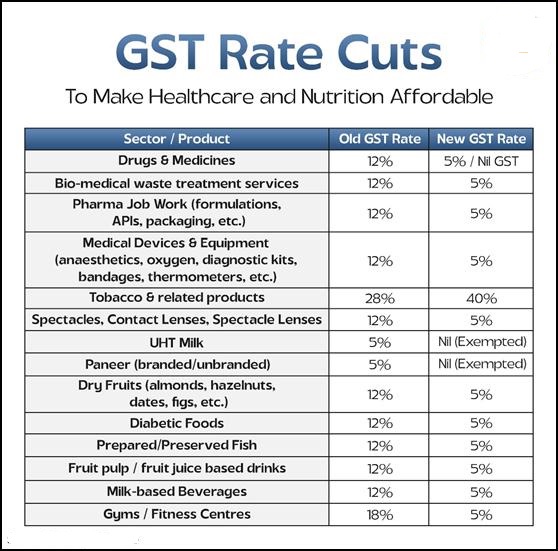

The GST reforms introduced in September 2025 have completely redefined India’s taxation system, focusing on affordability, innovation, and youth empowerment. Indeed, these reforms represent a paradigm shift that aims to simplify taxes, reduce costs, and promote inclusive economic growth. Moreover, they align with India’s broader vision of fostering self-reliance, entrepreneurship, and equitable prosperity for all. Introduction: A Transformative Step Toward an Empowered Economy The Government of India introduced comprehensive GST reforms in 2025 to build a new tax ecosystem that nurtures innovation, supports employment, and boosts affordability. Through these changes,…

Day: October 8, 2025

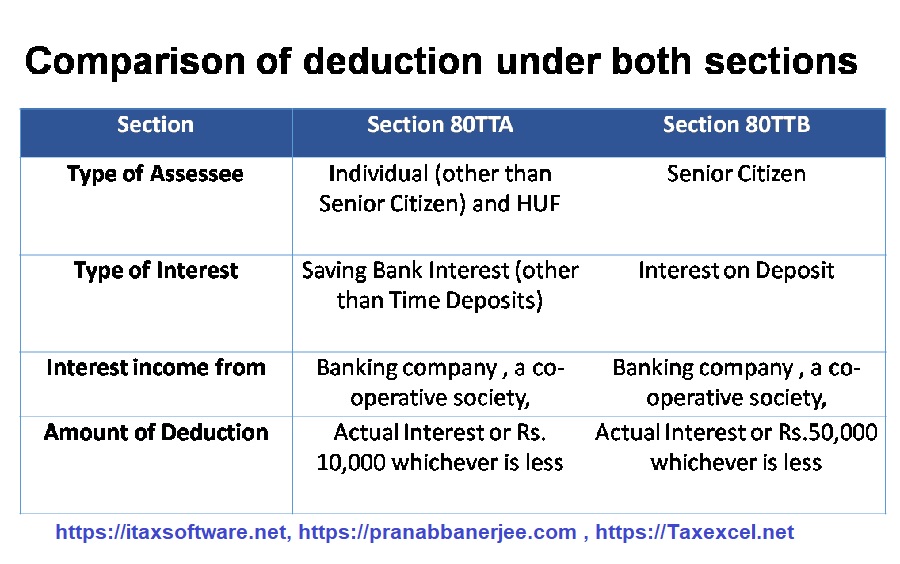

Deduction under Chapter VI-A for the Old Tax Regime as per Budget 2025

1. Introduction to Chapter VI-A Deductions When it comes to tax planning in India, Chapter VI-A of the Income Tax Act plays a central role. This section provides taxpayers with an array of deductions that reduce their taxable income, thereby lowering their overall tax liability. These deductions cover a wide spectrum of expenses and investments, ranging from life insurance premiums and provident fund contributions to health insurance, donations, and education loans. Chapter VI-A is not just about saving money—it is about encouraging responsible financial habits. The government uses this chapter…