The Union Budget 2025 reshaped India’s tax landscape by refining the New Tax Regime—now the default tax structure for FY 2025-26 (AY 2026-27). This move aims to simplify tax compliance and offer significant relief to middle-class taxpayers. While the Old Tax Regime remains available, you must actively opt for it when filing your Income Tax Return (ITR).

Therefore, Understanding the New Tax Regime: A Complete Guide for FY 2025-26

Have you ever wondered why everyone’s talking about the New Tax Regime lately? Well, it’s because this new system completely transforms how we calculate and pay taxes in India. Instead of juggling endless deductions, proofs, and receipts, the New Tax Regime focuses on simplicity, fairness, and transparency.

In other words, to help you make an informed decision, let’s dive into the major features, benefits, and comparisons of the New Tax Regime—and see how tools like the Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E make accurate and effortless tax computation possible.

Table of Contents

| Sr# | Headings |

| 1 | Introduction to the New Tax Regime |

| 2 | Why the New Regime Became the Default Choice |

| 3 | Key Features and Benefits |

| 4 | Increased Basic Exemption Limit |

| 5 | Enhanced Tax Rebate Under Section 87A |

| 6 | Zero Tax for Salaried Individuals |

| 7 | Revised and Simplified Tax Slabs |

| 8 | Major Differences Between New and Old Regimes |

| 9 | Standard Deduction Explained |

| 10 | Fewer Deductions but Simpler Compliance |

| 11 | How to Choose Between the Two Regimes |

| 12 | How Form 10E and Section 89(1) Provide Relief |

| 13 | Automatic Income Tax Arrears Relief Calculator Benefits |

| 14 | Practical Example of Comparing Both Regimes |

| 15 | Final Thoughts and Key Takeaways |

1. Introduction to the New Tax Regime

The New Tax Regime promotes simplicity and convenience. Instead of maintaining endless files of investment proofs, rent receipts, or insurance papers, taxpayers now focus on income levels directly. Consequently, however, the system eliminates confusion and allows individuals to understand their tax liability quickly. Moreover, the New Tax Regime benefits those who prefer a clean, straightforward approach to compliance.

2. Above all, Why the New Regime Became the Default Choice

The government introduced the New Tax Regime as the default system to encourage transparency and consistency. Previously, many taxpayers found it hard to choose between the two systems. Now, the new framework ensures that everyone starts with the New Regime by default—unless they choose otherwise. As a result, taxpayers make conscious, informed choices when filing their returns.

3. Key Features and Benefits

The New Tax Regime offers a variety of features that make tax filing smoother:

- Default Regime: You’re automatically included unless you opt for the old one.

- Simplified Compliance: Fewer deductions, fewer documents, and less stress.

- Fair Taxation: Revised slabs promote equitable tax distribution.

- Balanced Structure: Higher-income earners contribute progressively more.

Therefore, the new framework ensures efficiency while maintaining fairness.

4. Increased Basic Exemption Limit

Under the New Tax Regime, the basic exemption limit has increased from ₹3 lakh to ₹4 lakh. Hence, anyone earning ₹4 lakh or less pays no tax at all. In addition, this single change benefits lower-income groups directly and enhances disposable income. Furthermore, it promotes financial inclusion by encouraging more people to file returns confidently.

5. Enhanced Tax Rebate Under Section 87A

The government significantly raised the rebate under Section 87A—from ₹7 lakh to ₹12 lakh. Consequently, individuals with an annual income of up to ₹12 lakh now pay zero tax. In other words, the rebate ensures full exemption up to ₹12 lakh, providing relief worth up to ₹60,000.

Therefore, salaried individuals enjoy a major financial advantage under the New Tax Regime.

6. Zero Tax for Salaried Individuals

After that, combine the ₹75,000 standard deduction with the ₹12 lakh rebate, and you’ll find something impressive—zero tax liability up to ₹12.75 lakh! Imagine earning nearly ₹13 lakh and still paying nothing in taxes. As a result, salaried employees now retain more of their hard-earned income, boosting their financial stability.

7. Revised and Simplified Tax Slabs

Here’s how the revised slabs appear under the New Tax Regime (FY 2025-26):

| Income Range (₹) | Tax Rate (%) |

| Up to ₹4,00,000 | NIL |

| ₹4,00,001 – ₹8,00,000 | 5% |

| ₹8,00,001 – ₹12,00,000 | 10% |

| ₹12,00,001 – ₹16,00,000 | 15% |

| ₹16,00,001 – ₹20,00,000 | 20% |

| ₹20,00,001 – ₹24,00,000 | 25% |

| Above ₹24,00,000 | 30% |

These progressive slabs ensure that lower earners pay less, while higher earners contribute proportionately more—ensuring both balance and equity.

