Introduction The Goods and Services Tax (GST) cut has sparked a wave of optimism across India’s retail industry. With festive sales on the rise and reduced GST rates for everyday items, many had hoped for a broad-based boom in consumption. Yet, the story isn’t entirely uniform. While some sectors like electronics and jewellery have benefited from the GST cuts, others, such as footwear and quick-service restaurants (QSRs) continue to face uneven demand. In this detailed article, we will explore how these GST reforms are reshaping the retail landscape, what experts…

Category: GST

GST Reforms for a New Generation 2025

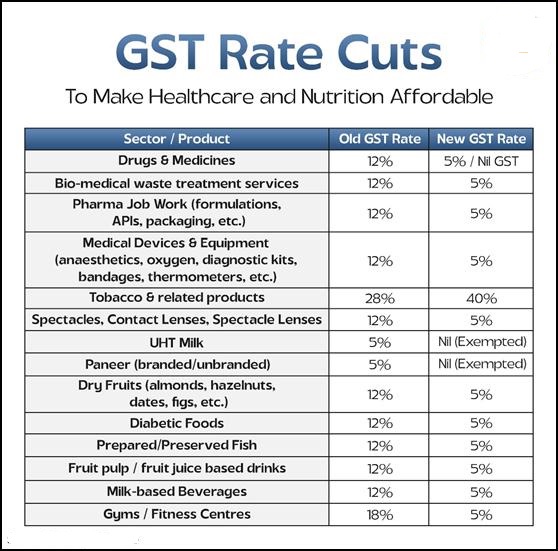

The GST reforms introduced in September 2025 have completely redefined India’s taxation system, focusing on affordability, innovation, and youth empowerment. Indeed, these reforms represent a paradigm shift that aims to simplify taxes, reduce costs, and promote inclusive economic growth. Moreover, they align with India’s broader vision of fostering self-reliance, entrepreneurship, and equitable prosperity for all. Introduction: A Transformative Step Toward an Empowered Economy The Government of India introduced comprehensive GST reforms in 2025 to build a new tax ecosystem that nurtures innovation, supports employment, and boosts affordability. Through these changes,…