Introduction

In the fiscal year 2023-24, it’s crucial to ensure accurate tax filings to stay compliant with regulations. One essential form for taxpayers is the Automatic Income Tax Excel Based Form 10E. Here’s a comprehensive guide on how to download this form effortlessly.

Understanding Form 10E

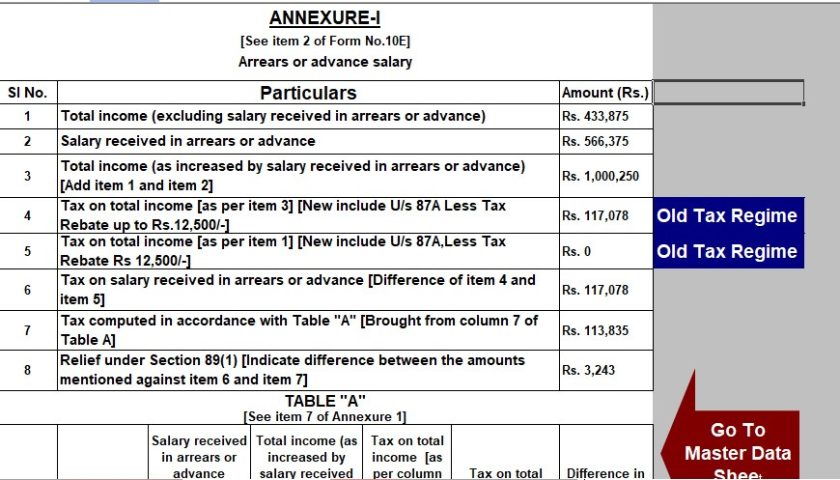

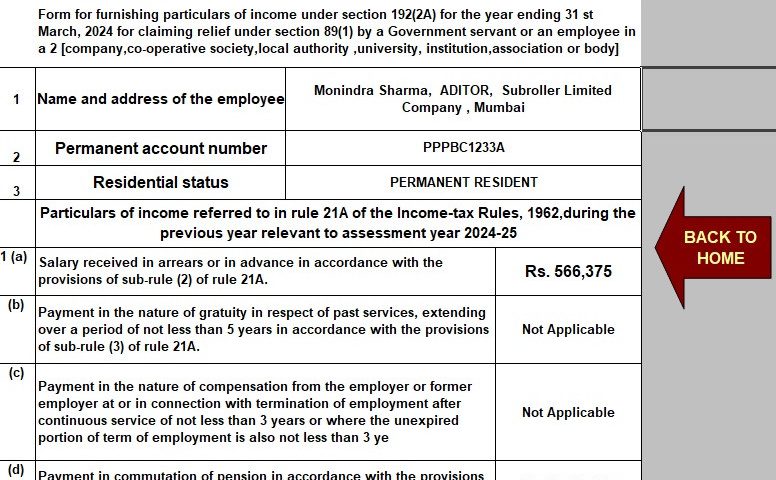

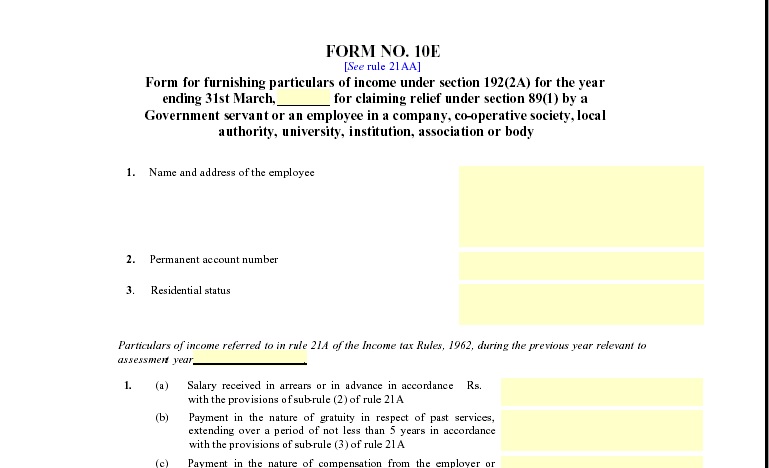

Form 10E is a document required by taxpayers to claim relief under section 89(1) of the Income Tax Act. It’s necessary for individuals receiving salary or pension in arrears or in advance.

Purpose of Form 10E

Form 10E facilitates the calculation and claiming of relief in cases where salary or pension is received in arrears or in advance, ensuring fair taxation for individuals.

Importance of Filing Correctly

Filing Form 10E accurately is crucial to prevent any discrepancies in tax calculations and to avoid penalties or legal issues with the tax authorities.

Steps to Download Form 10E

Downloading Form 10E is a straightforward process. Follow these steps:

Visit the Income Tax Department Website

Navigate to the official website of the Income Tax Department of your country.

Locate the Forms Section

Look for the section dedicated to tax forms. It’s usually found under the ‘Downloads’ or ‘Resources’ tab.

Search for Form 10E

Use the search function or browse through the list of forms to find Form 10E.

Click on the Download Link

Once you locate Form 10E, click on the download link provided next to it.

Verify the Downloaded File

After downloading, ensure that the file is authentic and from a reliable source to prevent any malware or phishing risks.

Tips for Filing Form 10E

Filing Form 10E accurately requires attention to detail. Here are some tips to ensure a smooth filing process:

Organize Financial Records

Gather all relevant financial records, including salary statements and tax documents, to provide accurate information.

Double-Check Information

Before submitting Form 10E, double-check all entries to ensure accuracy and completeness.

Seek Professional Assistance if Necessary

If you’re unsure about any aspect of filing Form 10E, consider seeking assistance from a tax professional or consultant.

FAQs (Frequently Asked Questions)

- How can I claim relief under section 89(1) of the Income Tax Act?

- Relief under section 89(1) can be claimed by filing Form 10E for the relevant assessment year.

- Is it mandatory to file Form 10E?

- It is mandatory to file Form 10E if you are claiming relief under section 89(1) of the Income Tax Act.

- Can Form 10E be filed online?

- Yes, Form 10E can be filed online through the official website of the Income Tax Department.

- What if I make a mistake in Form 10E?

- If you make a mistake in Form 10E, you can rectify it by filing a revised form with the correct information.

- How long does it take to process Form 10E?

- The processing time for Form 10E may vary, but it typically takes a few weeks for the tax authorities to review and process the form.

- Is there a deadline for filing Form 10E?

- Form 10E should be filed before the end of the relevant assessment year for which relief is being claimed.

Conclusion

Downloading Automatic Income Tax Excel Based Form 10E for the F.Y.2023-24 is essential for taxpayers seeking relief under section 89(1) of the Income Tax Act. By following the outlined steps and tips, individuals can ensure accurate filing and compliance with tax regulations.

Download Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E in Excel for the Financial Year 2023-24