Download Auto Calculate Income Tax Preparation Software in Excel for the Govt and Non-Govt Employees for the F.Y.2023-24 and A.Y.2024-25 | Tax planning for salaried employees is all about planning and discipline. Every salaried employee has some questions in his mind, Therefore, How reduce the Tax on my salary? Why does most of my salary go to taxes? How to reduce your tax burden? Can I deduct taxes in excess of 80C, 80D, and HRA? Are there any secret ways to save tax after 1,50,000? How can I reduce the tax on my salary earned?…

Category: Income Tax Arrears Relief Calculator U/s 89(1)

Can you get tax deductions for HR and home loans at the same time? With Automatic Income Tax Preparation Software in Excel for the Non-Govt Employees for the F.Y.2023-24 and A.Y.2024-25

Can you get tax deductions for HR and home loans at the same time? House Rent Allowance (HRA) is an allowance provided by employers to cover the cost of rented accommodation. The Income Tax Act allows exemption from HR if the employee lives in a rented house. In addition, the law allows an individual taxpayer to deduct the interest paid on his home loan. This discount applies to home loans for the purchase, construction, renovation, or reconstruction of residential property. As per the Income Tax Act. Entitled taxpayers to get benefits both Home Rent Allowance (HRA) and interest…

Advantage of filing Income Tax Returns in due time with Automatic Income Tax Preparation Software in Excel for the Govt and Non-Govt Employees for the F.Y.2023-24 and A.Y.2024-25

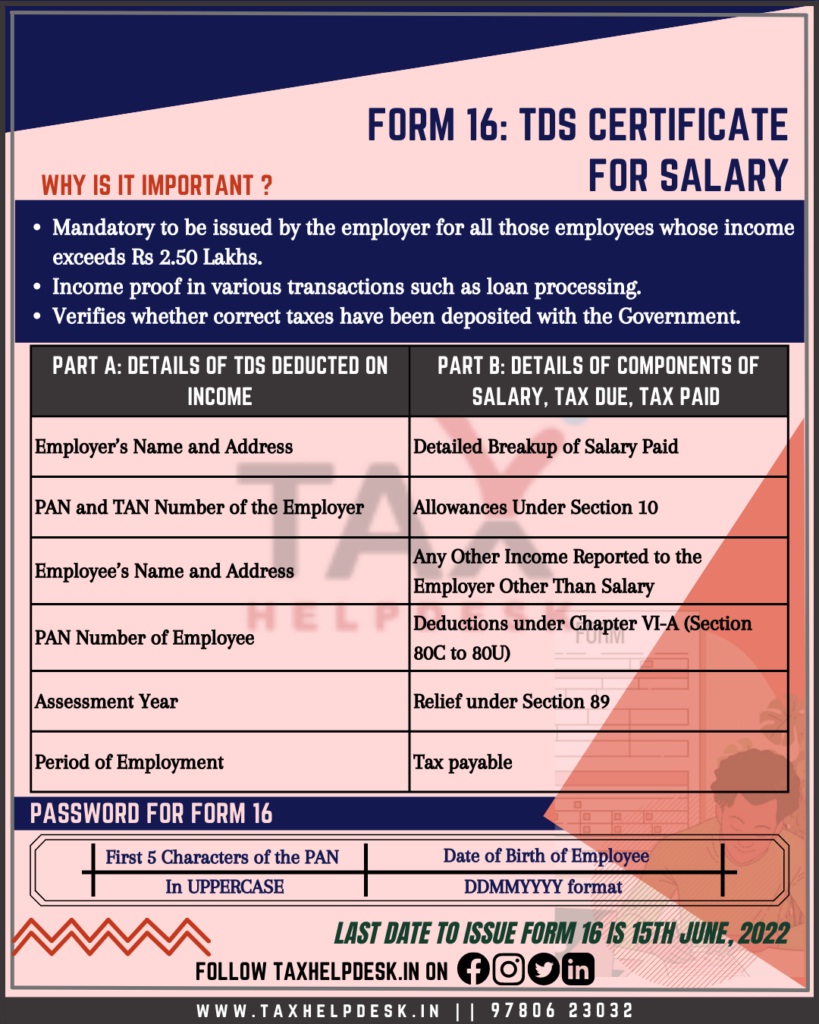

Advantages of filing Income Tax Return in due time | Below are some of the benefits of filing income tax on time: (1) Easy loan approval Banks and other financial institutions often require a copy of your tax return when applying for a loan. Filing your return on time will make it easier to get loan approval. (2) Refund of TDS If you have overpaid TDS, you can claim a refund. If you register early, you will be refunded. 3) Proof of income and address Your income tax return can be used to prove and address…

