Section 115BAC of the Income Tax Act introduces an alternative, simplified “new tax regime“ for individuals, Hindu Undivided Families (HUFs), and other specified entities. This regime offers lower income tax rates across different income slabs in exchange for foregoing most of the common exemptions and deductions available under the traditional “old tax regime”. Key Features of Section 115BAC Applicability: It applies to individuals, HUFs, Association of Persons (AOPs), Body of Individuals (BOIs), and Artificial Juridical Persons (AJPs). Default Regime: From the Financial Year 2023-24 (Assessment Year 2024-25) onwards, the new tax regime is the…

Day: November 12, 2025

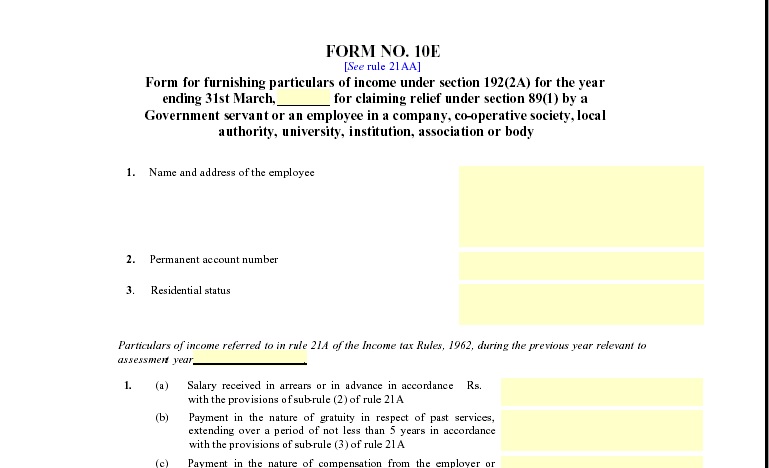

Salary Arrears Relief Calculator U/s 89(1) with Form 10E from the FY 2000-01 to FY 2025-26

Have you ever received your salary arrears and felt confused about the high tax deduction? You’re not alone! Many salaried employees face this issue every year when arrears are paid for previous financial years. Thankfully, the Income Tax Act’s Section 89(1) provides a simple solution — and with Form 10E, you can claim tax relief smartly and legally. Think of it as a “time machine for taxes” — you can adjust the extra tax you pay today for income that belonged to the past. Let’s dive deep into understanding how…