two classes- Class I and Class II.

Class I Heirs:

Class I heirs include immediate families linked to the male. This includes wife, son, daughter and mother. All the people of this class will divide equally among themselves.

For a better understanding of Class I heirs, refer to the chart below:

Comment:

1. In case of deceased son:

wife and children of deceased son will take his place, and have the same authority as him. However if there are two children, they will be considered as one unit, i.e. they will have a joint share which they can further distribute among themselves. And this will be applicable for the next two generations i.e. to the great-grandchildren.

For example,

A: Grand Father

B: Grand Mother (A’s wife)

C: Son

D: Son’s wife (daughter-in-law)

E: Grand Son

F: Grand Daughter

If A dies without a will, the right to the property is vested in his son C and his wife B, then both will share equal rights in the property i.e. half of each

However, if C had died, and A dies without a will, the right in the property would vest in B, D, E and F. Where, B, D, (E and F) will each share 1/3rd of the property. Hence the individual share of E & F is 1/6. Will happenth each.

2. In case of deceased daughter

deceased daughter’s children shall take his place and shall have equal rights in his share. And this will be applicable for the next two generations i.e. to the great-grandchildren. However, the husband of the deceased daughter has no right in her share.

A: Grand Father

B: Grand Mother (A’s wife)

C: daughter

D: Daughter’s husband (son-in-law)

E: Grand Son

F: Grand Daughter

If A dies without a will, the right to the property is vested in his daughter C and his wife B, then both will share equal rights in the property i.e. half of each

However, if C had died, and A dies without a will, then the rights in the property would vest in B, E and F. Where, B, (E & F) each shall share 1/2 of the asset. Hence the individual share of E & F is 1/4. Will happenth each.

Class II Heir: Absence of Class I Heir

As given above, in the absence of Class I heirs, Class II heirs will be entitled to the property of the deceased.

Second-class heirs include a number of relatives who have been grouped into categories and placed in a hierarchy. Priority is given to a ranking above, in which if a single member is available in the higher (earlier) category, all assets will be given to the members of that category and none to the next (later) category.

However, if one is not available in the higher (earlier) category then it will be passed on to the next members in the category (the latter).

Referring to the chart above, you will see that in the case of a married man, the rank of father is above the rank of grandchildren, brother and sister.

Here assuming that none is available from class I category i.e. mother, wife and children, the rights will be with class II people. At the same time, since the father is in the first place, he will be entitled to 100% of the property.

But if he is not alive then it will cumulatively move to the next category, i.e. grandson, brother and sister. Here all three of them will share the property equally, i.e. 1/3 each.

If by chance neither class I nor class II successors are available, it will first pass to the forerunners and then be cognizable.

