When you receive salary arrears, it often feels like an unexpected bonus. However, when you see the tax deduction on those arrears, it can feel like a bucket of cold water, right? Fortunately, Arrears Relief U/s 89(1) is your safety net. It helps you avoid paying extra tax just because your income was delayed. Think of it like adjusting the weight on a balancing scale so everything falls into place fairly.

This article explains, in simple and friendly language, how to calculate Income Tax Arrears Relief U/s 89(1) for the F.Y. 2025-26. We’ll walk through the steps, examples, important rules, and common mistakes to avoid.

Table of Contents

| Sr# | Headings |

| 1 | Introduction to Arrears Relief U/s 89(1) |

| 2 | Why Salary Arrears Increase Tax Burden |

| 3 | Who Can Claim Arrears Relief? |

| 4 | Components Covered Under Section 89(1) |

| 5 | Importance of Form 10E |

| 6 | Step-by-Step Calculation of Relief |

| 7 | How to Calculate Tax for Previous Years |

| 8 | How to Compare Both Tax Figures |

| 9 | Understanding the Relief Formula |

| 10 | Common Examples for Better Understanding |

| 11 | Mistakes to Avoid While Calculating Relief |

| 12 | Using Excel Tools for Relief Calculation |

| 13 | Documents Required for Claiming Relief |

| 14 | Filing Form 10E on the Income Tax Portal |

| 15 | Conclusion |

1. Introduction to Arrears Relief U/s 89(1)

When you receive arrears for earlier years, your income for the current year appears higher. As a result, you may move into a higher tax bracket, causing more tax liability. Arrears Relief U/s 89(1) ensures you are taxed fairly by adjusting your tax based on the year to which the arrears belong.

2. Why Salary Arrears Increase Tax Burden

Salary arrears add to your income in the year they are paid, even if they belong to earlier years. This may push your income into a higher slab. Since tax is calculated on total income, more income means more tax — a situation Section 89(1) tries to correct.

3. Who Can Claim Arrears Relief?

You can claim relief if you receive:

- Salary arrears

- Advance salary

- Gratuity for past service

- Leave encashment

- Compensation on termination

Anyone receiving delayed income from past years is eligible.

4. Components Covered Under Section 89(1)

Section 89(1) covers multiple income types, such as:

- Salary arrears

- Pension arrears

- Family pension arrears

- Gratuity arrears

These amounts must relate to earlier financial years.

5. Importance of Form 10E

Before claiming relief in your Income Tax Return (ITR), you must file Form 10E online. Without this form, your relief claim will be rejected. Filing Form 10E is mandatory and ensures the Income Tax Department recognises your arrears-related calculations.

6. Step-by-Step Calculation of Relief

The calculation involves comparing taxes with and without arrears for the year(s) to which the arrears belong. Here’s how:

- Calculate tax on current income, including arrears for F.Y. 2025-26.

- Calculate tax on current income excluding arrears for the same year.

- Find the difference — this gives extra tax due to arrears.

- For each previous year, calculate tax with and without the arrears applicable to that year.

- Find the difference for each year.

- Subtract the total extra tax of previous years from the current year’s extra tax.

- The balance amount is your Relief U/s 89(1).

7. How to Calculate Tax for Previous Years

To calculate tax for earlier years:

- Use the old income tax slab rates applicable to that year.

- Include the arrears amount only for that specific year.

This ensures fairness since slab rates change almost every year.

8. How to Compare Both Tax Figures

Relief = (Tax in current year with arrears – without arrears)

Minus

(Tax in previous year with arrears – without arrears)

If the result is positive, you get that amount as relief.

9. Understanding the Relief Formula

The relief formula can be understood like balancing two buckets of water. If this year’s bucket spills more when arrears are added, but the earlier year’s bucket spills less when arrears are added back, the difference is your relief.

10. Common Examples for Better Understanding

Example Case:

You receive ₹60,000 arrears for F.Y. 2022-23.

