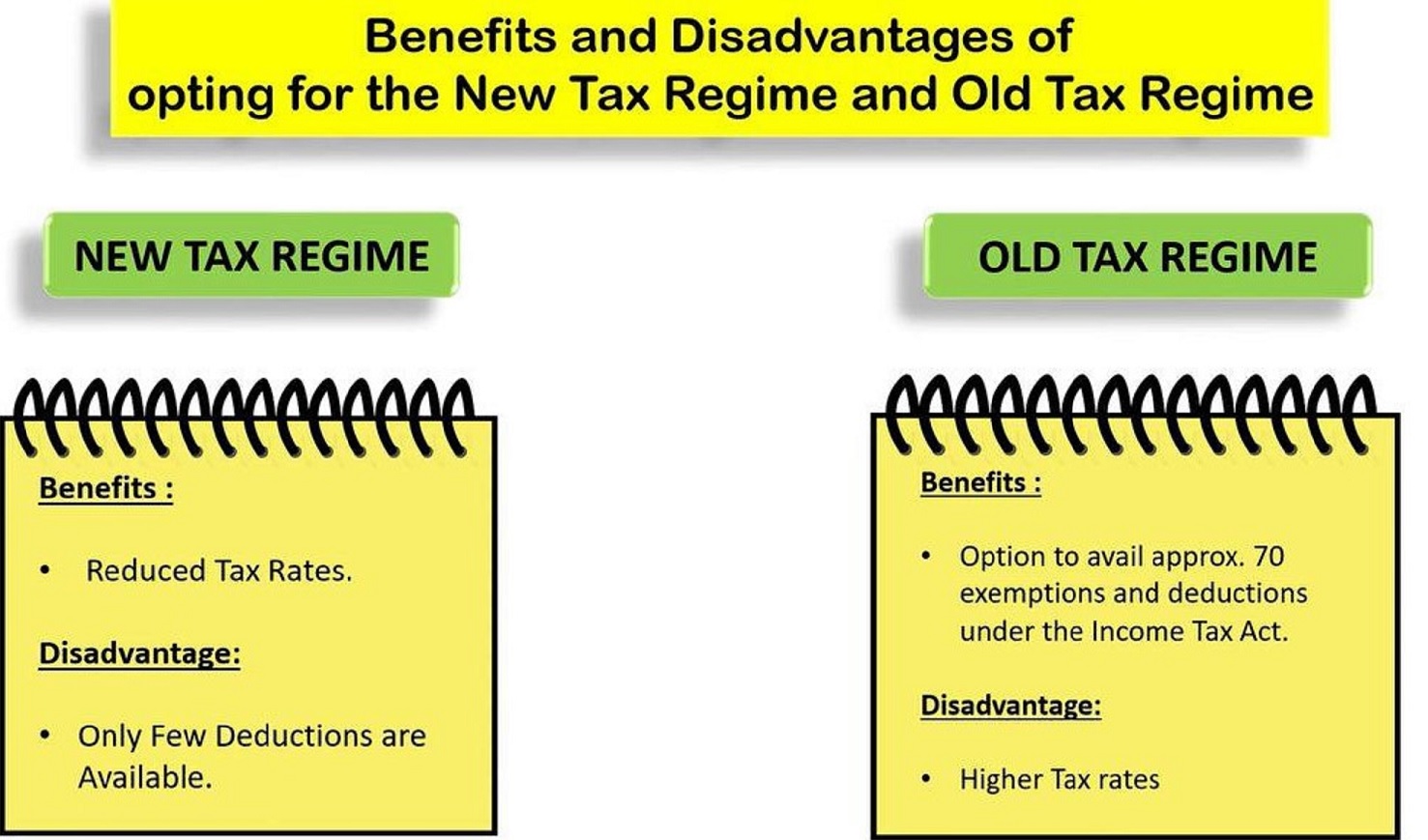

Introduction: Understanding India’s Dual Tax System India’s income tax structure offers two distinct regimes — the Old Tax Regime and the New Tax Regime. Both systems aim to give taxpayers flexibility, yet each carries unique implications for deductions, compliance, and overall tax liability.Since Budget 2025, the government has continued to emphasise simplifying taxation, particularly for middle-income earners and salaried individuals. However, deciding which tax regime suits you best depends on how you earn and invest. Before choosing, let’s dive into the latest updates, comparisons, and saving strategies so you can…

Tuesday, October 28, 2025

Recent posts

- Which Tax Regime Should You Choose for FY 2025–26?

- How to Save Income Tax in India 2025: A Complete Guide for Taxpayers with Automatic Income Tax Preparation Software in Excel

- What is Advance Tax? Deduction Process, Liability, and Penalties Explained

- 7 New Income Tax Rules From FY 2025-26 For Salaried Employees | With Automatic Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from F.Y.2000-01 to F.Y.2025-26

- Benefits of New Tax Regime and Loss for Old Tax Regime: Brief Discussion as per the Budget 2025 | Check your Tax, Which is Beneficial for You by the Automatic Income Tax Calculator All in One in Excel for the F.Y.2025-26