Section 80TTA / 80TTB – Deductions on interest income with Automatic Income Tax Preparation Software in Excel for the Non-Govt Employees for the F.Y.2023-24 and A.Y.2024-25

Deduction for savings account interest income Section 80TTA allows HUFs or individuals to claim exemption up to Rupees Ten Thousand interest from savings accounts. The difference is based on the interest earned on an account held in a bank, post office, or cooperative society. The maximum withdrawal limit is Rupees Ten Thousand irrespective of the amount of interest earned. Restriction Therefore, It is important to note that income under section 80TTA is not available for interest earned on fixed deposits, recurring deposits, and other time schemes. Also, the exemption is not…

Section 80EE-An additional income tax deduction for home loan interest| With Auto Calculate Income Tax Arrears Relief Calculator U/s 89(ia) with Form 10E for the F.Y.2023-24 and A.Y.2024-25 in Excel.

Section 80EE-An additional income tax deduction for home loan interest|Indeed, the fortunes of buying your first home are different. Especially after going through the daunting process that begins – finding a home that fits your budget and meets your needs – to the more tiring steps of getting a home loan. However, this can be beneficial for a first-time home loan buyer. A tax deduction is available under section 80EE for interest paid on loans (received by a first-time taxpayer) for the purpose of purchasing a residential property. You (the taxpayer) can claim a deduction of up…

Section 80DD Expenses – Claim tax deduction on medical expenses for disabled persons| With Auto Calculate Income Tax Software All in One for the Govt and Non-Govt Employees for the F.Y.2023-24 and A.Y.2024-25 in Excel

Section 80DD Expenses – Claim tax deduction on medical expenses for disabled persons| Individuals or HUFs can claim an exemption under Section 80DD of the Income Tax Act for a disabled person who is wholly dependent on the Individual/HUF for support and services. Therefore, the Conditions for claiming exemption under section 80DD To avail of this discount, need to the following conditions: • Taxpayers are entitled to payment, not taxpayers. • If the taxpayer claims exemption under section 80U for himself, the taxpayer cannot claim this exemption. In other words, Taxpayers include spouses, children, parents, siblings,…

Which is better between the New and Old Tax Regime for F.Y.2023-24 and A.Y.2024-25? With Auto Calculate Income Tax Preparation Software in Excel for the All Salaried Persons for the F.Y.2023-24 and A.Y.2024-25

Which is better between the New and Old Tax Regime for F.Y.2023-24 and A.Y.2024-25? Now is the time for many participants; Salaried individuals, in particular, have to choose between opting for the New Tax Regime or continuing with the Old Tax Regime. Through this article, the author wants to help them in their decision-making process. Therefore, There is no change in the slab rates for the old tax regime. No tax for income of 0 to 2.5 Lakh, a tax rate of 5% for income of 2.5 to 5 Lakh, a tax rate of 20% for…

Which is better, the new or old tax regime for salaried employees? With Excel-based automatic income tax preparation software for salaried employees for the financial year 2023-24 and assessment year 2024-25.

Which is better, the new or the old tax regime for salaried employees? Remember the new 2020 tax regime? If you missed it, now might be a good time to revisit it. The Union Budget 2023 re-introduced the new tax regime, making it superior to the existing one. Even if the old tax regime is in place, the incentives for the new one seem to be satisfactory. Trying to balance the new income tax regime with the old income tax regime? Let us help you understand the old and new tax regimes. Compare the…

Old vs. New Income Tax Slab: Salary Is Best for A.Y.2024-25 and checks your tax liability by this Excel Utility for the F.Y.2023-24 and A.Y.2024-25

Old vs. New Income Tax Slab – Everyone’s eyes are on the tax slab and the budget. Currently, there are two income tax slabs in the country. There are different provisions in both cases. If a person’s salary is 50 thousand, then how much tax will be deducted from the new or old tax slab? Let us tell you this. Therefore, Budget 2023: The general budget will be presented on February 1. The fiscal year 202-23 is about to end. This time, people are hoping that the income tax exemption…

New tax regime: Update! Income tax provided excellent information on the TDS of employees. With Auto Calculate Income Tax tools in Excel as the all-in-one for the F.Y.2023-24 and A.Y.2024-25

New tax regime: Update! Income tax provided excellent information on the TDS of employees. Note that the new tax section is the default, so if you don’t want to choose the new tax section and want to keep the old one, you can choose the old tax section. Let’s find out all about it. What new or old tax regime do you want to choose for taxation, now your company will ask you this question. In this regard, the Income Tax Department has recently issued a notification. The Income Tax…