[ad_1]

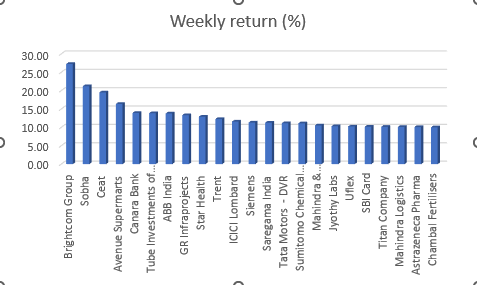

23 index stocks gained 10-23 per cent during the period, some of which reported strong quarterly business updates ahead of the June quarter earnings season.

For the week, the BSE 500 index closed at 22,028.14, up 688 points or 3.22 per cent from its previous week’s close of 21,340.25. It is against BSE Sensex and NSE Nifty In which there was an increase of 2.97 percent in each.

in BSE 500 names,

It rose 27.25 per cent to Rs 42.25 per piece from Rs 33.20 a week ago. When asked for clarifications by the stock exchanges, the company said that it does not have any additional information or declaration to share which needs to be disclosed to the exchanges or shareholders, which may have an impact on price and volume behaviour. 21 percent increase for the week. The stock gained in four out of five sessions. During the week, the realtor said it achieved the highest ever quarterly sales volume of 1.36 million sq ft in the April-June quarter (Q1FY23), up 51.7 per cent year-on-year (YoY). The retailer’s standalone revenue almost doubled to Rs 9,806.89 crore in the June quarter from Rs 5,031.75 crore in the year-ago quarter, jumping 16.39 per cent to Rs 3,942.05.

Amidst the fall in oil prices, the tire maker rose 19.51 percent to Rs 1120.25. It climbed 13.94 percent to Rs 210.85. Seasoned investor Rakesh Jhunjhunwala maintained his stake in Canara Bank at 1.96 per cent at the end of June quarter, latest shareholding data showed. It rose 13.87 per cent to Rs 2,013.40 for the week. 13 percent increase for the week. Credit Suisse received the stock as outperform rating and initiating coverage on the stock with a target of Rs 600. The brokerage oversees network expansion and product mix to drive growth for Star Health. It expects the return on equity for Star to bounce back on the back of fewer claims.

agencies

agenciesIt rose 11.57 per cent to Rs 1274.25 for the week. Credit Suisse also started coverage on this stock. It was felt that ICICI Lombard underperformed to run the rating again as it had suggested a target of Rs 1,400. Several domestic brokerage firms have also given good targets for the stock this week.

gr

It rose 13.33 per cent to Rs 1,239.55. In an interview with ET Now Swadesh, the company said it expects an order book of Rs 25,000 crore by FY13 due to increased government spending in the infrastructure sector and increasing road construction activities. The company expects new work orders to increase from Rs 9,000 crore to Rs 15,000 crore for FY23.

(Disclaimer: Recommendations, suggestions, views and opinions given by experts are their own. They do not represent whose views) economic times,

[ad_2]

Source link