8. Major Differences Between New and Old Regimes

| Feature | New Regime (FY 2025-26) | Old Regime |

| Basic Exemption | ₹4 lakh | ₹2.5–₹5 lakh (based on age) |

| Deductions | Limited | Multiple (80C, 80D, HRA, etc.) |

| Compliance | Simple | Heavy documentation |

| Tax Slabs | 7 lower slabs | 3 higher slabs |

The New Tax Regime offers simplicity, whereas the Old Regime benefits those with higher deductions. Therefore, choosing between them depends on your income and deductions.

9. Standard Deduction Explained

Under the New Tax Regime, both salaried individuals and pensioners enjoy a standard deduction of ₹75,000, automatically reducing taxable income. No receipts, no paperwork—just instant relief!

Thus, the new deduction structure adds convenience and fairness.

10. Fewer Deductions but Simpler Compliance

Although the New Tax Regime limits deductions, it rewards you with simplicity. You don’t need to store rent slips, investment certificates, or insurance receipts anymore. Consequently, your filing becomes faster, easier, and error-free—especially when you use an Automatic Income Tax Calculator in Excel.

11. How to Choose Between the Two Regimes

Here’s a smart approach to choosing:

- Calculate your gross income.

- Subtract deductions (like 80C, 80D, or HRA).

- Compare results using a tax calculator.

If deductions exceed ₹5–₹8 lakh, the Old Regime may still be better. Otherwise, the New Tax Regime provides more benefits and less paperwork.

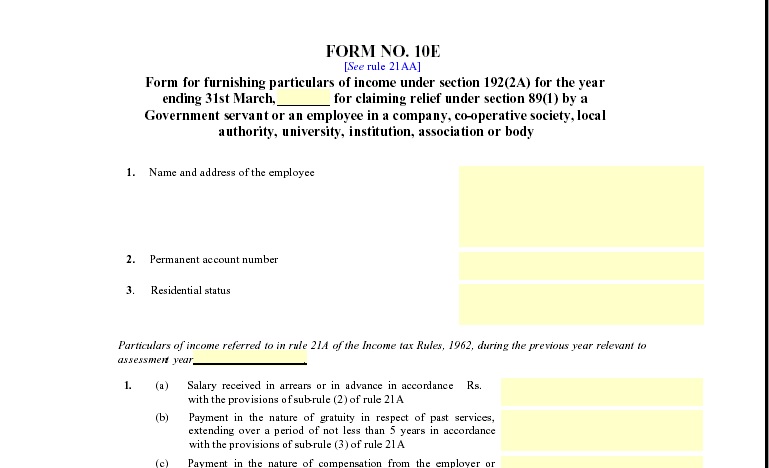

12. How Form 10E and Section 89(1) Provide Relief

When you receive arrears or bonuses for past years, you might face extra tax. Thankfully, Section 89(1) offers relief by redistributing arrears across previous years. By filing Form 10E, you officially claim that relief. Therefore, it ensures fair taxation while preventing overpayment.

13. Automatic Income Tax Arrears Relief Calculator Benefits

The Automatic Income Tax Arrears Relief Calculator U/s 89(1) simplifies everything:

- Automatically calculates arrears relief.

- Works for both Government and Non-Government employees.

- Covers financial years from 2000-01 to 2025-26.

- Integrates with Form 10E for effortless filing.

Hence, it’s a must-have tool for accurate tax relief computation.

14. Practical Example of Comparing Both Regimes

Consider Riya, who earns ₹12 lakh annually.

- Old Regime: After ₹3 lakh deductions, her taxable income = ₹9 lakh.

- New Regime: After rebate under Section 87A, her tax = ₹0.

Clearly, the New Tax Regime saves time, effort, and money—making it the smarter choice for many taxpayers.

15. Final Thoughts and Key Takeaways

In conclusion, the New Tax Regime (FY 2025-26) empowers taxpayers with simplicity, fairness, and flexibility. With higher exemption limits, enhanced rebates, and automatic calculators, tax filing is no longer a chore—it’s a seamless experience.

Choosing the right regime is like selecting between a manual and an automatic car—both reach the destination, but one makes the ride much smoother!

Frequently Asked Questions (FAQs)

- What is the basic exemption limit under the New Tax Regime for FY 2025-26?

The basic exemption limit is ₹4 lakh for all individuals, offering greater tax savings. - How does the enhanced rebate under Section 87A benefit taxpayers?

It allows complete tax exemption for incomes up to ₹12 lakh, saving up to ₹60,000. - Can I still use the Old Tax Regime if I prefer?

Yes, you can choose the Old Regime, but you must opt for it manually when filing your ITR. - What is the purpose of Form 10E under Section 89(1)?

