Introduction

Are you a salaried employee trying to make sense of income tax rules? The Tax Rebate U/s 87A as per Budget 2025 might just be your saviour! And what’s more? If you’re not a government employee, you now have powerful tools like Automatic Income Tax Preparation Software in Excel to help you file your taxes easily. This article breaks down everything—from understanding tax rebates and marginal relief to using Excel-based tax software—all in simple language.

Let’s dive in and make tax season a breeze, shall we?

Table of Contents

| Sr# | Headings |

| 1 | What is Tax Rebate U/s 87A? |

| 2 | Eligibility Criteria for Section 87A |

| 3 | Changes in Tax Rebate U/s 87A as per Budget 2025 |

| 4 | What is Marginal Relief? |

| 5 | How Marginal Relief Works: A Simple Explanation |

| 6 | Difference Between 87A Rebate and Marginal Relief |

| 7 | Challenges Faced by Non-Government Employees in Tax Filing |

| 8 | Why Use Excel-Based Automatic Tax Software? |

| 9 | Key Features of Automatic Income Tax Software in Excel |

| 10 | Step-by-Step Guide to Using the Software |

| 11 | How the Software Calculates 87A Rebate & Marginal Relief |

| 12 | Avoiding Common Mistakes While Filing Returns |

| 13 | Benefits of Timely and Accurate Tax Filing |

| 14 | Legal Compliance and Peace of Mind |

| 15 | Final Thoughts on Budget 2025 Tax Reforms |

1. What is Tax Rebate U/s 87A?

The Tax Rebate U/s 87A is a benefit given to individual taxpayers with lower incomes. It allows eligible taxpayers to reduce their tax liability by a certain amount, effectively making their net payable tax zero or very low.

2. Eligibility Criteria for Section 87A

To claim the rebate:

- You must be a resident individual.

- Your total taxable income should not exceed the prescribed limit (updated in Budget 2025).

- It’s not available to HUFs or NRIs.

This rebate is like a discount coupon on your total tax. If you qualify, you get to slash your tax bill instantly!

3. Changes in Tax Rebate U/s 87A as per Budget 2025

The Budget 2025 raised the eligible income ceiling, benefiting more people. The rebate amount has also increased to support middle-class earners struggling with inflation. These changes help non-government employees take home more salary.

4. What is Marginal Relief?

Marginal Relief is designed to protect taxpayers from a sharp jump in tax liability when their income slightly exceeds the threshold for a higher tax rate or surcharge. Imagine earning just ₹1 more and paying ₹10,000 extra in tax. Doesn’t seem fair, right? That’s where marginal relief steps in.

5. How Marginal Relief Works: A Simple Explanation

Let’s say the surcharge kicks in at ₹50 lakhs. If you earn ₹50,01,000, your tax liability shouldn’t suddenly jump drastically. Marginal relief ensures that the additional tax does not exceed the income that exceeds the threshold.

It’s like standing on the edge of a cliff with a safety net.

6. Difference Between 87A Rebate and Marginal Relief

- Section 87A is a rebate—a fixed deduction on tax.

- Marginal Relief is a protection mechanism against excessive tax due to crossing an income slab.

Both are taxpayer-friendly, but serve different purposes.

7. Challenges Faced by Non-Government Employees in Tax Filing

Non-government employees often face:

- Complex salary structures

- Lack of proper documentation

- Limited access to tax advisors

This can make tax filing a nightmare. But Excel-based solutions are here to help!

8. Why Use Excel-Based Automatic Tax Software?

Why Excel? Because:

- It’s easy to use

- No installation needed

- It works offline

- It’s cost-effective

Think of it as your personal accountant—always ready, never on leave.