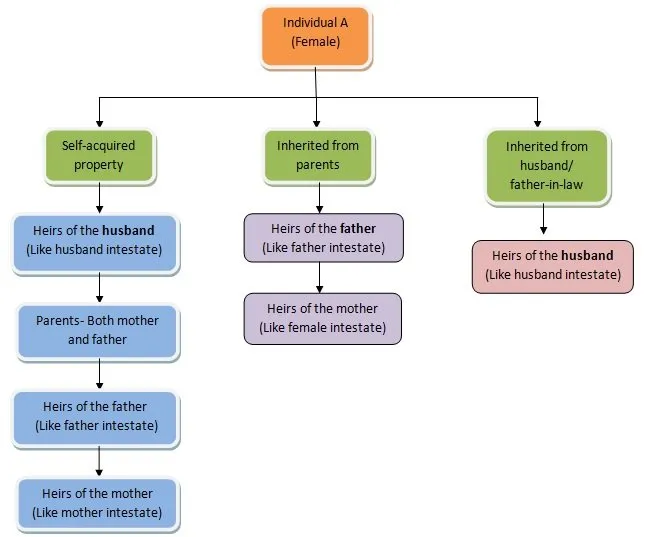

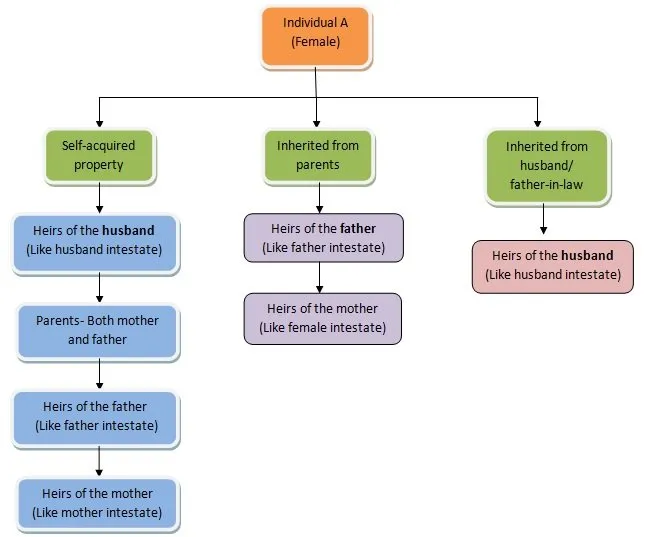

Succession in case of death of woman

After the amendment of the Act in 2005, women have been given the same right of succession as men. However the distribution of his wealth is different from that of a male.

A woman is the absolute owner of her property whether self-acquired or inherited. Any property whether movable or immovable, acquired or inherited by him, before, during or after the marriage, even before the commencement of the Act, shall be deemed to be his ‘Stridhan’.

A woman who dies intestate, i.e. without leaving a will, her property will be distributed as per the Hindu Succession Act.

According to the Act, her husband, son and daughter will have the first right over her property, including grandchildren, but only if the children are not alive.

If she is unmarried, her parents get her right.

In the absence of the above ones:

In the absence of the above, unlike the male succession rules, where the heirs were divided into two classes of heirs, there is no class here. However there is a hierarchy that defines the order in which the assets will be distributed. The ranking which comes first in the sequence will be given preference over the ranking which comes later. And only in the absence of a higher rank will it move to the next one in the sequence.

However, there is a difference in the distribution of assets with respect to the manner in which the asset is acquired.

Property can be acquired in three ways- self-acquired, inherited from parents and inherited from husband or father-in-law. There is a slight difference in the distribution of all three.

Referring to the chart above,

self earned:

In the first case, where the property is self-acquired, if the girl is married and the children and the husband are also not alive, then in that case, the property will be distributed as per the chart where the first right belongs to the husband’s heirs etc.

But if she is unmarried, then even in that case, we follow the above chart and leave the chart applicable for married woman i.e. husband. So for an unmarried girl, it is the parents- both mother and father will share the property equally. and in the absence of the parents, in the next order i.e. the heirs of the father shall be entitled to his property and so on.

Inherited from parents:

Now coming forward- Inheritance from parents. Here the right of property in the absence of children and husband even if the girl is married shall not vest in the heirs of the husband, Property acquired by way of inheritance from the parents will be passed on to the heirs of the father only and so on. The same happens if the girl is unmarried, as there are no children and husband by default.

Inherited from father-in-law:

Like inheritance from parents, in case of inheritance from father-in-law or husband, which is applicable only in case of a married woman, property will be passed on to the heirs of the husband only, if there is no husband and children. It will not be passed on to the parents of the girl child, even if they belong to the hierarchy.

GENERAL PROVISIONS – APPLICABLE TO ALL

An unborn child has the same rights as the one who is born. So in case of division of property, in case of a pregnant widow, her unborn child will be treated as a separate entity and both will have equal right in the share of the deceased’s property.

If a person does not want his right in the property, he can relinquish i.e. give up his right in the property.

- Hindus at the time of succession:

If a person converts his religion to any other religion, he and his children will cease to be the legal heirs of their Hindu relatives and will be disqualified from inheritance. However if they are Hindu when the succession opens, they will become eligible again.

If any person is found guilty of murder or being a party to the murder of any other person, he shall be disqualified to be the legal heir of such person.

- Specific Disqualifications:

If a person is specifically disqualified from inheriting property, he shall cease to be a legal heir.

No person shall be disqualified to be a legal heir by reason of disease, defect or deformity.

In the absence of any successor, the right in the property will be transferred to the government.

If the widow of the deceased remarries, she will not lose her right as heir to the property of the deceased.

However, if the widow of the son or brother remarries at the time of succession, she will lose the right of succession to the property of the deceased.

[ad_2]

Source link