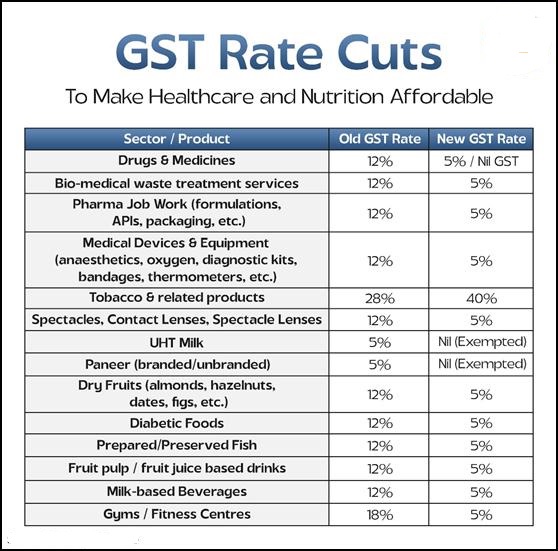

🧾 New GST Rates 2025: Full List of Items with Revised GST Percentage (Download PDF) The Government of India has implemented the new Goods and Services Tax (GST) structure effective from September 22, 2025. This major tax reform simplifies the nation’s indirect tax system while making essential items more affordable. Moreover, it aims to boost consumption, reduce inflationary pressure, and help citizens save significantly during the festive season. 🌟 Major Highlights of GST Reform 2025 The revised GST rates officially came into effect on September 22, 2025, aligning with the…

Category: CBDT Notification 2033(E) dated 24/06/2020

GST Cut Lifts Hopes, Yet Demand Remains Uneven Across the Retail Sector – What’s the Big Concern?

Introduction The Goods and Services Tax (GST) cut has sparked a wave of optimism across India’s retail industry. With festive sales on the rise and reduced GST rates for everyday items, many had hoped for a broad-based boom in consumption. Yet, the story isn’t entirely uniform. While some sectors like electronics and jewellery have benefited from the GST cuts, others, such as footwear and quick-service restaurants (QSRs) continue to face uneven demand. In this detailed article, we will explore how these GST reforms are reshaping the retail landscape, what experts…

GST Reforms for a New Generation 2025

The GST reforms introduced in September 2025 have completely redefined India’s taxation system, focusing on affordability, innovation, and youth empowerment. Indeed, these reforms represent a paradigm shift that aims to simplify taxes, reduce costs, and promote inclusive economic growth. Moreover, they align with India’s broader vision of fostering self-reliance, entrepreneurship, and equitable prosperity for all. Introduction: A Transformative Step Toward an Empowered Economy The Government of India introduced comprehensive GST reforms in 2025 to build a new tax ecosystem that nurtures innovation, supports employment, and boosts affordability. Through these changes,…

GST Price Cut List 2025: New GST Rates from Today, How Much Cheaper Are Items?

Starting today, September 22, 2025, India has entered a new phase of tax reforms with the introduction of GST 2.0. On the very first day of Navratri, the government released a revised GST Price List for 2025. These reforms affect almost every household product—from groceries and dairy to electronics and automobiles. While essential goods have become cheaper, some luxury and harmful items are now costlier. So, what does this mean for you and your family? Imagine your monthly budget as a balloon—you keep filling it with expenses. Now, with GST 2.0, some…

GST Return Filing to Get Easier! CBIC Plans Simpler Process and Monetary Threshold for Demand Notices

Good news is on the horizon for businesses and taxpayers in India. The Central Board of Indirect Taxes and Customs (CBIC) is working on a plan to make GST return filing simpler while also reducing unnecessary tax disputes. By introducing a monetary threshold for issuing demand notices, CBIC aims to bring relief to businesses that often struggle with minor, avoidable notices. At the same time, the department is exploring ways to automate GST return filing and make compliance smoother. So, what exactly does this mean for taxpayers, and how will…

Employees need to inform employers about intention to opt for new tax regime, CBDT circular says

The new income tax regime announced in Budget, give an option to individuals and Hindu Unified Families (HUFs) to be taxed at lower rates on the off chance that they don’t profit determined exclusions and reasoning’s The income tax office on Monday said employees should advise their employers about their expectation to select the new optional tax regime to empower the last to deduct TDS while paying compensations. The new income tax regime announced in Budget, give an option to individuals and Hindu Unified Families (HUFs) to be taxed at lower rates in the…

Automated Income Tax Calculator All in One for the Non-Govt (Private) Employees for the F.Y.2020-21 With New Tax Regime Under Section 115BAC introduced in Union Budget 2020

New tax regime under Section 115BAC The Finance Minister Smt. Nirmala Sitharaman has introduced her second Budget on first February, 2020. A new optional individual tax conspire has been proposed to vide a recently embedded section i.e., 115BAC for the Individuals and HUF. From the evaluation the year 2021-22 (FY 2020-21), individual and HUF taxpayers have an option to select taxation under the section 115BAC of the Act gave them choose to forego the predefined deductions and exceptions. The option to pay tax at lower rates will be accessible just…

Download Automated Income Tax Calculator All in One for the West Bengal Govt Employees for the F.Y.2020-21 and A.Y.2021-22 as per the Budget 2020 with New and Old Tax Regime U/s 115BAC

In the Budget 2020 introduced a new Section 115 BAC for the F.Y.2020-21. This Section 115BAC have an option that you can stay in the Old Tax System along with all the Income Tax Exemptions as per the F.Y.2019-20 and you can Opt in the New Tax Regime Excluding any Exemptions of Income Tax as the previous F.Y. 2019-20 as clearly mentioned in the Budge 2020 U/s 115BAC. As per the Budget the New Tax Slab is given below U/s 115BAC which introduced in the Budget 2020. Also, it is…

Automated Income Tax Calculator All in One for the West Bengal Govt. Employees F.Y 2020-21 With New and Old Tax Regime U/s 115BAC in Budget 2020

Anticipating your income tax or figuring your income tax liabilities is by all accounts an exceptionally overwhelming undertaking for huge numbers of us. On the off chance that you had confidence in this legend, without a doubt the Fund Budget 2020 would refute you. Now according to Budget 2020, to add salt to the injury, not just you are required to deal with your taxes yet in addition you need to choose which income tax regime is useful to you. Download Automated Income Tax Revised Form16 Part B for the…

Automated Income Tax Arrears Relief Calculator U/s 89(1) With Form 10E For the F.Y.2020-21 ( Amended Version)

Did you get any development salary or arrears of salary? In the event that truly, you may be stressed over the tax ramifications of the equivalent. Do I need to pay taxes on the total amount? Shouldn’t something be said about the tax counts of the earlier year, etc? Taxpayers who have such inquiries in their brain here is all that you have to know At this point, you would have just made sense of that income tax is calculated on the total income of a taxpayer for a specific year. The…