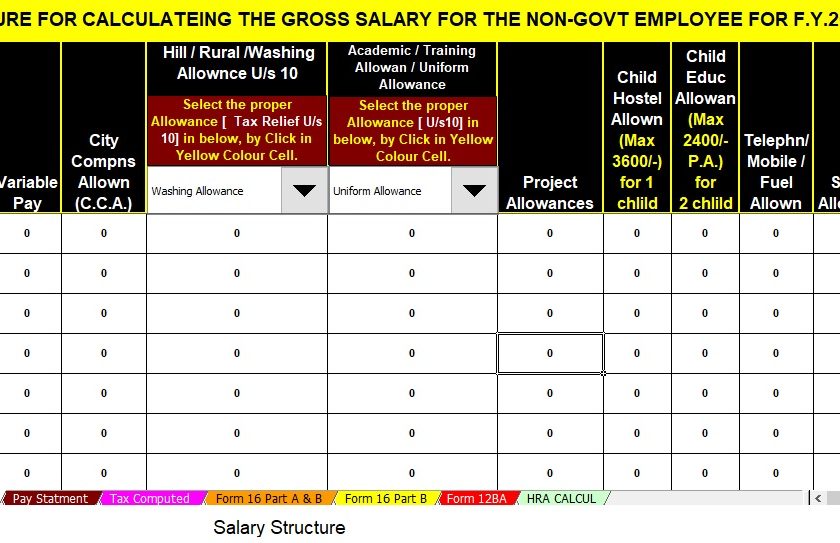

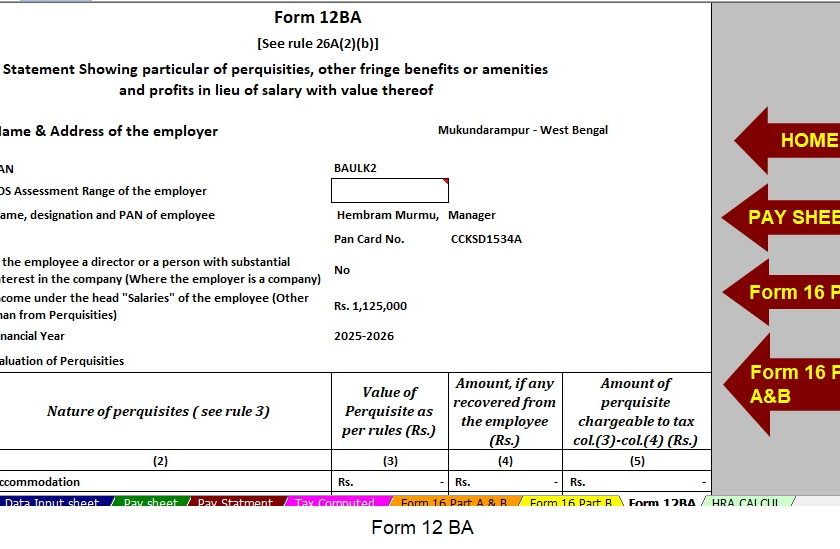

9. Key Features of Automatic Income Tax Software in Excel

This smart tool offers:

