[ad_1]

one in bear market Or the corporate earnings downgrade cycle, many analysts overestimate the PB ratio when evaluating companies. Analysts say that profitable companies with low P/B ratios are always better because they usually outperform when the market turns up.

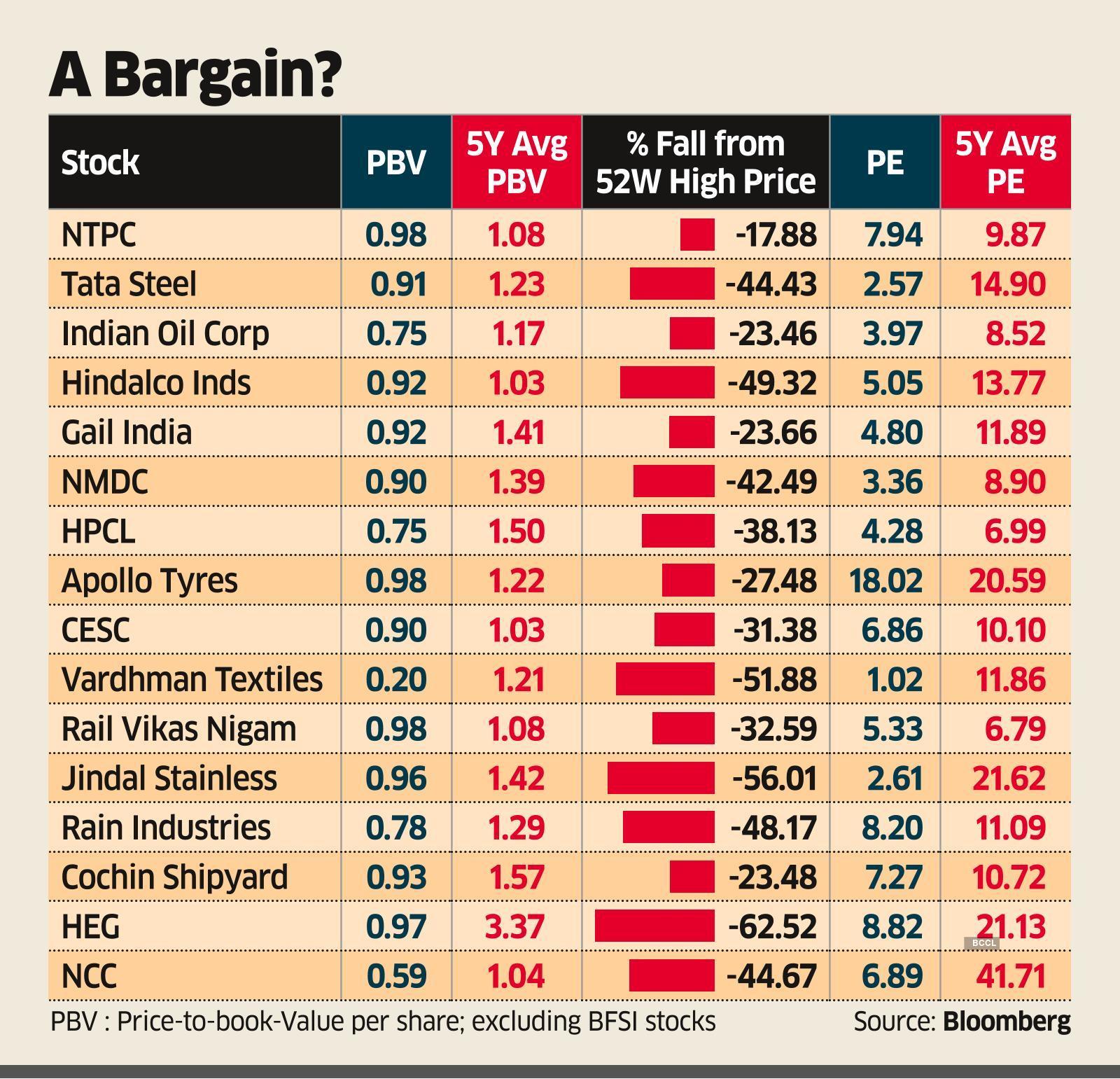

Companies whose share price is less than the book value include ONGC, NTPC,

, Hindalco, GAIL, NMDC, HPCL, and SAIL, etc. Some of the stocks like Grasim, Vedanta, BPCL, BSE, and NALCO are trading well above their book value.

The book value of a company is its net assets. This means that if a company sold all of its assets and paid off all of its debt, the remainder would be the company’s book value. Analysts said price-to-book value is not the only parameter for shortlisting potential price buys, but an equally important tool for stock picking.

G Chokalingam, founder, Equinomics Research and Advisory, says, “Insulinally strong companies with a lower price-to-book ratio are always better, as they usually do well when the market turns, barring those with corporate governance issues and high debt. “It is advisable to select the stock on a case by case basis keeping in mind the factors like operational efficiency, cash flow, order book and price to earnings.”

For example, Hindalco’s current book value per share is ₹352, while its stock currently trades at ₹322, an 8.5% discount on book value. This means that the value of Hindalco’s assets is 8.5% more than its equity value. But, valuing a commodity player like Hindalco on the basis of PB alone can be misleading as its stock price is also dependent on the stage of the commodity price cycle.

Earlier this year, 28 stocks in the NSE 500 traded below their book value. In theory, companies whose share price is less than a PB ratio of less than 1 times are considered cheaper. But, it may differ from one industry to another.

Several companies including NTPC, Tata Steel, Indian Oil, Hindalco, GAIL, HPCL, CESC, and others were earlier trading above their five-year average book value. But, this reading fell for many of them after the sharp drop in share prices.

Exide Industries,

, , Birla Corp., and Ceat, among others, are trading below their book value.

[ad_2]

Source link