Introduction

The Public Investment Fund (PIF) and its wholly owned subsidiaries, moreover, will now be explicitly named in the exemption section, thereby ensuring legal certainty and simultaneously encouraging long-term global investment. Consequently, this clarification not only boosts investor confidence but also guarantees smoother regulatory interpretation for future projects.

Impact

As a result, this reform will significantly increase foreign capital inflows, while it will also strengthen India’s infrastructure. Furthermore, it will align seamlessly with the government’s ambitious “Make in India” initiative as well as its “Viksit Bharat 2047” vision, thereby reinforcing India’s commitment to becoming a global economic powerhouse.

2. Abatement of Assessments in Search Cases

Meanwhile, the Second Amendment effectively streamlines tax procedures concerning search and seizure operations. Previously, however, ongoing assessments often remained unresolved, which consequently led to duplication and confusion across multiple proceedings.

Now, under the revised provision, all assessments for block periods will abate until the block assessment order is formally passed. Therefore, this consolidation ensures that all tax issues related to the searched period are addressed in a single proceeding, ultimately reducing compliance stress and saving both time and resources.

Ease of Doing Business

Undoubtedly, this marks a landmark reform under India’s Ease of Doing Business initiative, as it eliminates redundant litigation while promoting a fairer, more transparent tax process.

3. Standard Deduction Clarification

The confusion regarding the standard deduction, on the other hand, arose from a drafting error in Section 115BAC(1A). While the Finance Act, 2023, introduced revised tax slabs under the new regime, the reference to clause (iii) for FY 2025-26 was, unfortunately, omitted.

Because of this omission, taxpayers were uncertain about whether the enhanced standard deduction of ₹75,000 applied to the current financial year. Fortunately, however, the Taxation Laws (Amendment) Bill, 2025, has now rectified this oversight, thereby ensuring that salaried taxpayers can claim the ₹75,000 deduction under the new tax regime for FY 2025-26.

4. Unified Pension Scheme (UPS) Alignment with NPS

In addition, to eliminate persistent confusion between pension schemes, the government has aligned the UPS (Unified Pension Scheme) with the NPS (National Pension System) for tax purposes. Consequently, both pension schemes now offer identical tax benefits, ensuring uniform treatment across all sectors.

According to the CBDT’s Office Memorandum dated July 2, 2025, the tax benefits are uniformly applicable to both schemes.

Key Tax Deductions

- Employee contribution: Deductible under Section 80CCD(1) within the ₹1.5 lakh Section 80C limit, plus an additional ₹50,000 under Section 80CCD(1B).

- Employer contribution: Deductible up to 14% of salary for government employees and 10% for others under Section 80CCD(2).

Withdrawal Rules

Furthermore, up to 60% of the accumulated corpus can be withdrawn tax-free at the time of retirement. The remaining 40%, however, must be used to purchase an annuity, which is taxed as pension income when received. Although premature withdrawals are fully taxable, partial withdrawals of up to 25% remain exempt under certain conditions.

Thus, this alignment ensures complete tax neutrality between UPS and NPS, allowing individuals to choose based on scheme benefits rather than tax advantages.

Clarifying the Standard Deduction Issue

Additionally, experts such as Naveen Wadhwa from Taxmann highlighted that clause (iii) had previously been omitted, causing confusion among taxpayers. Thankfully, the government swiftly amended the provision, thereby restoring clarity and ensuring fair relief for all salaried individuals.

Indeed, this timely correction signifies a responsive and taxpayer-friendly approach, which India’s tax administration has long been striving to achieve.

Deep Dive: Unified Pension Scheme (UPS)

Moreover, the Unified Pension Scheme (UPS) is designed to simplify retirement savings for employees across all sectors. Because of its tax parity with NPS, both government and private employees can now enjoy equal advantages, which, in turn, fosters inclusivity and financial security.

Additionally, UPS promotes financial literacy and long-term savings discipline, thereby encouraging professionals to invest confidently in secure, tax-efficient retirement options.

Income Tax Search Case Amendment

Under the amended Section 153A, all open or pending assessments will now automatically abate once a search proceeding begins. Consequently, taxpayers will no longer face multiple scrutiny rounds for the same financial years.

Instead, the entire block period will be assessed comprehensively in one single process. As a result, this reform simplifies compliance, reduces procedural overlaps, and protects taxpayers from repeated investigations.

Broader Implications for Taxpayers

Taken together, these four amendments represent a major turning point in India’s tax landscape. They not only simplify compliance but also reduce ambiguity, increase legal certainty, and build taxpayer trust—all of which are essential for a progressive and transparent taxation system.

Linkage Between Old and New Tax Regimes

With the standard deduction correction, the new tax regime now stands on equal footing with the old regime. Therefore, taxpayers can now easily compare both systems, determine which structure offers the maximum benefit, and make informed decisions about their financial planning.

Economic and Policy Rationale

Undoubtedly, these reforms reflect India’s strong commitment to modernisation and investor confidence. By encouraging global capital participation, simplifying compliance structures, and empowering salaried individuals, the government consistently strengthens its vision for a digitally enabled, transparent, and business-friendly economy.

Expert Opinions

Tax professionals across India, moreover, have warmly welcomed these updates. For instance, Sanjay Kumar from Nangia Andersen LLP stated that aligning UPS with NPS effectively removes tax-driven bias, allowing investors to focus purely on scheme benefits.

Similarly, many experts agree that the abatement of search assessments is a long-awaited and essential reform, moving India toward greater fairness, administrative efficiency, and predictability.

What Taxpayers Should Do Next

To fully benefit from these reforms, taxpayers should:

- Review their chosen tax regime for FY 2025-26 carefully.

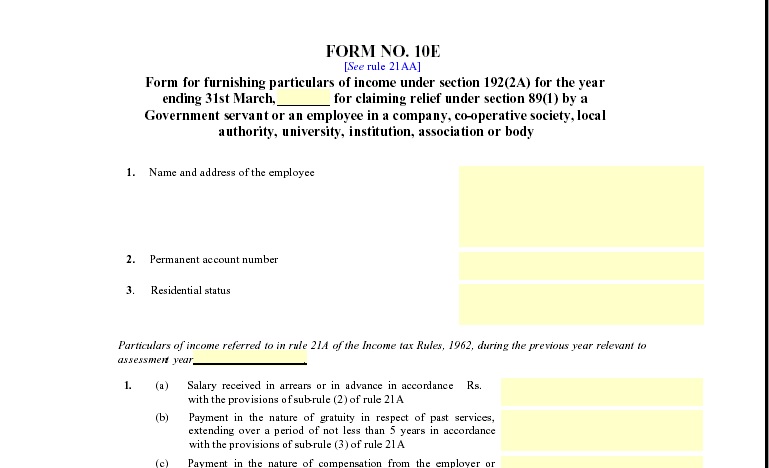

- Update their Form 10E and investment declarations under UPS/NPS

- Consult their chartered accountant to fine-tune advance tax planning.

- Maintain proper documentation for income and investment proofs.

By doing so, individuals can maximise benefits while staying fully compliant with the amended tax laws.

Conclusion

In conclusion, the four transformative changes—namely, tax exemptions for sovereign funds, abatement of search assessments, clarification of standard deduction, and alignment of UPS with NPS—collectively mark a progressive step in India’s taxation reform journey.

Altogether, these amendments ensure simplified compliance, enhanced transparency, and greater taxpayer confidence, thereby making FY 2025-26 a pivotal year in the modernisation of India’s tax ecosystem.