- Auto-calculation of income and deductions

- Built-in tax slabs

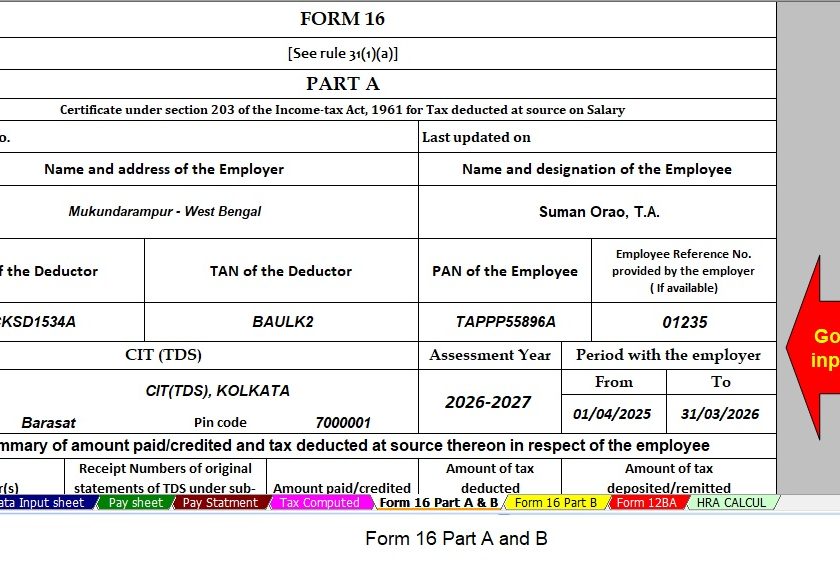

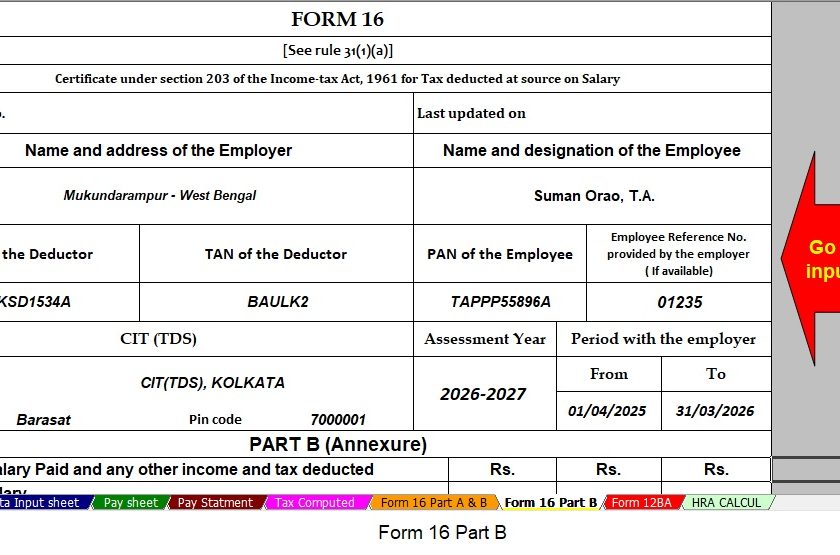

- Support for Form 10E

- Summary reports for filing

It’s like giving your spreadsheet a brain!

10. Step-by-Step Guide to Using the Software

- Download the Excel file.

- Enable macros (don’t worry, it’s safe).

- Enter personal and income details.

- Verify deductions and investments.

- Review the tax summary.

- File with confidence.

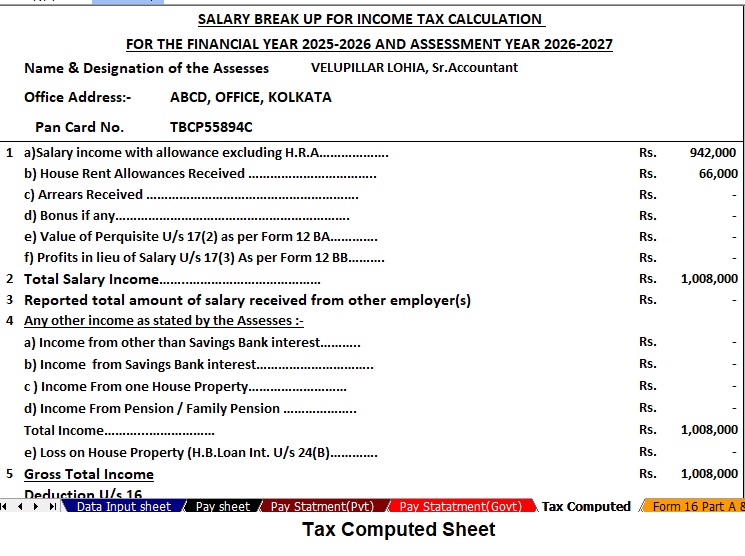

11. How the Software Calculates 87A Rebate & Marginal Relief

The software is updated with Budget 2025 tax slabs and rules:

- It checks if you’re eligible for 87A.

- It applies rebate limits accurately.

- For high incomes, it calculates marginal relief automatically.

No manual math. No confusion. Just clarity.

12. Avoiding Common Mistakes While Filing Returns

Mistakes to avoid:

- Entering the wrong PAN or income

- Missing out on Form 10E

- Not claiming eligible deductions

The software alerts you before you go wrong. It’s smarter than most calculators.

13. Benefits of Timely and Accurate Tax Filing

Filing your return on time:

- Avoids penalties

- Improves creditworthiness

- Helps in getting refunds quickly

Plus, you sleep better knowing the taxman won’t come knocking.

14. Legal Compliance and Peace of Mind

Using the right software ensures you’re compliant with tax laws. You don’t need to fear notices or audits when everything is well-documented and accurate.

15. Final Thoughts on Budget 2025 Tax Reforms

The Tax Rebate U/s 87A as per Budget 2025, and reforms like marginal relief have made the tax system fairer. For non-government employees, automatic Excel tools offer a lifesaver during tax season.

It’s not just about saving money—it’s about empowering individuals with the right information and tools.

FAQs

1. Who can claim the Tax Rebate U/s 87A as per Budget 2025?

Any resident individual whose total income does not exceed the threshold (as per Budget 2025) is eligible.

2. Is Marginal Relief automatically applied in Excel tax software?

Yes, the software calculates and applies marginal relief based on your total income and surcharge applicability.

3. Can I use this Excel software without internet access?

Absolutely. Once downloaded, it works offline and doesn’t require internet.

4. Do I still need to file Form 10E if I’m claiming relief under Section 89?

Yes, Form 10E is mandatory if you’re claiming relief under Section 89 for salary arrears.

5. Is this Excel software suitable for freelancers or self-employed individuals?

It’s primarily designed for salaried individuals, but some versions support freelance income too.

Download Automatic Income Tax Preparation Software All in One in Excel for Non-Government Employees as per Budget 2025