Introduction

The Budget 2025 has once again stirred the age-old debate—Old Tax Regime vs. New Tax Regime. For India’s middle-class taxpayers, this choice is more crucial than ever. Should you stick with the traditional deductions and exemptions under the Old Regime or shift to the simplified, rebate-rich New Regime?

Choosing wisely can save you thousands—or even lakhs—in Income Tax. Thanks to Automated Income Tax Calculators in Excel, this decision is now easier and faster. Let’s break it all down step by step, in clear and simple language, so you can make the smartest financial choice this financial year.

Table of Contents

| Sr# | Headings |

| 1 | Understanding the Old and New Tax Regimes |

| 2 | Key Highlights of Budget 2025 for Middle-Class Taxpayers |

| 3 | Benefits of the New Tax Regime for FY 2025-26 |

| 4 | Benefits of the Old Tax Regime for FY 2025-26 |

| 5 | Major Differences Between the Two Regimes |

| 6 | Income Tax Slabs Comparison: Old vs New |

| 7 | How the ₹12.75 Lakh Tax-Free Limit Works |

| 8 | Deductions and Exemptions Under the Old Regime |

| 9 | Why Minimal Documentation Matters in the New Regime |

| 10 | How to Choose the Right Regime for FY 2025-26 |

| 11 | Step-by-Step: Comparing Taxes Using an Excel Calculator |

| 12 | Common Mistakes to Avoid While Filing Income Tax |

| 13 | How Budget 2025 Impacts the Middle Class |

| 14 | Real-Life Examples: When Old Regime Still Wins |

| 15 | Conclusion: Which One Is the Better Choice for You? |

1. Understanding the Old and New Tax Regimes

The Indian government introduced the New Tax Regime to simplify taxation. It offers lower tax rates but removes most deductions. The Old Regime, on the other hand, lets taxpayers reduce taxable income through various exemptions—like investments, insurance, and housing loan interest.

Think of it like this:

The Old Regime is a buffet—you pick and choose what deductions suit you.

The New Regime is a combo meal—simpler, faster, and less paperwork.

2. Key Highlights of Budget 2025 for Middle-Class Taxpayers

Budget 2025 has tilted the balance in favor of the New Tax Regime. It increased the basic exemption limit to ₹12 lakh and added a ₹75,000 standard deduction, making income up to ₹12.75 lakh effectively tax-free for salaried individuals.

Additionally:

- The 30% tax slab now starts at ₹24 lakh (previously ₹15 lakh).

- Rebate under Section 87A covers income up to ₹12 lakh for others.

- Simplified filing means less stress during tax season.

3. Benefits of the New Tax Regime for FY 2025-26

The New Regime is tailor-made for simplicity and speed. Here’s why it shines:

- Zero Tax up to ₹12.75 lakh: That’s a big relief for salaried employees.

- Lower Tax Rates: Higher income attracts lower rates compared to the old system.

- Minimal Paperwork: No need to keep track of dozens of receipts.

- Transparent Structure: The seven tax slabs offer clarity and fairness.

- Perfect for middle-income earners who don’t have heavy deductions.

4. Benefits of the Old Tax Regime for FY 2025-26

Despite the new perks, the Old Regime still holds value—especially if you’re an avid saver.

You can claim:

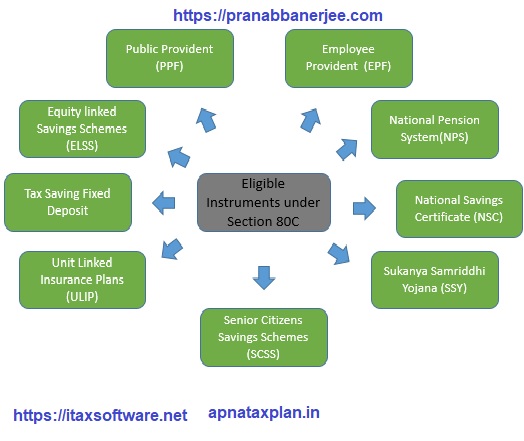

- Section 80C: Up to ₹1.5 lakh for PF, PPF, ELSS, tuition fees, etc.

- Section 80D: Health insurance premiums.

- HRA: For rented accommodation.

- Section 24(b): Interest on home loan (up to ₹2 lakh).

👉 If your total deductions exceed ₹4–₹5 lakh, the Old Regime can save you more tax.

5. Major Differences Between the Two Regimes

| Feature | Old Regime | New Regime |

| Deductions Allowed | Yes | No (mostly) |

| Tax Rates | Higher | Lower |

| Complexity | High | Simple |

| Documentation | Extensive | Minimal |

| Ideal For | High investors | Middle-income earners |

This comparison clearly shows that while the Old Regime rewards disciplined investors, the New Regime benefits those seeking ease and simplicity.