- Extra tax this year due to arrears: ₹8,000

- Extra tax in 2022-23 due to arrears: ₹5,000

Relief = 8,000 – 5,000 = ₹3,000

This ₹3,000 is the amount you can claim as relief.

11. Mistakes to Avoid While Calculating Relief

- Not filing Form 10E before ITR

- Using the wrong slab rates for earlier years

- Ignoring surcharge or cess

- Wrongly dividing arrears among years

- Not using accurate salary slips or documents

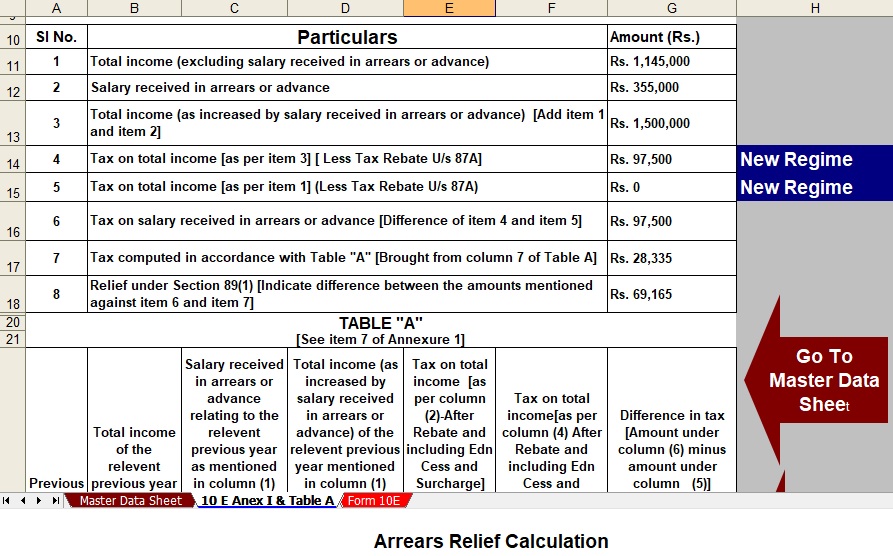

12. Using Excel Tools for Relief Calculation

Many Excel tools automatically compute:

- Tax for each year

- Arrears distribution

- Relief amount

These tools simplify complex calculations and reduce errors.

13. Documents Required for Claiming Relief

You will need:

- Salary arrears statement

- Form 16

- Salary slips

- Breakdown of arrears by year

- Form 10E acknowledgment

14. Filing Form 10E on the Income Tax Portal

Steps:

- Log in to incometax.gov.in

- Go to e-File → Income Tax Forms → File Form 10E

- Enter arrears details for relevant years

- Submit the form online

- File ITR afterwards

15. Conclusion

Calculating Arrears Relief U/s 89(1) is not difficult when broken down into steps. It ensures you don’t pay extra tax just because your income arrived late. Filing Form 10E and using accurate calculations can save you a significant amount, giving you financial relief when you need it most.

FAQs

1. Who can claim Arrears Relief U/s 89(1)?

Anyone receiving arrears or delayed income related to previous financial years can claim this relief.

2. Is Form 10E mandatory for claiming relief?

Yes, filing Form 10E is compulsory. Without it, the Income Tax Department will deny your relief claim.

3. Can pensioners claim relief under Section 89(1)?

Yes, pensioners receiving pension arrears are fully eligible to claim this relief.

4. Does the relief apply if slab rates have changed?

Absolutely. Relief U/s 89(1) exists to adjust tax liability based on earlier slab rates.

5. How many years back can arrears be claimed?

There is no fixed limit. Relief can be claimed for any previous financial year as long as the arrears relate to that year.

Download Automatic Income Tax Salary Arrears Relief Calculator U/s 89(1) with Form 10E from the FY 2000-01 to FY 2025-26(Updated Version)