For the Financial Year (F.Y.) 2025-26, Section 80TTA of the Income Tax Act provides a deduction of up to ₹10,000 on the interest income earned from savings accounts. This deduction is available to individuals and Hindu Undivided Families (HUFs) who choose the old tax regime. Key provisions under Section 80TTA for F.Y. 2025-26 Eligibility The deduction can be claimed by the following taxpayers: Individuals: This applies to residents and non-residents, as long as they are not senior citizens (60 years or older). Senior citizens have a separate provision, Section 80TTB, with…

Wednesday, November 19, 2025

Recent posts

- Section 80TTA of the Income Tax Act: Eligibility, Limit, and Complete Benefits Explained

- Income Tax Deduction Chapter 6A with Automatic Income Tax Preparation Software/Calculator for the Salaried Persons for the F.Y.2025-26

- Pay Zero Income Tax on Capital Gains: Save Tax by Reinvesting up to ₹10 Crore LTCG

- Four Critical Changes in Income Tax Act: Standard Deduction, UPS, Income Tax Search, and Other Changes to be Applicable in FY 2025-26

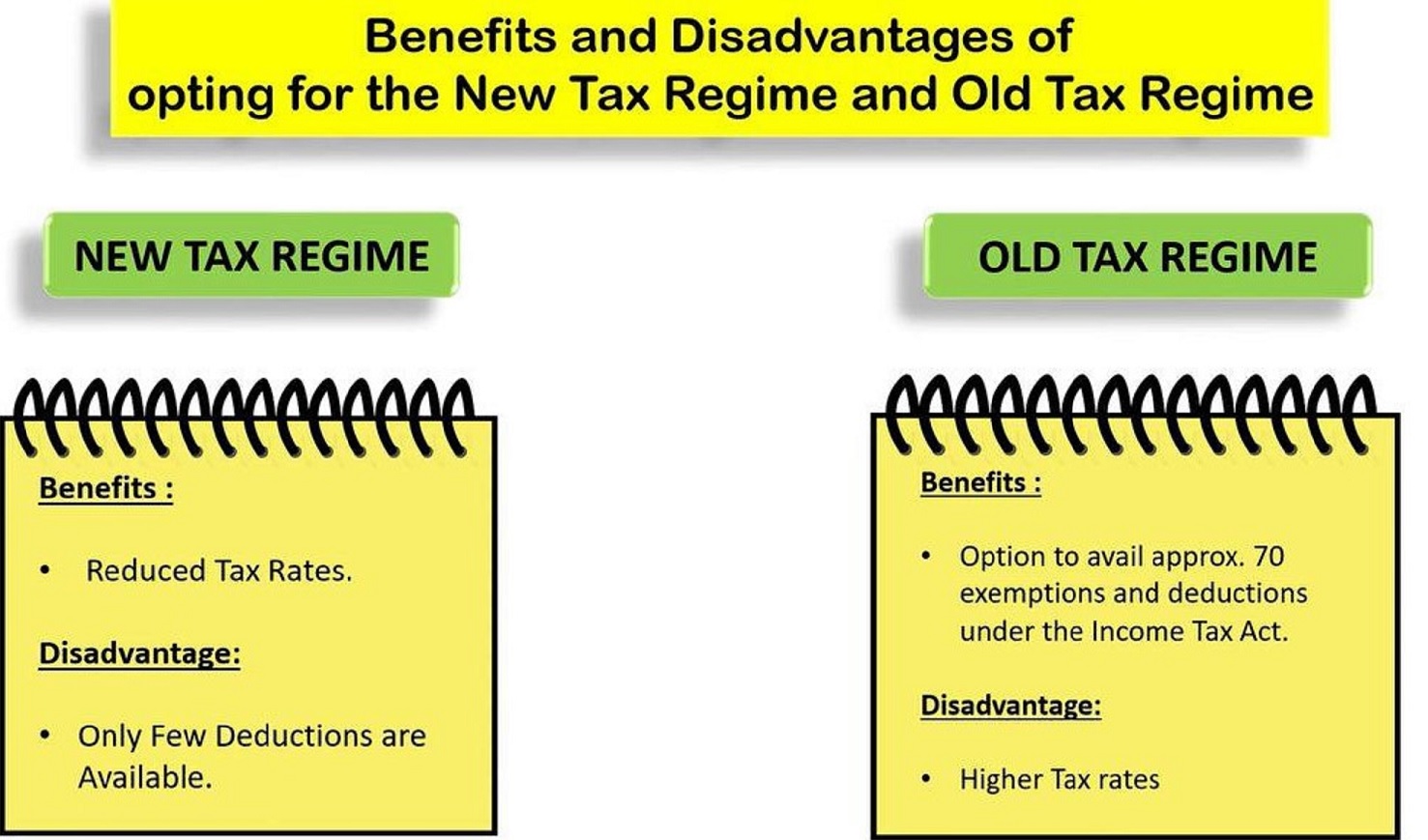

- Old Regime vs New Regime 2025: Which Tax Regime is Better for You?