Excel-based income tax calculators for the Financial Year (FY) 2025-26 are readily available for download from several finance and tax-related websites

. These calculators are designed to be comprehensive, catering to salaried employees in both the government and private sectors.

Where to download a reliable Excel calculator

- CAclubindia: This resource offers an all-in-one Excel preparation tool for FY 2025-26. It supports both the new and old tax regimes, and it includes special features for government and non-government employees, such as a Form 16 generator and an arrear relief calculator.

- itaxsoftware.net: This site provides an Excel-based calculator for FY 2025-26 (AY 2026-27). It lets you compare the tax computations under both the old and new tax regimes by simply entering your income and deduction details into the highlighted cells.

- pranabbanerjeecom: This website offers a history of Excel income tax calculators, with the latest available for FY 2025-26.

- apnataxplan.in This site specialises in tax information and links to reliable Excel-based income tax calculators for salaried individuals, including specific resources for government employees.

Key features of the all-in-one Excel calculator

These comprehensive calculators generally include the following features to assist both government and non-government employees:

- Old vs. New Tax Regime Comparison: The calculator helps you decide which tax regime is more beneficial by automatically computing and displaying the tax liability under both the old and new regimes side-by-side. The new regime, which is the default option, features revised tax slabs for FY 2025-26.

- Detailed Salary Structure: It is often customised to handle salary components unique to government employees, such as specific allowances and pension contributions.

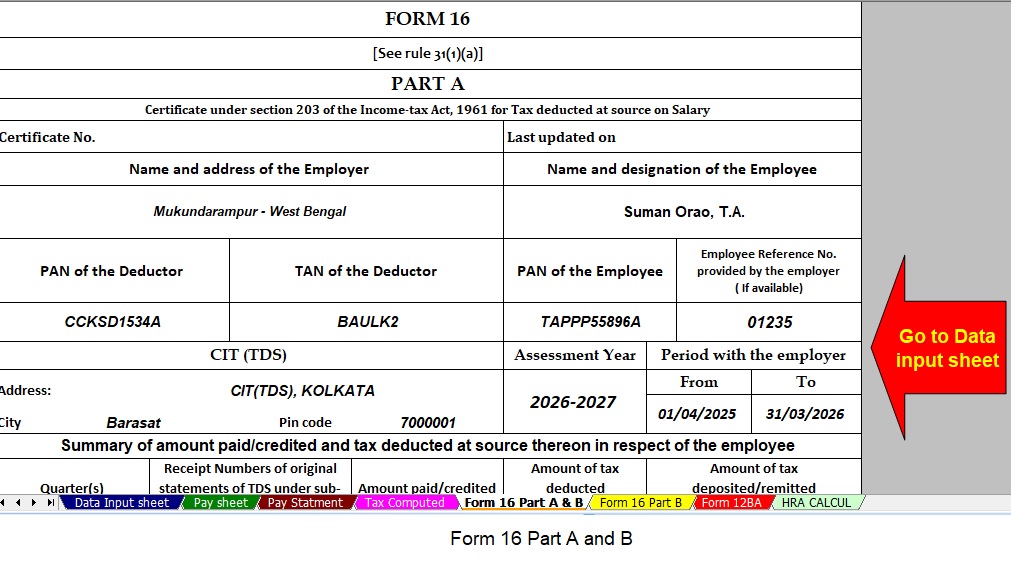

- Automated Form 16:Some advanced versions automatically generate a revised Form 16 (Part A & B) for FY 2025-26, which simplifies the tax filing process.