6. Income Tax Slabs Comparison: Old vs New

Let’s look at how the slabs differ for FY 2025–26:

| Income Range | Old Regime Tax Rate | New Regime Tax Rate |

| Up to ₹2.5L | 0% | 0% |

| ₹2.5L – ₹5L | 5% | 5% |

| ₹5L – ₹12L | 20% | 10% |

| ₹12L – ₹24L | 30% | 20% |

| Above ₹24L | 30% | 30% |

Clearly, the New Regime rewards moderate earners with reduced tax rates.

7. How the ₹12.75 Lakh Tax-Free Limit Works

Under Budget 2025, salaried employees enjoy:

- Basic Exemption: ₹12 lakh

- Standard Deduction: ₹75,000

Together, this means zero tax up to ₹12.75 lakh. For non-salaried individuals, the Section 87A rebate ensures zero tax up to ₹12 lakh.

This adjustment directly benefits India’s growing middle-income group, improving disposable income.

8. Deductions and Exemptions Under the Old Regime

While the New Regime is straightforward, the Old one still appeals to those who:

- Invest in PPF or life insurance.

- Pay home loan interest.

- Contribute to NPS or ELSS funds.

- Claim medical and educational expenses.

If you utilise these benefits fully, you can reduce taxable income significantly—even below ₹10 lakh, making the Old Regime more profitable.

9. Why Minimal Documentation Matters in the New Regime

Gone are the days of hunting receipts!

The New Regime removes the need to submit proofs for deductions. It’s faster, cleaner, and less stressful—especially for young professionals or those without major investments.

Less documentation = less headache = happier tax season.

10. How to Choose the Right Regime for FY 2025-26

Here’s how you can decide smartly:

- Calculate deductions under the Old Regime (like 80C, 80D, HRA).

- Use an Automated Income Tax Calculator in Excel to compare both regimes.

- Select the one with lower payable tax.

This approach ensures you don’t miss out on any potential savings.

11. Step-by-Step: Comparing Taxes Using an Excel Calculator

Using an Excel-based Automated Income Tax Software makes this process effortless:

- Enter your annual income.

- Add all deductions and exemptions (for the Old Regime).

- Let the calculator automatically compute taxes under both regimes.

- Instantly see which regime saves you more.

The result? Clear, data-backed decision-making—without manual errors.

12. Common Mistakes to Avoid While Filing Income Tax

Even seasoned taxpayers make errors like:

- Forgetting to declare all income sources.

- Choosing a regime without comparison.

- Ignoring rebates and standard deductions.

- Submitting incorrect investment proofs.

Avoid these pitfalls to ensure a smooth, error-free filing experience.

13. How Budget 2025 Impacts the Middle Class

The middle class stands to gain the most. With the increased tax-free threshold, many will fall into the zero-tax bracket. Additionally, lower slab rates ensure more take-home salary, boosting consumption and savings.

It’s a win-win—especially for salaried individuals.

14. Real-Life Examples: When the Old Regime Still Wins

Let’s take two examples:

- Ravi, a salaried employee earning ₹14 lakh with ₹5 lakh in deductions, benefits more under the Old Regime.

- Anita, earning ₹12 lakh without significant investments—she pays zero tax under the New Regime.

Moral of the story? Your tax planning strategy decides your best regime.

15. Conclusion: Which One Is the Better Choice for You?

For the majority of middle-class taxpayers, the New Tax Regime under Budget 2025 is the smarter choice. It offers zero tax up to ₹12.75 lakh, simplified filing, and less paperwork.

However, if you have substantial investments or a home loan, the Old Regime might still offer better tax relief.

In short, compare before you choose, and let your Automated Excel Tax Calculator be your guide.

Frequently Asked Questions (FAQs)

- What is the best tax regime for middle-class taxpayers in FY 2025–26?

The New Tax Regime is generally better for most middle-class earners due to its higher exemption and simpler process. - Can I switch between the Old and New Regime every year?

Yes, salaried employees can switch each year before filing returns. Business owners, however, have stricter switching rules. - How can I compare both regimes easily?

Use an Automated Income Tax Calculator in Excel to compare tax liabilities under both regimes accurately. - Is the New Regime mandatory?

No, it’s the default option, but you can choose the Old Regime if it offers more benefits. - What income is tax-free under the New Regime as per Budget 2025?

Income up to ₹12.75 lakh (salaried) or ₹12 lakh (others) is completely tax-free.