Introduction The Union Budget 2025 has brought in some big updates for salaried employees that will take effect from April 1, 2025. These changes are meant to simplify the tax system, provide relief, and help employees plan their finances better. Think of it like getting a new set of tools in your financial toolkit—you can build your tax-saving strategy more effectively if you know how to use them. In this article, we will unpack the 7 New Income Tax Rules as per Budget 2025 in a simple, easy-to-understand way. You…

Day: October 23, 2025

Benefits of New Tax Regime and Loss for Old Tax Regime: Brief Discussion as per the Budget 2025 | Check your Tax, Which is Beneficial for You by the Automatic Income Tax Calculator All in One in Excel for the F.Y.2025-26

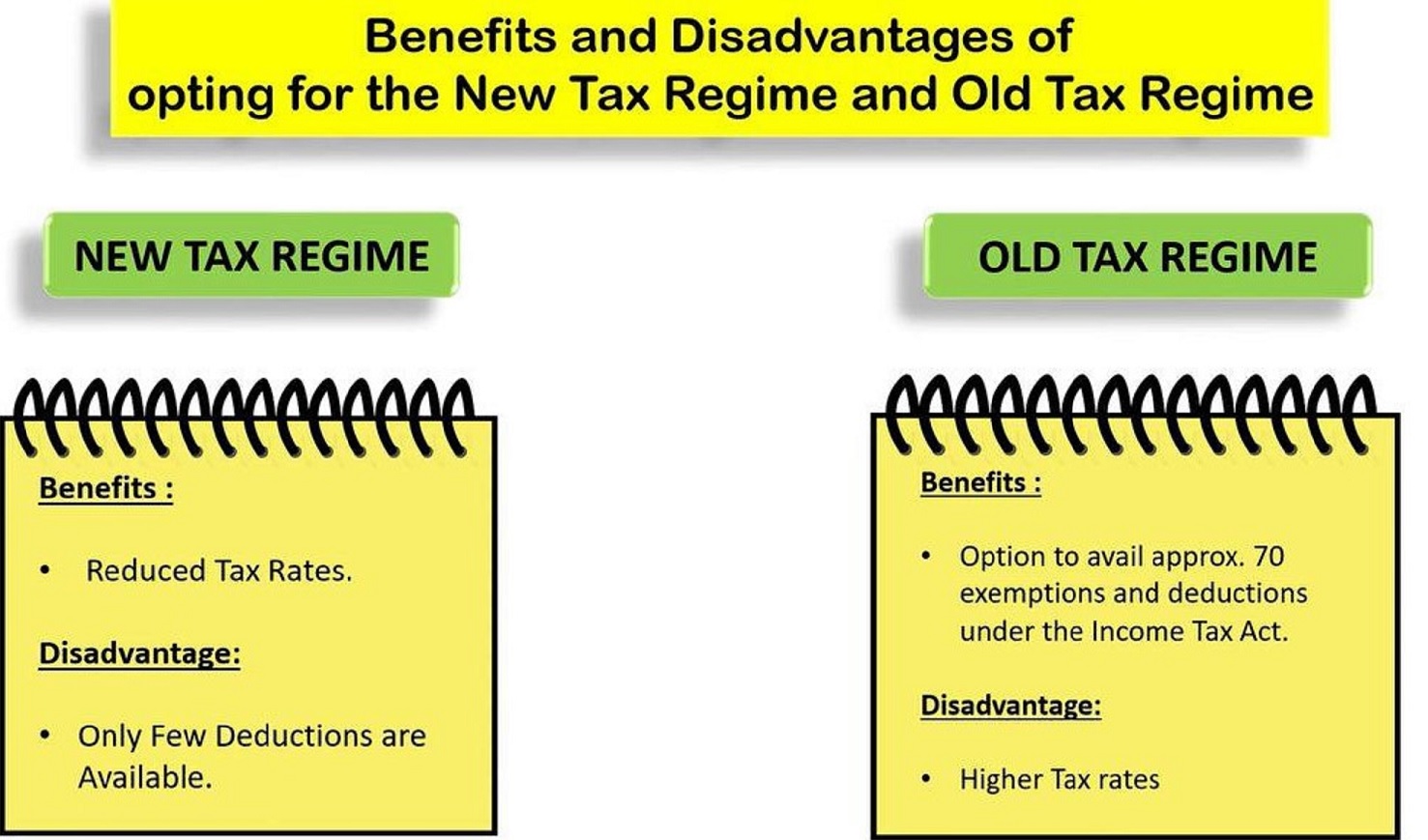

Have you ever wondered which tax regime saves you more money—the new or the old? As the Union Budget 2025 reshaped tax rules, taxpayers across India are debating this crucial question. While the New Tax Regime for FY 2025-26 offers simplified rates and fewer deductions, the Old Regime still appeals to those who rely heavily on exemptions and investments. To make the choice easier, an Automatic Income Tax Calculator, all-in-one in Excel, helps you quickly compare and decide what’s beneficial for you. Think of it like choosing between two different…

How to Decide Which Tax Regime Will Be Perfect for a Taxpayer for the F.Y.2025-26 | You can Check Your Tax Burden by this Automatic Income Tax Calculator F.Y.2025-26

Choosing the best tax regime for the Financial Year 2025-26 is one of the most important financial decisions for every taxpayer. Since the Government of India has introduced both the Old Tax Regime with deductions and the New Tax Regime with lower slab rates, taxpayers now have more flexibility. However, this flexibility also creates confusion. Many salaried employees, pensioners, and professionals ask the same question: Which tax regime will be more beneficial for me in FY 2025-26? Therefore, to answer this, you need to compare both regimes carefully. In addition,…

Income Tax Calculator All in One for All Salaried Persons for FY 2025-26 (AY 2026-27) Excel Download

Introduction Budget 2025 has completely reshaped how salaried taxpayers in India view Income Tax. With zero tax up to ₹12.75 lakh, countless middle-class families now breathe a sigh of relief. However, despite this welcome relief, taxpayers still struggle with Income Tax calculations, which often feel like solving a puzzle with missing pieces. Wouldn’t life be simpler if a personal assistant handled all the numbers for you? That’s exactly what the Income Tax Calculator All-in-One in Excel for FY 2025-26 delivers. Think of it as a digital tax buddy—you enter your…