Most of us keep a savings account, but here’s the catch—the interest you earn on it is taxable. Many people don’t realise that the seemingly small amounts of interest can add up and impact their income tax return. Under the Income Tax Act, this interest is considered “Income from Other Sources.” Fortunately, Section 80TTA of the Income Tax Act comes to the rescue. It allows taxpayers to claim a deduction of up to ₹10,000 on the interest earned from savings bank accounts. This benefit is only available under the old…

Saturday, October 4, 2025

Recent posts

- Tax on Savings Bank Interest: Deductions U/s 80TTA | With Automatic Income Tax Calculator All in One with Form 10E for the Govt & Non-Govt Employees for F.Y.2025-26

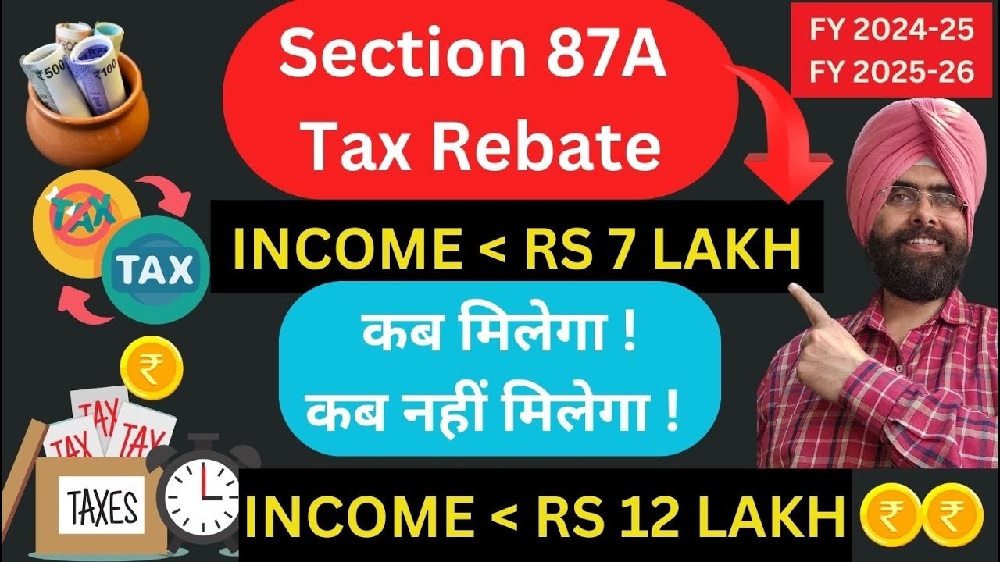

- Income Tax Rebate Under Section 87A With Automatic Income Tax Preparation Excel-Based Software All-in-One for the Government and Non-Government Employees for F.Y. 2025-26

- Tax Planning 2025–26: What Taxpayers Need to Know Before Picking the Perfect Regime

- GST Price Cut List 2025: New GST Rates from Today, How Much Cheaper Are Items?

- LIC FD 2025: ₹1 Lakh Deposit with Guaranteed ₹6,500 Monthly Income