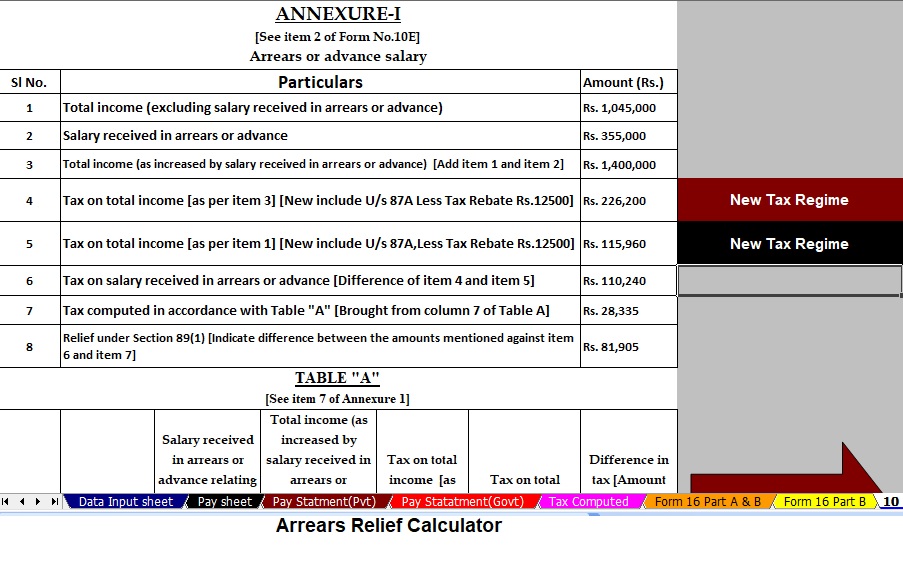

- Arrear Relief Calculation: Some tools offer an automated Section 89(1) arrear relief calculator, which is especially useful for government employees who have received salary arrears.

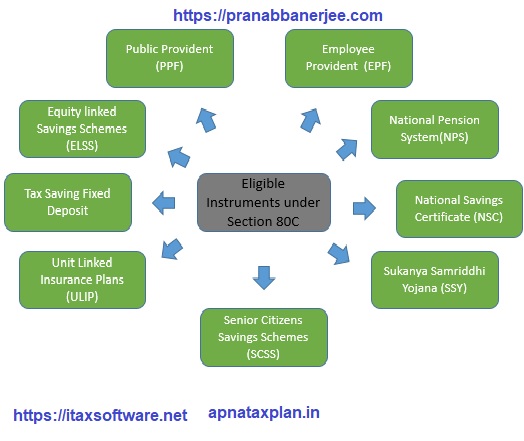

- Comprehensive Deduction Handling: It includes fields for all eligible deductions under Chapter VI-A (e.g., Section 80C, 80D, 80G) for the old tax regime, as well as the limited deductions available under the new regime.

Important steps for using the calculator

- Download the Excel file from one of the reputable sources listed above.

- Enter your income details, including your gross salary and income from other sources, into the specified fields.

- Input your deductions, exemptions, and other investment proofs in the relevant cells.

- Compare the tax calculated under the old and new regimes to see which one results in a lower tax outgo.

- Save the file for your records and for use during your tax planning and filing.

Download Automatic Income Tax Preparation Software All-in-One in Excel (F.Y. 2025–26) for Government and Non-Government Employees

Key Features of the Excel-Based Tax Preparation Utility

- Dual Regime Option:

You can effortlessly choose between the New or Old Tax Regime under Section 115BAC. Furthermore, the tool automatically compares both regimes to help you identify the most tax-saving option. - Customised Salary Structure:

It automatically adjusts according to your salary format, whether you belong to a Government or Non-Government organisation. Additionally, this customisation reduces manual entry and saves valuable time. - Automatic Arrears Relief Calculator [Section 89(1) + Form 10E]:

It accurately calculates arrears relief for the financial years ranging from 2000–01 to 2025–26. In addition, it instantly generates Form 10E for submission, ensuring precise tax relief computations. - Updated Form 16 (Part A & B):

This tool automatically generates Revised Form 16 (Part A & B) for the Financial Year 2025–26. Likewise, it ensures that your Form 16 remains compliant with the latest tax formats. - Simplified Compliance:

It ensures quick and error-free tax computation through advanced built-in formulas. Furthermore, you can confidently prepare your return with zero manual intervention, enhancing both speed and accuracy.