Form 10E helps claim relief on salary arrears, ensuring fair tax distribution across years. - How does the Automatic Income Tax Arrears Relief Calculator help employees?

It automates arrears relief computation under Section 89(1), ensuring accuracy and compliance for all employees.

14. Benefits of Using Excel-Based Automatic Tax Calculators

Using an Excel-based Automatic Income Tax Calculator saves both time and effort. It automatically performs all complex calculations, minimising the chance of human error. Moreover, it updates easily whenever the government revises the tax slabs or deductions.

Because this calculator already includes Form 10E and Section 89(1) arrears relief, it benefits both government and non-government employees. Instead of wasting hours with manual formulas, you can simply enter your salary data and get instant results. In short, this tool acts like your digital accountant — accurate, fast, and always ready.

Furthermore, it simplifies tax planning. You can easily switch between the Old Regime and the New Tax Regime to compare results. Therefore, it empowers taxpayers to make informed financial choices.

15. Step-by-Step Guide to Calculate Tax under the New Regime

To make the most of the New Tax Regime, follow these steps carefully:

- Gather Your Salary Details: Start by collecting your income slips, allowances, and any applicable deductions.

- Open the Automatic Calculator: Download the Excel-based file and open it on your device.

- Select the Financial Year (FY 2025-26): Make sure you choose the right assessment year to get accurate results.

- Enter Income Figures: Input your total salary, allowances, and any additional income sources.

- Review Standard Deduction: The calculator automatically applies the ₹75,000 standard deduction for salaried or pensioned individuals.

- Apply Section 87A Rebate: Check whether your total income after deductions stays below ₹12 lakh. If so, the calculator will automatically apply the ₹60,000 rebate.

- Review Tax Slabs: It displays the correct slab rate from ₹0 to ₹24 lakh and beyond.

- Compare with the Old Regime: If you prefer, switch tabs to compare which regime offers more savings.

- Check Arrears Relief (if applicable): Use the built-in Section 89(1) module to compute arrears relief through Form 10E.

- Save and Print: Finally, save or print the result for your tax filing records.

By following these steps, you ensure full compliance while optimising your tax benefits.

16. Common Mistakes to Avoid

Even though the New Tax Regime simplifies taxation, many taxpayers still make errors. Let’s discuss the common ones:

- Forgetting to File Form 10E: If you claim arrears relief without Form 10E, the Income Tax Department may reject your claim.

- Choosing the Wrong Regime: Some taxpayers forget to compare both regimes and end up paying extra tax.

- Ignoring Updates: Always verify that you are using the latest version of the Automatic Tax Calculator, especially after every budget.

- Not Checking Slab Changes: Rates may adjust slightly each year; therefore, always reconfirm before filing.

- Missing Deadlines: Late filing leads to penalties and interest, even if your calculations are correct.

Avoiding these mistakes not only saves money but also ensures stress-free compliance.

17. Conclusion

To sum up, the New Tax Regime under Budget 2025 truly transforms India’s tax landscape. It replaces complex deductions with transparent slabs and clear rebates. Consequently, taxpayers enjoy higher take-home pay and fewer formalities.

Moreover, when you pair this system with the Automatic Income Tax Arrears Relief Calculator U/s 89(1) and Form 10E, tax management becomes effortless. Whether you are a government employee or part of the private sector, this combination helps you save time, reduce stress, and remain fully compliant.

Therefore, adopt the New Tax Regime confidently — it’s modern, straightforward, and designed to keep your finances under control.

18. Frequently Asked Questions (FAQs)

1. What is the main benefit of the New Tax Regime?

The New Tax Regime offers lower tax rates and simplified compliance. It removes most deductions but increases the exemption limit and rebates, allowing taxpayers to file easily and save time.

2. Can I switch between the Old and New Tax Regime every year?

Yes, salaried taxpayers can choose either regime every financial year while filing their ITR. However, business owners can switch only once in a lifetime.

3. Do I still need to submit investment proofs under the New Tax Regime?

No. Because the New Tax Regime allows minimal deductions, you don’t have to submit proof of investments like 80C or 80D receipts.

4. How does Form 10E help in tax calculation?

Form 10E enables you to claim relief under Section 89(1) for arrears received in previous years. Filing it ensures your tax liability is computed accurately.

5. Is the Automatic Income Tax Arrears Relief Calculator safe to use?

Yes. It’s an Excel-based offline tool that requires no internet connection. It simply automates calculations based on government-approved tax rules.

✅ Final Thought

In conclusion, the New Tax Regime encourages simplicity, fairness, and transparency in India’s tax system. When combined with smart tools like the Automatic Income Tax Arrears Relief Calculator U/s 89(1) and Form 10E, it transforms a once-complicated process into a smooth and efficient experience for every taxpayer.